Top Pick for Foreign and Institutional Investors This Month

Target Prices Raised on Memory Market Recovery

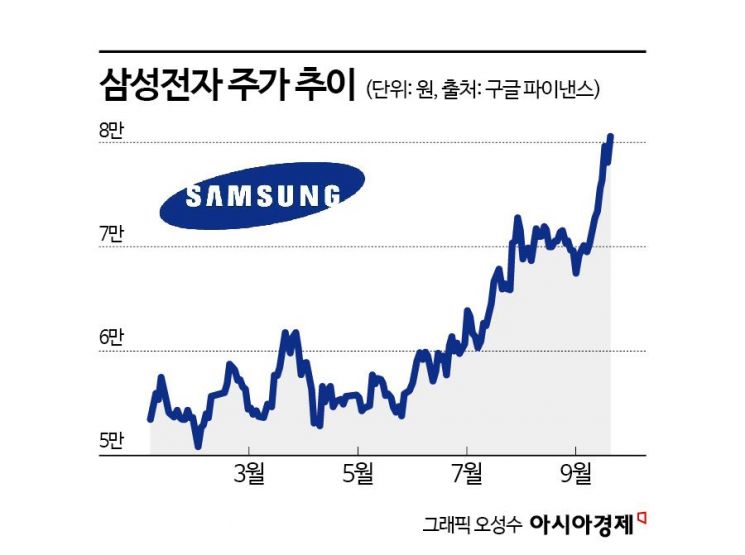

Samsung Electronics, often referred to as the "people's stock" in Korea, has surpassed the 80,000 won mark, buoyed by strong buying from both foreign investors and institutions. As the scale of foreign investment in Samsung Electronics and SK Hynix approaches 6 trillion won, the semiconductor sector is experiencing a pronounced concentration of capital, and the securities industry is now awash with optimistic forecasts, with many predicting that Samsung Electronics could reach the 100,000 won level.

According to the Korea Exchange on September 19, Samsung Electronics closed at 80,500 won the previous day, up 2.94%, setting a new yearly high. This is the first time in 13 months, since August 19 last year, that Samsung Electronics has traded above 80,000 won. SK Hynix, which also set a new record high alongside Samsung Electronics, surged more than 7% during the session, reaching an all-time high of 357,000 won.

Since September, both foreign investors and institutions, having turned to net buying on the KOSPI, have focused their attention on semiconductors. During this period, Samsung Electronics was the most purchased stock by both groups, with foreigners buying 3.3788 trillion won and institutions purchasing 1.8678 trillion won worth of shares. Notably, foreigners also poured 2.5497 trillion won into SK Hynix, making it their second-largest net purchase. As a result, the KRX Semiconductor Index has jumped 19.41% this month, posting the highest growth rate among all KRX indices.

Securities Firms Raise Target Prices

Thanks to the "buying spree" by foreign investors and institutions, the securities industry is overflowing with bullish forecasts for Samsung Electronics to reach the 100,000 won mark. Analysts note that as investments centered on artificial intelligence (AI) servers, which have relied heavily on high-bandwidth memory (HBM), expand to general servers based on DRAM and SSDs, Samsung Electronics' presence is becoming more prominent.

Kim Woonho, a researcher at IBK Investment & Securities, stated, "For DRAM, we expect a differentiated increase in average selling price (ASP) due to improvements in the product mix, and we also anticipate significant improvements in NAND prices and operating profit from the non-memory business unit." He raised his target price for Samsung Electronics from 90,000 won to 110,000 won. He estimated Samsung Electronics' third-quarter revenue this year at 87.8 trillion won and operating profit at 10.4 trillion won. Similarly, SK Securities projected that Samsung Electronics' memory business would achieve a record-high operating profit of 36 trillion won in 2026 and raised its target price from 77,000 won to 110,000 won.

The partnership with Nvidia is also seen as a positive factor. Kim Younggun, a researcher at Mirae Asset Securities, said, "The likelihood of passing quality tests for high-bandwidth memory (HBM) 4 for Nvidia is gradually increasing. It is estimated that about 10% of total HBM production capacity is allocated to sample production, and as the scale of samples grows, revenue recognition will begin."

Semiconductor Stocks Take the Wheel, No Issues Expected Through Year-End

With the domestic stock market having safely navigated the major event of the September Federal Open Market Committee (FOMC) meeting, there are expectations that large-cap semiconductor stocks will continue to drive the KOSPI's upward momentum through the end of the year. Kim Kyungtae, a researcher at SangSangIn Securities, said, "As the supplier-dominant market in semiconductors is expected to persist, the narrowing interest rate gap between Korea and the US, along with a weaker dollar, will encourage the return of foreign capital, thereby increasing overall market liquidity." He forecast the KOSPI to end the year in the range of 3,150 to 3,700.

However, the rapid short-term surge of leading semiconductor stocks, which have been key to the bull market, could become a source of fatigue. According to the Korea Financial Investment Association, as of September 17, the balance of securities lending for Samsung Electronics stood at 7.483 trillion won, ranking second after SK Hynix (8.6351 trillion won). While a high securities lending balance does not necessarily indicate an imminent increase in short selling, a rising balance often leads to increased short-selling pressure, which is why it is considered a "leading indicator" for short selling.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.