Temporary Visa-Free Policy for Chinese Group Tourists Begins This Month

Sales Decline Despite Increase in Shoppers, Creating a Vicious Cycle

Shift Toward Value-Driven Beauty and Fashion Consumption Trends

Rising Rent Burden at Incheon Airport Sto

Despite the temporary visa-free policy for Chinese group tourists set to take effect at the end of this month, the domestic duty-free industry is responding with a wry smile. This marks the first time since 2017, when China imposed the Hallyu ban (restrictions on Korean content) in response to the U.S.-China conflict over the deployment of the Terminal High Altitude Area Defense (THAAD) system on the Korean Peninsula, that visa-free group tourism from China is resuming. However, due to the economic downturn in China, it is expected that spending by Chinese group tourists, often referred to as "Youke," will decrease.

Already, the duty-free industry has lost its core customer base to emerging beauty and fashion powerhouses known collectively as "OlDamu" (Olive Young, Daiso, Musinsa), reflecting the global trend toward value-for-money consumption. In addition, duty-free stores located at Incheon International Airport are facing increased pressure after failing to reach an agreement on rent adjustments. If the number of visa-free Chinese group tourists surges, rents could rise even further.

Tourists including Chinese visitors are shopping at a duty-free store in Seoul. Photo by Yonhap News

Tourists including Chinese visitors are shopping at a duty-free store in Seoul. Photo by Yonhap News

According to industry sources on September 16, the Korean government will implement a temporary visa-free policy for Chinese group tourists from September 29 to June 30 next year as part of efforts to revitalize the tourism industry. During this period, groups of three or more tourists, organized by designated travel agencies specializing in attracting group tourists (as selected by the Ministry of Culture, Sports and Tourism) and visa application agencies designated by Korean diplomatic missions in China, will be able to visit Korea visa-free for up to 15 days.

An industry insider from the travel sector stated, "With the upcoming Chinese National Day and Mid-Autumn Festival holidays early next month, there is growing demand for travel to Korea, fueled by marketing products from local travel agencies." As a result, there are expectations that related industries such as hotels, shopping, and casinos may benefit from this tourism boost.

Duty-Free Stores: Mixed Expectations and Concerns Over Visa-Free Entry of Youke

However, within the duty-free industry, there is a mix of hope and concern. Even if the number of foreign visitors to Korea increases, it is uncertain whether this will translate into a proportional rise in actual purchases. According to the Korea Duty Free Shops Association, as of July, the number of foreign customers at domestic duty-free shops was approximately 990,000, up more than 25% from 790,000 during the same period last year. However, sales from these customers fell by 14.2%, from 746.6 billion won to 640.5 billion won.

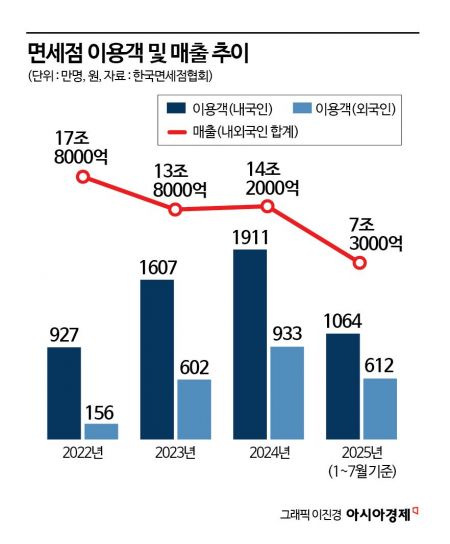

The total number of duty-free shoppers, including Koreans, increased from 10.83 million in 2022, when the endemic phase of the pandemic began, to 28.44 million last year. Nevertheless, total sales dropped from 17.8 trillion won to 14.2 trillion won. Compared to 2019, before the COVID-19 outbreak, the number of shoppers decreased by 41.3%, and sales fell by more than 10 trillion won. This year, from January to July, the number of shoppers reached 16.76 million, likely to surpass last year's performance, but sales are sluggish at 7.3 trillion won.

An industry official pointed out, "Chinese visitors, who traditionally have high spending and purchase volumes, are now spending less on duty-free shopping due to weak consumption. Moreover, as foreign tourists' spending trends have shifted, more are seeking value-for-money stores such as Olive Young and Daiso, depending on their individual travel itineraries." In fact, analysis of Hana Card's data on foreign visitors to Korea showed that last year, Olive Young's transaction amount, number of users, and number of transactions increased by 106%, 77%, and 80%, respectively, compared to the previous year. During the same period, Daiso saw increases of 49%, 46%, and 41%, while Musinsa recorded growth of 343%, 348%, and 350%, respectively.

This shift has had an even greater impact on duty-free store operators at Incheon Airport, where rent is calculated based on the number of airport users. Shilla Duty Free and Shinsegae Duty Free requested temporary rent reductions from Incheon International Airport Corporation, but negotiations broke down as the airport cited fairness to other bidders who lost in the tender process. The court proposed a compulsory adjustment, ordering the airport to reduce Shilla Duty Free's rent by 25% and Shinsegae Duty Free's by 27%. However, the airport plans to file an objection, which could lead to a full-fledged lawsuit or the possibility of the two companies withdrawing from Incheon Airport. Both companies have stated they are "reviewing internal measures" and declined to comment further unless the compulsory adjustment is accepted.

Competition to Attract High-Value MICE and Incentive Tourists

Nevertheless, the duty-free industry is moving quickly to attract Chinese tourists, who were once the "big spenders" in the domestic market. For example, Lotte Duty Free's marketing chief Namgoong Pyo and other key executives visited Guangzhou and Qingdao in China from September 10 to 12, meeting with more than 30 local travel agencies and major partners to discuss collaboration, including offering special benefits for group tourists. In the second quarter of this year, Chinese customers accounted for the largest share of Lotte Duty Free's sales by nationality, at 62.5%. On September 18, the company will also host a guide invitation event, inviting more than 200 tour interpreters specializing in Chinese, Japanese, and Southeast Asian languages to introduce major stores, brands, and benefits at its duty-free shops.

Shilla Duty Free selected actor Park Hyungsik, who is highly recognized in Asia, as its promotional model last month and has launched marketing campaigns leveraging Hallyu. Recently, the company also appointed the multinational seven-member boy group N.SSign as models, aiming to attract Millennials & Gen Z customers through their global fan base. In addition, Shilla Duty Free is targeting high-value-added demand such as MICE (Meetings, Incentives, Conferences, and Exhibitions) and incentive tours by collaborating with its China office and local travel agencies.

Shinsegae Duty Free also aims to attract more than 50,000 customers through its incentive group tour program by the end of the year, and, if the visa-free policy is implemented, to bring in an additional 10,000 Chinese tourists. Last month, about 1,400 group tourists from China's top dairy company Yili Group and leading online education company New Oriental Group visited Shinsegae Duty Free's Myeongdong store.

Additionally, Hyundai Duty Free is working to attract Chinese MICE groups by leveraging the characteristics of its customer base at COEX, a popular destination for independent foreign travelers, and is preparing to develop group tour products linked to tourist attractions such as aquariums. The company is also running an "Alipay Discount Promotion," offering an instant 30 yuan discount to customers who spend 1,000 yuan (about 190,000 won) or more at any of its online or offline stores using Alipay.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.