Bloom Energy Shares Continue to Climb on NYSE

Rising Demand for Power Generation Fuel Cells

Sales of Fuel Cell Plumbing Modules Expected to Increase

As artificial intelligence (AI) data centers rapidly increase in number, the issue of power supply shortages is becoming increasingly serious. This is driving a surge in demand for on-site power generation within data center sites. As a result, Bloom Energy's stock price has been rising steadily on the New York Stock Exchange. In the domestic stock market, growing interest in solid oxide fuel cells (SOFCs) for power generation is quickly boosting the corporate value of Hansun Engineering.

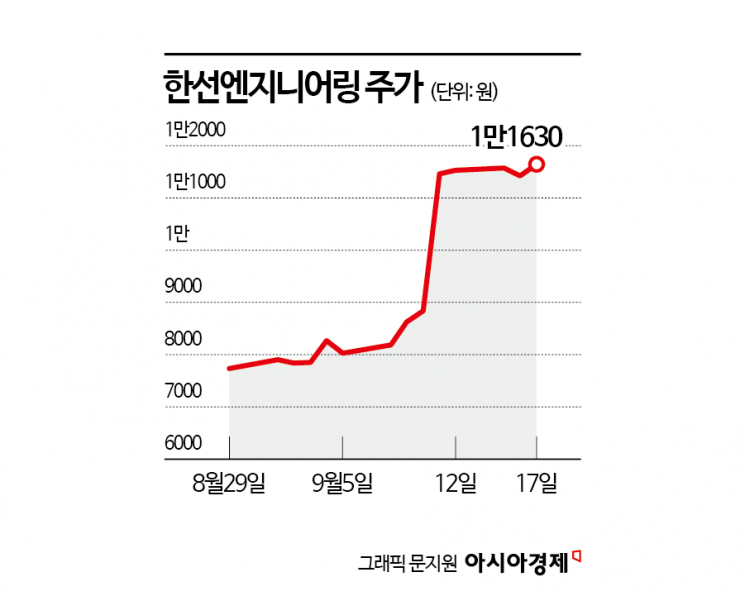

According to the financial investment industry on September 18, Hansun Engineering's stock price has risen by 50% so far this month.

Hansun Engineering is a manufacturer of fittings and valves for measuring equipment. The company supplies products to industries that require fluid flow control, including petrochemicals, shipbuilding, offshore, defense, onshore and offshore plants, aerospace, semiconductors, displays, hydrogen fuel cells, and energy storage systems (ESS). Hansun Engineering is a supplier to Bloom SK Fuel Cell, a joint venture between Bloom Energy in the United States and SK Ecoplant in Korea. The company produces plumbing modules for hydrogen fuel cells, which are exported worldwide through Bloom Energy's manufacturing facilities in the United States. Plumbing modules for SOFCs serve the function of fuel distribution within fuel cell systems. High durability and heat resistance are essential to match the characteristics of fuel cells that operate 24 hours a day.

In the first half of this year, Hansun Engineering recorded sales of 28.6 billion won and operating profit of 4.3 billion won. Compared to the same period last year, sales increased by 14.4%, while operating profit rose by 38.8%.

The recent rise in share price is linked to the growth of Bloom Energy. While Bloom Energy's stock price hovered around 20 dollars at the end of last year, it surpassed 70 dollars on September 16. Bloom Energy's SOFCs use natural gas as fuel. In regions where only gas infrastructure is available, electricity can be supplied quickly. As SOFCs are emerging as a power source to solve the power shortage in data centers, the company's corporate value is also rising.

Kim Si-hyun, a researcher at Hana Securities, explained, "Bloom Energy is the only company that has signed SOFC contracts at a commercial scale," adding, "SOFC fuel cells are deployed on-site using a stacking method, and it is estimated that the current generation capacity per site is about 100MW or more."

He further stated, "In July, Oracle announced a partnership plan to deploy Bloom Energy's fuel cells at its data centers, providing on-site power within 90 days," and added, "SOFCs are now transitioning from a supplementary to a primary power source."

As power demand increases and SOFCs gain attention as an on-site power supply solution, expectations for Hansun Engineering are also rising. Hansun Engineering's sales of SOFC plumbing modules supplied to its major client, Bloom Energy, could grow rapidly.

Hansun Engineering used part of the funds raised from its initial public offering (IPO) in November 2023 to expand its production capacity for fuel cell plumbing module products. The company expects to complete its second plant as early as the end of this year and begin full-scale operations in the second half of next year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.