"Please also check the NAV trends." "If you blindly trust recommended videos and posts on YouTube or other platforms, you may incur investment losses or may not be able to receive legal protection."

On September 9, the Financial Supervisory Service announced six key "Investor Precautions" as domestic Exchange-Traded Funds (ETFs) have gained attention as a means of growing personal assets, with their net asset value exceeding 232 trillion won.

As of the end of August, the net assets of domestic ETFs stood at 232 trillion won, which is approximately 4.5 times higher than at the end of 2020 (52 trillion won). The number of listed ETF products reached 1,016, surpassing 1,000 for the first time since ETFs were introduced in Korea in 2002. The Financial Supervisory Service explained, "ETFs allow for diversified investments at relatively low costs and can be traded in real time just like listed stocks." However, it also pointed out, "ETFs with complex structures, such as those utilizing options, can also be traded immediately without separate investment recommendations, so providing accurate information is even more important."

First, the Financial Supervisory Service urged investors to check NAV (Net Asset Value) trends together, as even if the distribution rate appears high, investment losses may occur if the NAV drops significantly. For distribution-type ETFs, an investor's actual profit or loss should be determined by adding the distribution amount to the gains or losses from NAV fluctuations. This means that even if you receive distributions, you may still incur losses if the drop in NAV is greater than the distribution received.

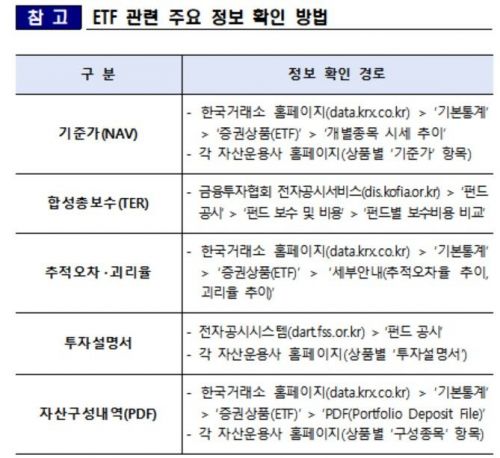

The NAV is calculated by dividing the ETF's total net assets (assets minus liabilities) by the total number of shares issued, representing the theoretical value per share. This can be checked on the Korea Exchange website or on the product-specific NAV section of the relevant ETF asset management company's website. The Financial Supervisory Service also emphasized that the distribution rate refers to the distribution amount compared to the ETF's NAV on the distribution record date, and is unrelated to the investor's principal. An official from the Financial Supervisory Service pointed out, "For an ETF with a target distribution rate of 20% per year, expressions such as 'If you invest 100 million won, you will receive 1.5 million won per month'?implying a fixed payment like bank deposit interest based on the invested principal?are incorrect."

Second, the Financial Supervisory Service explained that in order for investors to accurately understand their actual expenses, they should check the total expense ratio (TER) of the ETF, which includes all investment costs. The total expense ratio includes not only the management, sales, and trust fees, but also other expenses required for fund management, such as index license fees and audit fees. This information can be found on the Korea Financial Investment Association's electronic disclosure service under the fund disclosure?fund fees and expenses?fund-by-fund fee comparison page.

Additionally, the Financial Supervisory Service warned that if an ETF's tracking error (the difference between the underlying index it tracks and its NAV) widens significantly, there is a risk that the investor's expected return and actual investment performance may diverge. If the premium/discount rate, which is the difference between the ETF's market price and its NAV, widens, investment losses may also occur. In particular, ETFs that invest in overseas assets may experience temporary premium/discount rates due to time differences, but if such discrepancies become excessive or persist for a long period, investors should exercise caution.

The Financial Supervisory Service also noted that ETFs utilizing options have both advantages and disadvantages depending on market conditions, such as giving up a portion of the underlying asset's gains when selling call options in a rising market. It recommended that investors thoroughly understand the product's management strategy in advance, as the strategy of ETFs using options can be difficult to grasp intuitively and only certain aspects, such as high distributions through option selling, may be highlighted. This information can be found in the investment strategy section disclosed on the electronic disclosure system or on the relevant ETF asset management company's website.

Furthermore, it was mentioned that the detailed asset composition (PDF) reflecting the ETF's stated management strategy can be checked on the Korea Exchange or the asset management company's website. Through the real-time disclosed ETF PDF, investors can review the ETF's holdings and investment proportions. For example, for an ETF with a management strategy focused on global value stocks, investors can search for the names of the constituent companies listed in the PDF and analyze the investment proportions by country or industry sector.

Finally, the Financial Supervisory Service emphasized that blindly trusting ETF recommendation videos or posts on YouTube or other social networking services (SNS) carries a high risk of incurring investment losses or not being able to receive legal protection. The Financial Supervisory Service stated, "Finfluencers active on SNS may not be registered personnel under financial law, so their knowledge and experience regarding financial products may not be verified, and any conflicts of interest arising from introducing specific products may not be disclosed in their videos or posts. Therefore, investors should be especially cautious." It added that since the final responsibility for investment lies with the investor, it is necessary to thoroughly review and understand the investment prospectus, investment strategy, and investment risks posted on the asset management company's website before investing.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.