Korea Employers Federation Releases Wage Analysis for First Half

Large Corporations: 6.19 Million Won, SMEs: 3.73 Million Won

Large Corporations Up 5.7%, SMEs Up 2.7%

Finance & Insurance Sector Leads in Both Wages and Growth Rate

The average monthly total wage of regular employees in the first half of this year rose by 3.5%, marking a larger increase than last year. However, as large corporations significantly increased their performance bonuses, the wage gap between large enterprises and small-to-medium-sized companies widened further. In particular, the finance and insurance sector recorded the highest average monthly wage at 8.05 million won among 17 industries, more than three times higher than that of the accommodation and food service sector.

Wages Up 3.5% in the First Half of the Year

The total wage growth rate for salaried workers in the first half of this year increased, while the gap between large and small-to-medium enterprises widened. The photo shows job seekers at the Gangnam-gu Employment Fair held at COEX in Gangnam-gu, Seoul, checking the job posting board. Photo by XXX

The total wage growth rate for salaried workers in the first half of this year increased, while the gap between large and small-to-medium enterprises widened. The photo shows job seekers at the Gangnam-gu Employment Fair held at COEX in Gangnam-gu, Seoul, checking the job posting board. Photo by XXX

According to the "2025 First Half Wage Increase Status by Company Size and Industry" released by the Korea Employers Federation on the 21st, the average monthly total wage (excluding overtime pay) of regular employees from January to June this year was 4.188 million won, up 3.5% from the same period last year. This is 1.3 percentage points higher than the 2.2% increase in the first half of last year. The main reason cited is the expansion of special bonuses, which are mainly performance-based.

By category, fixed wages such as base salary increased by 2.9% to 3.638 million won, while special bonuses such as performance bonuses rose by 8.1% to 550,000 won. The fixed wage increase rate dropped by 0.6 percentage points compared to last year, but the special bonus increase rate surged by 13.8 percentage points from last year’s -5.7%. Special bonuses hit a record high of 562,000 won in 2022, then declined for two consecutive years, but rebounded this year to the second-highest level ever.

Large Corporations See 'Jackpot' Performance Bonuses, Widening Gap with SMEs

By company size, the upward trend was even more pronounced among large corporations. The average monthly total wage at companies with 300 or more employees was 6.199 million won, up 5.7% year-on-year, while companies with fewer than 300 employees saw only a 2.7% increase to 3.739 million won. Considering this year’s consumer price inflation rate of 2.1%, wage increases for small and medium-sized enterprise employees barely kept pace with inflation. As a result, the wage gap between large and small-to-medium-sized companies widened from 2.226 million won last year to 2.46 million won this year.

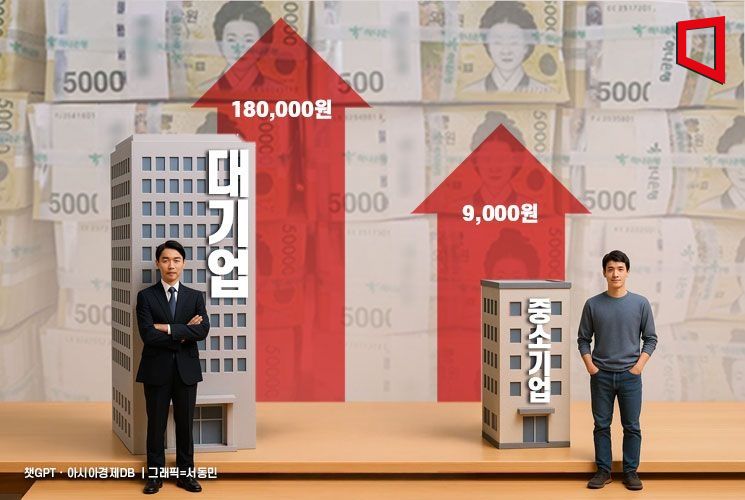

The gap was even more pronounced in special bonuses. Large corporations’ special bonuses increased by 12.8% (180,000 won) to 1.59 million won, while those at small and medium-sized companies rose by just 3.0% (9,000 won) to 318,000 won. Fixed wages also showed a clear disparity, with large corporations up 3.4% to 4.61 million won and small and medium-sized companies up 2.6% to 3.421 million won. The Korea Employers Federation analyzed, "The high increase in special bonuses at large corporations appears to have driven the overall wage growth rate."

Finance & Insurance: 8.05 Million Won vs. Accommodation & Food Services: 2.63 Million Won

Among 17 industries, the finance and insurance sector ranked first in both average monthly total wages and wage increase rate. The photo shows job seekers lining up to enter the venue at the "2025 Joint Recruitment Fair for the Financial Sector" held at Dongdaemun Design Plaza in Jung-gu, Seoul. Photo by [Photographer's Name]

Among 17 industries, the finance and insurance sector ranked first in both average monthly total wages and wage increase rate. The photo shows job seekers lining up to enter the venue at the "2025 Joint Recruitment Fair for the Financial Sector" held at Dongdaemun Design Plaza in Jung-gu, Seoul. Photo by [Photographer's Name]

Among 17 industries, the finance and insurance sector overwhelmingly ranked first in both average monthly total wage (8.051 million won) and wage increase rate (7.2%). In contrast, the accommodation and food service sector posted the lowest average monthly wage at 2.635 million won among all industries. The increase rate of special bonuses also varied by industry. Finance and insurance (16.0%), manufacturing (15.3%), and information and communications (11.3%) all saw double-digit increases, whereas mining (-33.7%) and electricity, gas, and steam supply (-9.4%) experienced significant declines.

In terms of total wages, electricity, gas, and steam supply (7.314 million won), professional, scientific, and technical services (5.522 million won), information and communications (5.431 million won), and mining (4.608 million won) followed finance and insurance, while accommodation and food services (2.635 million won) were at the bottom. For wage increase rates, manufacturing (4.8%), information and communications (3.9%), health and social welfare (3.6%), and associations and other services (3.3%) ranked second to fifth, with electricity, gas, and steam supply being the only sector to record negative growth (-1.8%).

Ha Sangwoo, Head of the Economic Research Division at the Korea Employers Federation, emphasized, "In a situation where external uncertainties such as recent U.S. tariff policies are increasing, excessive wage increase demands by some large corporation labor unions not only threaten corporate sustainability but can also lead to a wider gap in the labor market and intensify social conflict, and therefore should be avoided."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.