[Hyundai Motor, Over the Mobility] (33)

Why "K-Autonomous Driving" Is Progressing Slowly

Recruiting Top Automotive SW Talent: "Like Picking Stars from the Sky"

Seniority-Based Pay System Hampers Talent Acquisition

Restrictive Regulations and a

Rendering image of Ioniq 5 equipped with Waymo technology, scheduled to begin demonstration on U.S. roads at the end of 2025. Provided by Hyundai Motor Company

Rendering image of Ioniq 5 equipped with Waymo technology, scheduled to begin demonstration on U.S. roads at the end of 2025. Provided by Hyundai Motor Company

The shift to software-defined vehicles (SDVs) and the development of autonomous driving have become key topics in the global automotive industry. Hyundai Motor Group is also keeping pace with this trend, but the process comes with several challenges. While previous installments examined internal issues, this article explores the structural problems facing the entire "K-autonomous driving" sector, including Hyundai Motor.

Industry experts identify "talent acquisition" as the most urgent and fundamental issue. There are concerns that Hyundai Motor may lag behind the rapid SDV transition being pushed by global automakers due to a shortage of software (SW) professionals.

Song Changhyun, President of the AVP Division at Hyundai Motor Group and CEO of Fortytwodot, who rarely appears in public, personally delivers the keynote speech to recruit SW talent at the annual HMG Developer Conference. When asked in 2023 about the biggest challenge in the SDV transition, Song answered with a single word: "Talent." His brief but significant response highlights how the shortage of domestic SW professionals is having a considerable impact on Hyundai Motor Group's core strategic initiatives.

Securing Domestic Automotive SW Talent: "Like Picking Stars from the Sky"

The pool of domestic automotive SW experts is extremely limited. Fusion-type SW professionals who understand both automobiles and software are even rarer. In the SDV sector, where experienced hires are essential, it is difficult to find seasoned professionals. Fortytwodot, Hyundai Motor Group's SW subsidiary, is focusing on hiring domestic SW talent, but only proceeds with employment contracts if certain performance benchmarks are met during the probation period, subjecting candidates to a rigorous vetting process. This clearly illustrates how challenging it is to secure talent with both experience and capability from a limited pool.

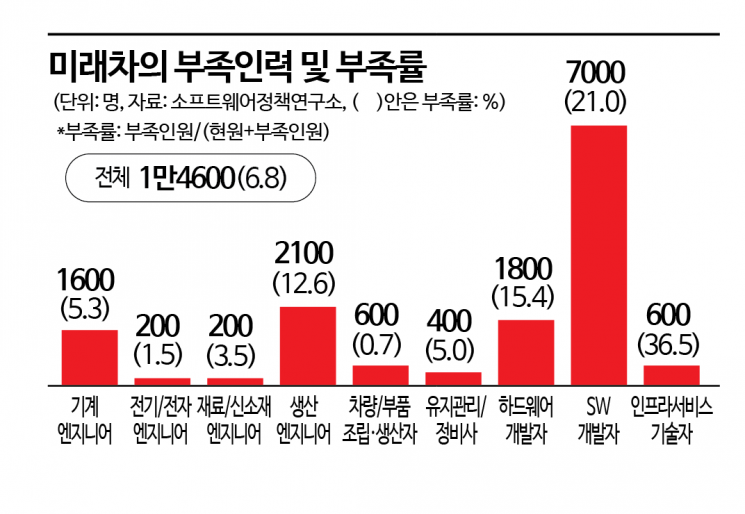

This industry struggle is evident in the report "Training SW Talent for the Future Automotive Industry" by Ji Eunhee, a research fellow at the Software Policy & Research Institute. The report surveyed 2,485 domestic companies in the future automotive sector, including: complete vehicle and parts manufacturers (including engineering service companies); ICT companies (HW and SW services); and infrastructure companies (communications, road traffic, and charging companies).

The survey estimates that there are between 4,000 and 25,000 future automotive SW experts in Korea. Other countries are also estimated to have tens of thousands of future automotive SW professionals, but accurate counts are difficult everywhere. As of 2024, the total workforce in the integrated future automotive sector (automobiles, parts, ICT, and infrastructure) is estimated at 198,600. By job category, vehicle parts assembly and production account for 44.3%, mechanical engineers for 14.0%, while SW professionals make up only 13.3% (about 25,000 people). If we narrow it down to just the automotive and parts industries, excluding SW professionals in ICT and infrastructure, SW engineers account for only 2.5% (about 4,100 people). Meanwhile, the estimated workforce shortage in the future automotive sector is about 14,600, with SW developers making up the largest share at 48.1%. The shortage rate for SW developers is 21.0%, far exceeding the overall job shortage rate of 6.8%.

