Bank of Korea's September Monetary and Credit Policy Report

Reviewing the Impact of the June 27 Measures

Clear Slowdown in Price Increases and Transaction Volume

Risks Remain from Expectations of Further Price Hikes and Latent Demand

Following the government's June 27 household loan regulations, the real estate market in the Seoul metropolitan area has somewhat stabilized, but the Bank of Korea assessed that it is difficult to view this as a trend toward lasting stability. The central bank pointed out that risk factors such as expectations of further price increases and latent demand remain. It also warned that if concerns about supply shortages and an easing of financial conditions coincide, the housing market could overheat again.

On September 11, the Bank of Korea made this assessment of the metropolitan housing market in its Monetary and Credit Policy Report, following the June 27 measures.

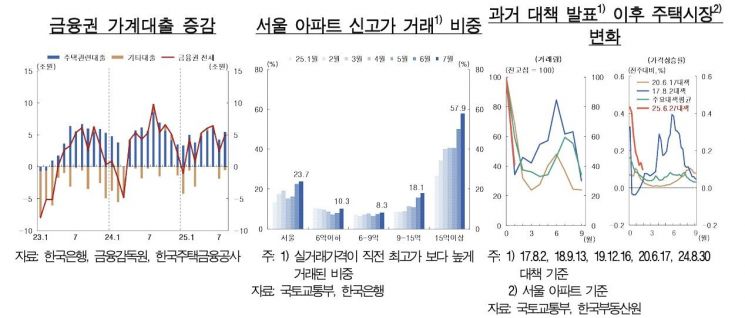

Since the June 27 measures, the metropolitan housing market has shown signs of moderation, with a narrowing in the pace of price increases and a slowdown in transactions, indicating some alleviation of overheating. Specifically, transactions have decreased for high-priced homes affected by the restriction on mortgage loans exceeding 600 million won-namely, homes priced at 1.2 billion won or more in regulated areas and 860 million won or more in non-regulated areas. In Seoul, the proportion of transactions for homes priced above 860 million won fell from 51.3% in June to 36.8% in July, while those above 1.2 billion won dropped from 33.9% to 23.2%. The Bank of Korea also estimated that speculative transactions, such as gap investments, have declined significantly.

Household loan growth has also moderated. The increase in household loans from financial institutions in July was about one-third of the previous month's level. In August, loan growth expanded again due to increased housing transactions before the regulations, but the rise was limited. This was the result of both direct effects, such as reduced loan limits, and voluntary actions by financial institutions, including stricter loan screening and the suspension of broker-mediated loans, which strengthened household loan management.

However, the Bank of Korea found that the upward trend in home prices in Seoul remains strong, with expectations of further price increases and latent demand still robust. According to the Ministry of Land, Infrastructure and Transport and the Bank of Korea, the proportion of record-high apartment transactions in Seoul rose slightly from 22.7% in July to 23.7%, and for apartments priced above 1.5 billion won, the share jumped by 7.7 percentage points from 50.2% to 57.9%, indicating that the proportion of record-high transactions remains high.

The central bank also cautioned that the effects of the June 27 measures could gradually weaken due to spillover effects between regions or the so-called "learning effect" from past real estate policies. According to the report, following previous real estate policy announcements, housing prices typically slowed for about three months, but if effective additional measures were not introduced in a timely manner, prices tended to rebound.

The head of the Market Overview Team at the Bank of Korea's Financial Markets Department, who authored the report, stated, "Although overheating in the metropolitan housing market has somewhat subsided and the growth in household loans has slowed since the measures, it is necessary to further monitor whether this will lead to a sustained trend of stability, given the underlying risk factors. If expectations for further price increases in Seoul do not sufficiently subside and factors such as regional spillover effects, concerns about supply shortages, and an easing of financial conditions coincide, the metropolitan housing market could overheat again and household debt growth could accelerate once more."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)