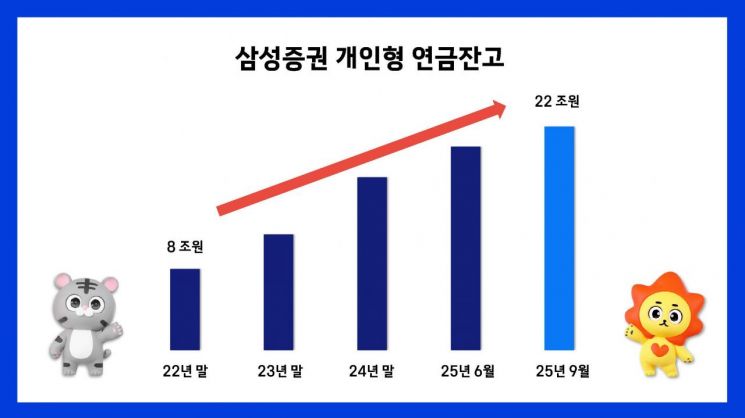

Samsung Securities is experiencing rapid growth, with the total balance of individual pension accounts-including pension savings, defined contribution (DC) plans, and individual retirement pensions (IRP)-surpassing 22.2 trillion won based on market value.

According to Samsung Securities on September 17, the total balance of individual pension accounts at the company grew explosively by 30%, rising from approximately 17.1 trillion won at the end of 2024 to over 22.2 trillion won as of September 11, 2025. During the same period, the total pension balance also increased by 23.8%, from 21.2 trillion won to 26.3 trillion won.

Among individual pensions, the balances of pension savings, DC plans, and IRP accounts increased by 34.6%, 27.4%, and 26.9%, respectively, over the same period.

There was a significant increase in individual pension balances among investors in their 40s and 50s. The balance for these clients, which stood at about 10.9 trillion won at the end of 2024, grew by approximately 34.8% to reach around 14.7 trillion won as of September 11, 2025.

Additionally, exchange-traded funds (ETFs) have gained popularity among middle-aged and older clients, recording the highest growth rate among all products. ETF balances rose by 54% during the same period, expanding from around 6.7 trillion won to 10 trillion won.

The rapid growth of Samsung Securities' pension balances is attributed to subscriber-focused pension services. Notably, in 2021, the company transformed the retirement pension fee structure by introducing 'Direct IRP,' the first retirement pension product to offer zero management and asset management fees (excluding fund fees). Samsung Securities also launched the '3-Minute Pension' service, which greatly enhances subscriber convenience by eliminating the need for paperwork and mailings when signing up (excluding time required for personal information provision and terms confirmation).

Through its official mobile trading system, mPOP, Samsung Securities also offers convenient pension management services such as 'Pension Stock,' 'Robo Discretionary,' and 'ETF Accumulation.'

Furthermore, Samsung Securities was the first in the industry to establish dedicated pension centers, currently operating three locations in Seoul, Suwon, and Daegu. These centers provide specialized pension consultation services by experienced professionals with over 10 years of private banking experience.

The Samsung Securities Pension Centers not only offer consultations for pension subscribers but also support seminars for corporations introducing retirement pensions. Over the past year alone, the company held more than 200 seminars.

Lee Sungjoo, Executive Director and Head of the Pension Division at Samsung Securities, stated, "It is important to manage retirement pensions systematically with a long-term perspective," adding, "Samsung Securities will do its utmost to serve as a reliable pension partner for customers by providing excellent pension management services."

Meanwhile, Samsung Securities is running the 'Pension Savings Net Deposit Event' until Tuesday, September 30, 2025, to raise awareness of pension savings and provide tangible benefits to pension clients.

The event consists of two programs. Various benefits are provided according to the net deposit amount. The net deposit amount is calculated by adding up new deposits, transfers from other companies' pensions, and conversions of matured ISAs into pensions made in pension savings accounts during the event period.

The 'Pension Savings Together Event' offers gift certificates based on net deposit tiers, starting from a minimum net deposit of 10 million won, with a maximum benefit of a 1 million won mobile gift certificate for net deposits of 500 million won or more. If the pension is transferred from an insurance company, the net deposit amount for benefit calculation is doubled.

The 'Boom-up Event' targets new clients or those with a total balance of less than 1 million won. Clients who make a net deposit of at least 1 million won but less than 10 million won in their pension savings account during the event period will receive a 5,000 won mobile gift certificate.

Please note that statutory severance pay (including legal severance pay, honorary retirement pay, retirement consolation pay, special voluntary retirement pay, and similar non-statutory severance payments) is excluded from the net deposit calculation for these events.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)