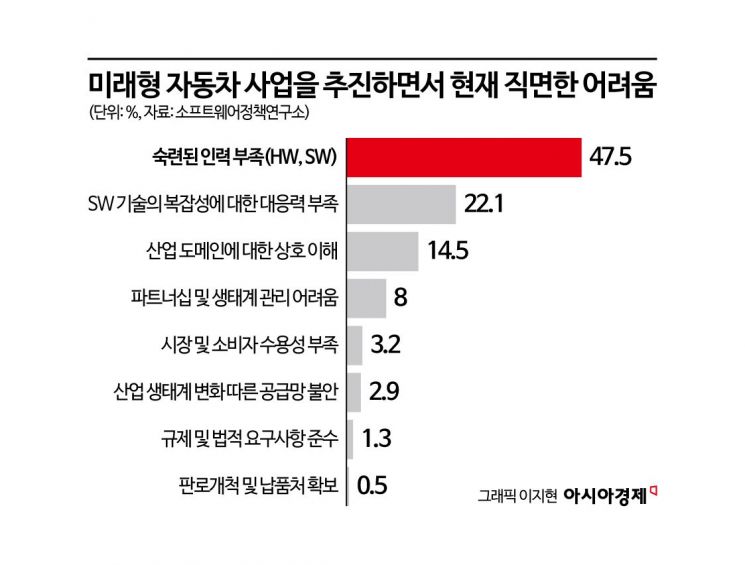

When major companies were asked about the biggest challenge in the SDV transition, the most common response was "shortage of skilled personnel" (47.5%). Researcher Ji emphasized that for the traditional manufacturing-based automotive industry to survive in the SDV era, it must break down barriers with the IT industry and integrate human, material, and technological resources. However, she also pointed out the difficulties of such cross-industry collaboration. Companies cited "differences in industry culture and organizational structure" (37%) and "differences in technical expertise and language" (35.7%) as the main reasons. Ji explained, "The automotive industry values stability and reliability, adopting a conservative and long-term approach, while the IT industry prefers innovation, speed, and flexibility, favoring short-term development cycles. This cultural gap makes collaboration between the two industries difficult."

Let's compare the development environments of the automotive and gaming industries. Automotive SW and gaming SW differ in development objectives, environments, safety and quality requirements, and performance evaluation. Automotive SW is directly linked to safety in driving and operation, demanding very high reliability. The development process takes at least five years, and even after product launch, it is difficult to assess individual contributions. In contrast, gaming SW relies on user experience, graphic performance, and creative ideas. Updates are frequent, and development is relatively free and flexible, allowing the ideas of a few outstanding developers to have a major impact on results. Performance measurement and rewards are thus much clearer. An automotive SW industry insider noted, "Young developers who value fast product launches and flexible development cycles tend to prefer IT companies over automotive firms. Even if they are recruited with high salaries, many return to the IT sector because they cannot endure the rigidity of the work environment."

Seniority-Based Pay System: An Obstacle to Securing Top Talent

Hyundai Motor Group's seniority-based wage system is also an obstacle to recruiting outstanding SW professionals. Not only Hyundai Motor and Kia, but also major affiliates still maintain seniority-based pay tables. Even if the company wants to attract top talent with high salaries, there are limitations within the current system. Hyundai Motor is attempting to introduce a performance-based pay system for R&D positions, but discussions have stalled for years due to opposition from the labor union. Industry observers point out that without a shift to a performance- and role-based wage system, it will be virtually impossible to recruit key talent or star developers from the IT sector.

To address the entrenched wage structure and rigid organizational culture, Hyundai Motor established "Fortytwodot," a specialized SW subsidiary. Separate from the Hyundai Motor and Kia R&D centers, it operates a global SW center to foster a flexible organizational culture and accelerate development. However, from the perspective of traditional mechanical engineering, or hardware-centric R&D organizations, such changes may seem unfamiliar. In fact, the currently profitable and high-performing electric vehicle platforms and hybrid systems were all developed by the existing R&D centers. As a result, there is some skepticism about maintaining a compensation system at Fortytwodot that is higher than the group average, given that it has yet to deliver clear results.

Nevertheless, perspectives inside and outside the industry differ somewhat. The reason Chairman Chung Euisun of Hyundai Motor Group has granted President Song such extensive authority is not just to develop new technologies, but also to transform the organization to operate in an "agile" manner like an IT company. This means Song faces the dual challenge of driving both technological and organizational innovation.

