Preventing Unfair Surcharges in Advance

Strengthening Customized Taxpayer Guidance

Gangnam District in Seoul (District Mayor Cho Sungmyung) announced on September 9 that it has officially launched the "My Acquisition Tax Notification Talk" service this month. This initiative aims to prevent cases where taxpayers are unfairly burdened with additional taxes because they were unaware of the reporting deadlines or tax reduction requirements during real estate acquisition.

The service is intended to proactively address the issue of taxpayers falling into an information blind spot, especially in situations where reporting is commonly handled by legal representatives such as judicial scriveners.

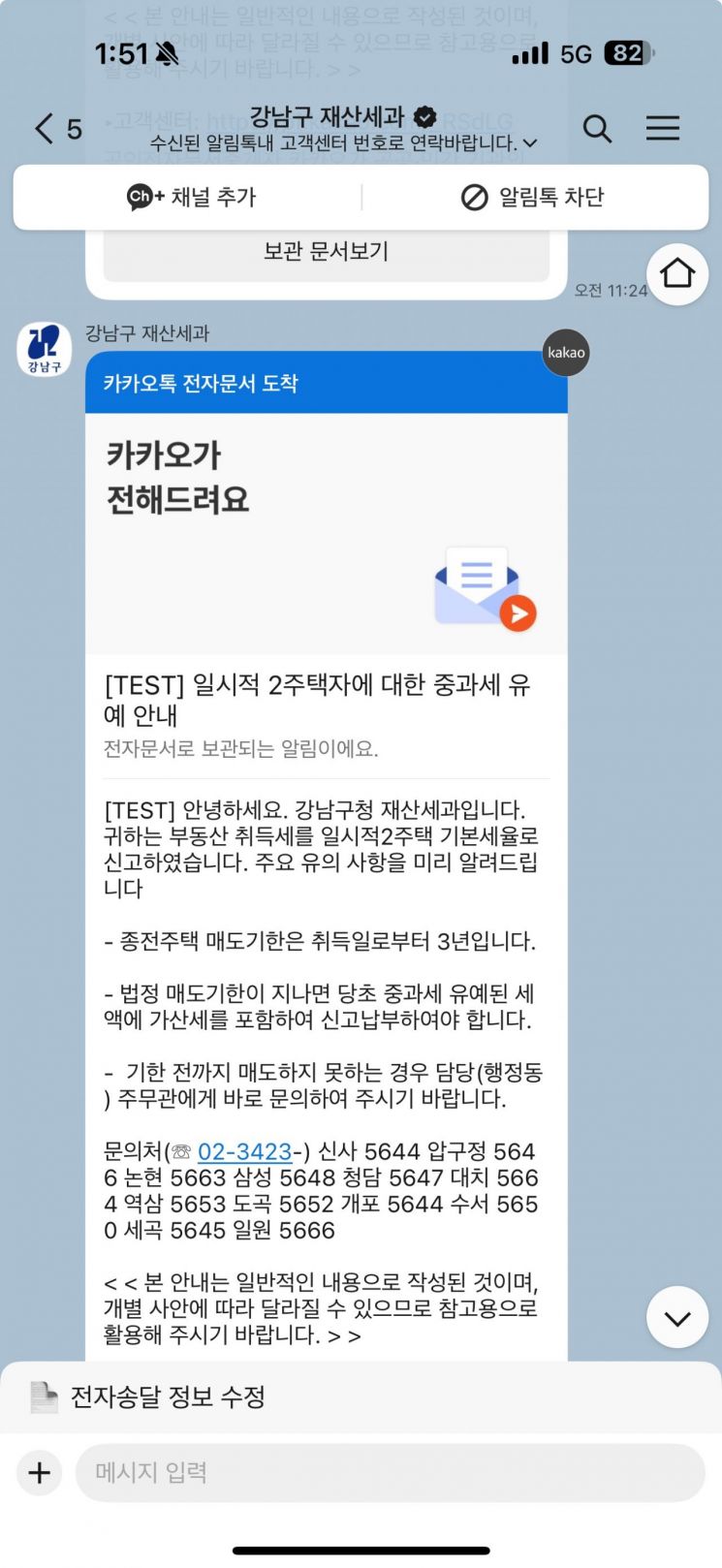

The district conducted a comprehensive review of 6,165 real estate acquisition tax filings from the first half of this year and identified 891 cases that required advance notification. Four categories were selected as targets for the Notification Talk messages: temporary two-homeowners, first-time homebuyers, recipients of property acquired without payment, and real estate heirs. On September 2 and 3, the first notification messages were sent to 420 individuals in these groups.

In practice, temporary two-homeowners are subject to additional tax rates and surcharges if they fail to dispose of their previous home within three years. First-time homebuyers can receive up to 3 million won in tax benefits when purchasing a home valued at 1.2 billion won or less, but must repay the taxes, including surcharges, if they do not meet requirements such as moving in, maintaining a single home, and actual residence. Additionally, those who acquire property without payment must recalculate their tax base based on the officially recognized market value, and heirs must file a mandatory report within six months.

Gangnam District plans to repeatedly send Notification Talk messages to help recipients verify whether they meet the requirements. The district will also run an on-site information session program called "My Home, My Tax" for new apartment residents.

The district has submitted this service as a best practice at the "2025 Second Half Seoul City and District Joint Revenue Collection Strategy Meeting" and is promoting it as part of taxpayer-centered tax administration, with the goal of "Warm Taxation, Fair Taxation."

Cho Sungmyung, Mayor of Gangnam District, stated, "By providing accurate tax information in advance, we expect to protect honest taxpayers and reduce unnecessary tax-related complaints. We will continue to strengthen customized guidance for each taxpayer and do our utmost to implement fair tax administration."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)