BSM Disclosure Expands Among KOSPI 200 Companies,

But Utilization Remains Limited

Only 26% Systematically Manage Board Skills Matrix;

Gender Diversity Targets Rarely Disclosed

Report Highlights Need for Practical Use,

Clear Standards, and Strategic Alignment

Global Best Practices Emphasized for Board Competencies

and Diversity Policies

Female Outside Director Ratio Doubles,

But Policy and Education Needed for True Diversity

Internal Control Disclosure Cases Analyzed;

Key Governance Agendas Addressed

According to an analysis by Deloitte Korea Group, the adoption of the Board Skills Matrix (BSM) disclosure among KOSPI 200 companies is spreading, but its utilization and management remain insufficient.

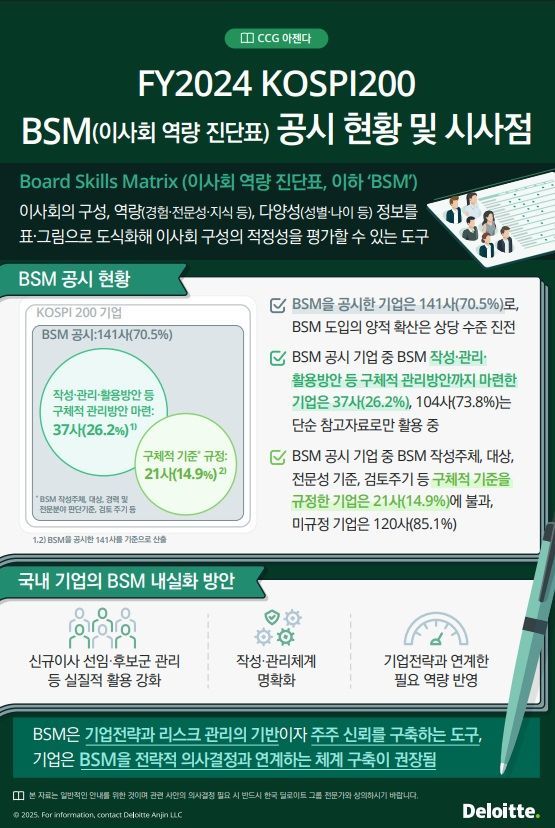

The 11th issue of "Corporate Governance Organization Insight," published on September 8 by the Corporate Governance Organization Development Center at Deloitte Korea Group, revealed that 70% (141 companies) of KOSPI 200 companies are disclosing the Board Skills Matrix (BSM), which assesses the adequacy of board composition. This indicates that the adoption of BSM is becoming more widespread in Korea.

However, only 26% (37 companies) have established systematic processes for creating, managing, and utilizing the BSM, suggesting that most companies are using the BSM merely as a reference material.

The BSM is a tool that visualizes information on board composition, competencies, and diversity through tables and graphs, allowing for an assessment of the board's adequacy. Although it is not a legal requirement, the BSM enables companies to quickly identify both the competencies present and those lacking on the board, which has led to growing interest in Korea. Just two to three years ago, BSM disclosures were limited to financial holding companies and a few large corporations, but now they have become a key item in the governance disclosures of major domestic companies.

Among the companies disclosing the BSM (141 companies), only 14.9% (21 companies) have clearly defined specific operational standards such as the responsible parties for preparation and review, criteria for expertise, and review cycles. Furthermore, only 4.3% (6 companies) disclose gender diversity targets, indicating that BSM disclosure remains largely superficial in many cases.

Meanwhile, in the financial sector, the use of BSM has been expanding institutionally, linking it to succession planning, candidate recommendations, and diversity targets, following the "Best Practices for Bank Governance" announced by financial authorities at the end of 2023.

The report also highlights that leading global companies such as Chevron and GE transparently present not only board competencies but also required competencies linked to long-term strategies, diversity policies, and criteria for board restructuring. To enhance the quality of BSM disclosures, the report suggests strengthening practical utilization, clarifying creation and management systems, and reflecting required competencies linked to corporate strategy.

Kim Hanseok, head of the Corporate Governance Organization Development Center at Deloitte Korea Group, emphasized, "BSM should function not just as a governance disclosure item, but as a foundation for corporate strategy and risk management, as well as a tool for building trust with shareholders." He added, "It is desirable for Korean companies to refer to global best practices and establish systems that strategically connect the BSM to core decision-making processes such as new director appointments, succession planning, and candidate pool management."

The report also examined board diversity in domestic listed companies through the proportion of female outside and inside directors, and analyzed early disclosure cases of internal control over funds, drawing relevant implications. The proportion of female outside directors at Korea Exchange-listed companies reached 13.9% (324 individuals) for the 2024 fiscal year, more than doubling from the 2021 fiscal year. However, the report pointed out that beyond increasing numbers, policies and education are needed to truly achieve diversity.

Additionally, Jung Hyun, head of the Internal Accounting Management System Center of Excellence at Deloitte Korea Group, analyzed 48 cases of early disclosure regarding internal control over funds, suggesting improvements in company-wide monitoring and the management of affiliates. The report also addressed other key agendas, including the revised cumulative voting system (by Professor Jang Jeongae of Ajou University Law School and former advisor to the Corporate Governance Organization Development Center at Deloitte Korea Group) and occupational fraud and internal control (by Professor Noh Junhwa of Chungnam National University Business School and advisor to the Corporate Governance Organization Development Center at Deloitte Korea Group).

This issue also covers a range of topics, such as AI-based governance leadership, the scope of recognition for accounting and audit support organizations, the translated version of "Key Board Competencies Required in Complex Business Environments" published by Deloitte Global, and partial amendments to the "Detailed Regulations for the Enforcement of External Audit and Accounting Rules," including standards for measures following audit review results.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)