Regulations and Social Perceptions Holding Back Progress

The advancement of autonomous driving technology, a mobility innovation driven by SW, is heavily influenced by regulations and social perceptions. Increased social acceptance is necessary for regulatory easing, and regulatory relaxation is needed to accelerate technological development. Since regulations and perceptions are interlinked, industry discussions about the progress of autonomous driving often revolve around the "chicken or the egg" dilemma.

Currently, autonomous driving technology applied to mass-produced vehicles is encountering institutional and legal barriers in the transition from Level 2 to Level 3. Up to Level 2, the driver is responsible for accidents, but from Level 3, the division of responsibility between driver and vehicle becomes ambiguous, making regulatory design crucial. Although technology now allows for driving without the driver watching the road or keeping hands on the wheel, the industry argues that slow regulatory groundwork hinders practical implementation. On the other hand, regulatory authorities such as the Ministry of Land, Infrastructure and Transport insist that safety must be ensured in all scenarios and that supplementary measures must be in place before regulations can be eased.

Next-generation infotainment system 'Pleos Connect' developed by Hyundai Motor Group. Provided by FortyTwoDot.

Next-generation infotainment system 'Pleos Connect' developed by Hyundai Motor Group. Provided by FortyTwoDot.

Some analysts attribute the government's cautious stance to the low level of technological acceptance in Korean society. In the United States, after an accident involving a driverless robotaxi operated by GM's autonomous driving subsidiary Cruise, the business was suspended amid tighter regulations and negative public opinion. If a similar accident were to occur in Korea, domestic companies and the government would likely face even greater pressure. As a result, the domestic autonomous driving industry is seen as facing a dual bottleneck in both technology and regulation. To break this deadlock, a mediation and consensus-building process involving the government, industry, and society is necessary.

The issue of social acceptance is also linked to "data," the core of autonomous driving technology. Advancing autonomous driving requires vast amounts of driving data, but the question is how many drivers are willing to provide this data as a public resource. Although there is still debate over making driving data public, the view that public data sharing is inevitable for the advancement of new industries like autonomous driving is gaining traction. In fact, major advanced countries such as the United States and Europe are sharing driving and high-definition map data to foster the development of autonomous driving, treating it as a key industrial resource. However, social and technical safeguards to protect personal information and prevent data-related crimes are essential. Korea also needs to quickly build national consensus on the need for data openness and sharing.

Difficulties in Building an Ecosystem... Hyundai Motor Considers Acquiring a Chinese Autonomous Driving Company

The domestic autonomous driving sector is struggling to build a robust ecosystem. Korea's parts industry is highly dependent on Hyundai Motor and Kia. It is virtually impossible to convert the entire HW-centric parts supply chain to SW companies. As a result, some parts suppliers argue that survival is difficult unless they are incorporated into the Hyundai Motor and Kia SDV ecosystem, since both HW and SW companies need to supply in large volumes to automakers to secure profits. In particular, autonomous vehicles require advanced technology, making it difficult to change HW components or SW programs once installed. If even one component changes, the entire verification process must be repeated. Therefore, only a few companies selected by Hyundai Motor and Kia are likely to survive.

In contrast, China is rapidly building a diverse SDV ecosystem. Dozens of automakers supported by various provinces possess a wide range of HW platforms, and the IT ecosystem is rich with companies like Baidu, Huawei, and Xiaomi. In addition, government ministries such as the Ministry of Industry and Information Technology have formed consortia for the commercialization of autonomous driving. These consortia include major automakers such as BYD, SAIC Motor, BAIC Motor, and Changan Automobile, as well as big tech and SW companies like Baidu, Huawei, and Xiaomi. The Chinese government actively facilitates cross-industry collaboration, provides public road demonstration permits, builds infrastructure, and offers policy incentives to ensure the autonomous driving ecosystem develops organically.

In this context, Hyundai Motor has announced plans to acquire the Chinese autonomous driving company "Momenta," acknowledging the strengths of China's ecosystem and technology. The company is also actively entering the U.S. autonomous driving ecosystem by supplying autonomous driving HW to Google Waymo. While these diverse efforts are positive, many argue that Hyundai Motor must continue to strengthen domestic technology development and investment to solidify its foundation.

Hyundai Motor Company announced last April that it will conduct a demonstration of mobility services for transportation-vulnerable groups based on the demand-responsive transport system "Shuckle." This is an image of the demonstration vehicle operating in Dongtan 1 New City, Hwaseong Special City, Gyeonggi Province. Provided by Hyundai Motor Company

Hyundai Motor Company announced last April that it will conduct a demonstration of mobility services for transportation-vulnerable groups based on the demand-responsive transport system "Shuckle." This is an image of the demonstration vehicle operating in Dongtan 1 New City, Hwaseong Special City, Gyeonggi Province. Provided by Hyundai Motor Company

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.