Hyundai Motor Company and Kia have seen their combined operating margin for the second quarter decrease by 2.1 percentage points due to tariffs imposed by the United States. There are concerns that if Toyota of Japan, which already benefits from lower tariffs, pursues a strategy to expand its market share, it could increase operational pressure on Hyundai and Kia. However, it is expected that the impact of tariffs will gradually diminish in the future as a result of the Korea-U.S. tariff negotiation agreement. The effect on Hyundai and Kia's credit ratings is also considered to be limited.

Kim Younghoon, Senior Analyst at Korea Credit Rating Agency, made this announcement during a webcast titled "The End of Free Trade: The Reorganization of the Global Trade Order and Its Impact by Industry," held on the afternoon of the 22nd, focusing on the automotive sector.

Senior Analyst Kim stated, "Most automakers produce 30% to 50% of their U.S. sales volume outside the United States," diagnosing that 67% of Hyundai and Kia's U.S. sales-equivalent to two-thirds-are exposed to the effects of tariffs.

As of the second quarter, Hyundai and Kia's tariff burdens are estimated at 828.2 billion won and 786 billion won, respectively. He explained, "The combined operating margin of the two companies fell from 10.3% to 8.2%, a decrease of 2.1 percentage points," and pointed out, "Despite favorable exchange rate effects and increased sales of high-priced hybrid vehicles, profitability in the high-contribution U.S. market weakened due to the imposition of tariffs."

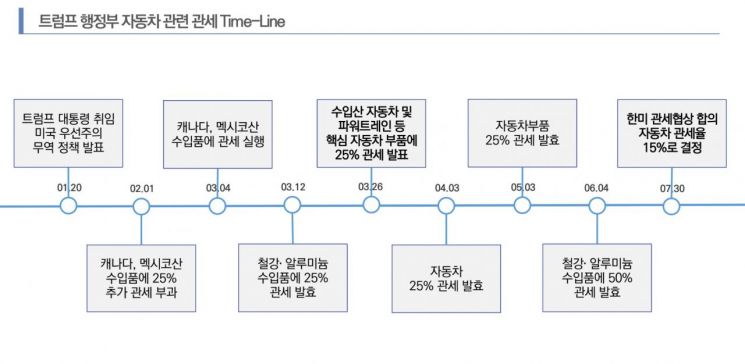

Previously, the Korea-U.S. tariff negotiation agreement is expected to lower the automotive tariff rate from 25% to 15%, but the timing of implementation remains undecided. Senior Analyst Kim said, "The impact of tariffs is expected to decrease in the future," but also noted, "The administrative order is somewhat delayed, so it will be difficult in the short term. There remains uncertainty regarding the finalization of the 350 billion dollar investment in the United States."

However, when comparing the impact on each company, he said, "Contrary to expectations that Korean companies with a lower proportion of U.S. production would be more affected by tariffs, local companies such as Ford, which have a higher proportion of U.S. production, experienced a greater decline in performance." He cited relatively high import ratios from Mexico and Canada, as well as rising raw material prices such as imported steel for U.S. production volumes, as the reasons. He assessed, "Based on the second quarter results, when the 25% tariff rate was applied, Hyundai and Kia's tariff burden remained at a manageable level."

He also predicted that as the Donald Trump administration increases the proportion of automobile and parts production within the United States, automakers' cost burdens will rise, and the burden will be even greater for Japanese and American companies that rely heavily on Mexico and Canada. In addition, he expressed concern that Chinese brands are rapidly expanding, particularly in electric vehicles and plug-in hybrids, and that excessive production from China could lead to fierce price competition, posing a threat to the global industry.

On this day, Senior Analyst Kim suggested that Hyundai and Kia's response strategies should include the growth of hybrid vehicles and strengthening of regional portfolios. He said, "A decline in performance due to tariffs is inevitable, but this is a common factor across the industry," and added, "Despite concerns over tariffs, Hyundai and Kia will respond to tariff risks based on strong profitability and competitive advantage."

He also assessed that although uncertainty regarding U.S.-imposed tariffs remains, the impact on credit ratings is still limited. He emphasized, "The period when competitors' performance is faltering is a golden opportunity for Hyundai and Kia to secure technological leadership."

When asked whether Hyundai and Kia have become disadvantaged in competition since Toyota's tariff rate was lowered, Senior Analyst Kim responded, "So far, Toyota's average selling price has been higher than Hyundai's," and cautioned, "If Toyota pursues a market share expansion strategy, it could become an operational burden." He also noted that Hyundai had previously stated there would be no significant price increases reflecting tariffs, and added, "There may be some impact on profitability, but there will be no price reversal."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)