Only One New Listing This Month

Sharp Decline Compared to 11 in August and 5 in September Last Year

IPO System Reforms Add to Traditional Off-Season Slump

Focus Shifts to Myungin Pharmaceutical’s Upcoming IPO

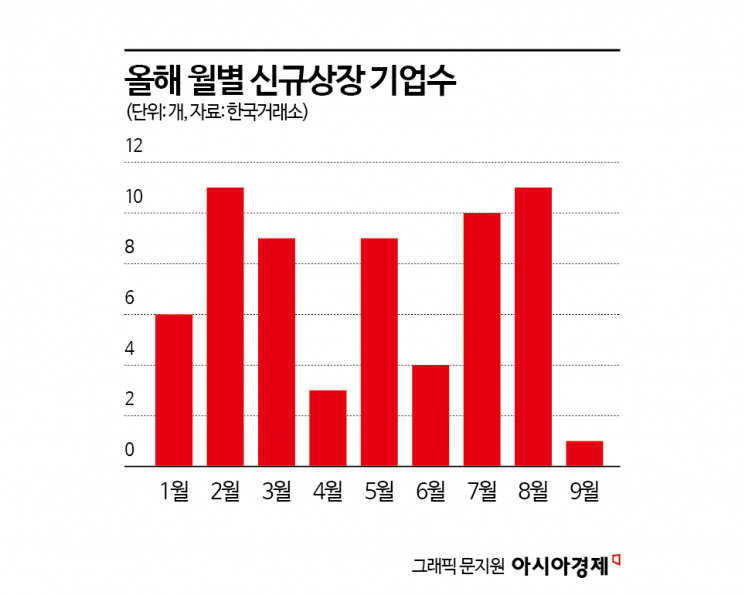

While the KOSPI has been hitting record highs day after day this month, creating an unprecedented bull market, the initial public offering (IPO) market is experiencing a cold spell. With only one new listing this month, the IPO market is expected to post historically poor results.

According to the Korea Exchange on September 18, there has been only one new listing this month. Even this was on the KONEX market, with no new listings on either the KOSPI or KOSDAQ markets. This is a significant decrease compared to the five new listings in September last year. The situation is even worse compared to the previous month, when there were 11 new listings, and 10 in July, marking two consecutive months of double-digit new listings. The only company expected to debut on the KOSDAQ market this month is S2W, scheduled for listing on September 19.

Park Jongseon, a researcher at Eugene Investment & Securities, said, "The average number of IPOs in September from 1999 to 2024 was seven, and the average for the past five years (2020-2024) was nine, so this year is significantly lower." He added, "Both the total funds raised and the expected market capitalization for September's IPOs are expected to be lower than the historical monthly averages."

Despite the stock market reaching all-time highs and showing an unprecedented bull run, the sluggishness in the IPO market is attributed to September traditionally being an off-season, as well as recent IPO system reforms. Previously, financial authorities implemented reforms to rationalize the IPO market by expanding the mandatory holding period commitments for institutional investors and strengthening eligibility and underwriter responsibilities for bookbuilding. Since July, at least 40% of institutional allocations must be preferentially assigned to institutions making mandatory holding commitments. If the proportion of such commitments falls short, the underwriter must directly acquire 1% of the public offering (up to 3 billion won) and hold it for six months. Park explained, "September, along with April, is considered an off-season for IPOs, as this is when companies pursue IPOs based on their first-half results." He added, "In particular, given the impact of various policies applied to the IPO market since July, it appears that companies are taking a wait-and-see approach."

As a result, market attention is focused on whether Myungin Pharmaceutical, scheduled to go public next month, will be a success. Considered one of the major IPOs in the second half of the year, Myungin Pharmaceutical conducted a bookbuilding process for institutional investors from September 9 to 15. A total of 2,028 domestic and international institutional investors participated, resulting in a competition ratio of 488.95 to 1. Of all the shares requested (including those without price indications), 99.99% were at or above the upper end of the offering price range (45,000 to 58,000 won), leading to the final offering price being set at 58,000 won. The total amount raised is expected to be 19.72 billion won, and the market capitalization after listing is projected to be 84.68 billion won. Myungin Pharmaceutical plans to go through general subscription from September 18 to 19 and aims to list on the KOSPI market on October 1.

Heo Hyemin, a researcher at Kiwoom Securities, commented, "Myungin Pharmaceutical is well known for 'Maykin' and 'Igatan,' but over-the-counter (OTC) drugs account for only 15% of its business, while prescription drug (ETC) sales make up the majority, allowing the company to maintain an operating margin of 34% over the past three years. In particular, it holds the top market share in the central nervous system (CNS) therapeutics segment in Korea." She added, "The largest shareholder holds a 73.81% stake, so concerns about overhang (potential shares for sale) are low. The cash dividend payout ratio was 16% in 2024, and it is expected to increase after listing. With the new plant scheduled to begin operation in 2027 and the planned domestic launch of a new schizophrenia drug, the company is expected to secure new growth drivers."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.