Financial Services Commission Raises Consumer Alert Level for Smishing Related to Consumer Coupons

The financial authorities have raised the consumer alert level, anticipating a variety of smishing attempts during the second consumer coupon distribution period.

On September 21, the Financial Services Commission announced that it has upgraded the consumer alert level from "Caution" to "Warning" due to concerns about potential smishing damage during the second round of livelihood recovery consumer coupon distribution (from September 22 to October 31).

Previously, the Financial Services Commission had issued a "Caution" consumer alert due to concerns over smishing incidents related to consumer coupons. Following the alert, there were 430 cases of smishing text messages and instances of malicious apps impersonating Government24 identified during the first consumer coupon distribution period.

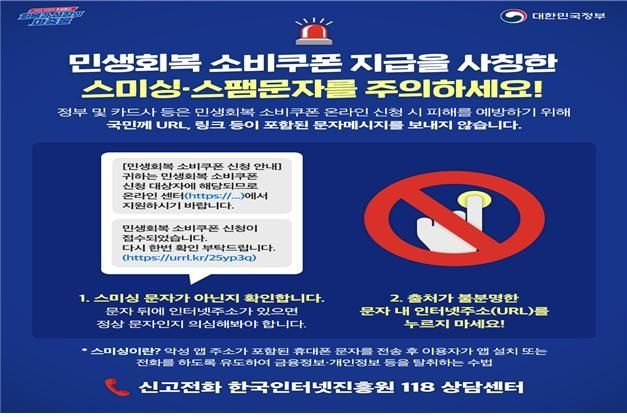

The Financial Services Commission emphasized that the consumer guidance for the second round of livelihood recovery consumer coupons will not include any URLs. In addition, the authorities warned that scammers may impersonate financial institutions to create fake web pages and steal information, and advised consumers to immediately stop the process and verify the official website address if asked for excessive personal or financial information.

If you receive a smishing text message, you should report it to the Voice Phishing Integrated Reporting and Response Center to suspend the use of the sender's phone number. If you become a victim of smishing, the Financial Services Commission explained that you should immediately report it to the financial institution of your account or the scammer's account, or to the Voice Phishing Integrated Reporting and Response Center (112), and request a payment suspension.

Furthermore, the authorities recommended actively using the Safe Blocking Service for credit and non-face-to-face account openings to prevent unauthorized loans or new account openings due to personal information leakage. This service can be easily applied for by visiting a branch of your financial institution or through the bank's mobile app.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.