"Fiat Currency Is 'Fake Money' Vulnerable to Inflation"

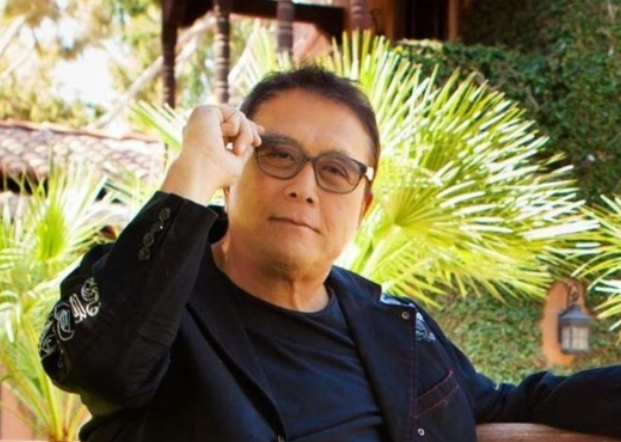

Robert Kiyosaki, author of the bestseller "Rich Dad Poor Dad," has once again urged people to hold Bitcoin, calling fiat currencies like the US dollar "fake money."

According to Cointelegraph, a media outlet specializing in digital assets, on September 19 (local time), Kiyosaki appeared on a podcast hosted by Jordan Walker, co-founder of Bitcoin Collective. He criticized, "Schools and professors brainwash children to work for fake money that is subject to inflation." He went on to say, "Poor people are poor because they don't know what real money is," raising his voice on the matter.

Kiyosaki pointed out, "Our society teaches people to go to school, get a good job, work hard, save, and then contribute to a 401(k) filled with lousy investment products." He emphasized that this traditional approach does not guarantee wealth and stressed the importance of holding tangible assets such as Bitcoin, gold, and silver.

Kiyosaki also warned about the risks of exchange-traded funds (ETFs). He argued that investing in gold, silver, or cryptocurrencies through ETFs is risky because it does not secure the actual assets. He added, "You need to know the difference between real assets and paper assets," likening it to "having a picture of a gun instead of an actual gun."

Meanwhile, Kiyosaki revealed that he first bought Bitcoin when it was in the $6,000 range and currently holds 60 BTC. He said, "I regret not buying more," and added, "I continue to purchase gold, silver, oil, Bitcoin, and Ethereum with my rental income."

Previously, in April, Kiyosaki predicted that Bitcoin would reach $1 million in the future. He said, "These assets will undergo price corrections in the short term," and stated his plan to buy more during market downturns. He also projected that, in the long term by 2030, Bitcoin will surpass $1 million, gold will exceed $30,000 per ounce, and silver will go beyond $3,000 per ounce.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)