Delinquency Rate Hits 1.76%, Highest Since Q3 2014

Profitability Worsens as Merchant Fee Income Falls and Bad Debt Expenses Rise

"Emergency Cash Window" Card Loans Decline, While Cash Advances Remain at Last Year's Level

Due to the economic downturn, the delinquency rate among the eight domestic standalone credit card companies at the end of June reached its highest level in 10 years and 9 months. Net profit for the first half of the year also fell by about 18% compared to the same period last year, indicating a deterioration in profitability.

Delinquency Rate Hits Highest Level in 10.5 Years, Raising Concerns Over Asset Quality

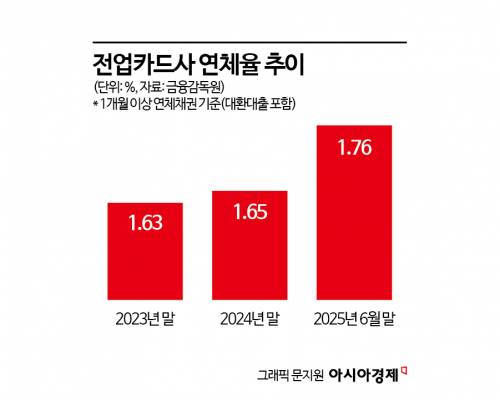

According to the business performance report for specialized credit finance companies for the first half of 2025 released by the Financial Supervisory Service on September 5, the delinquency rate at the end of the first half (end of June) for the eight standalone credit card companies (Samsung, Shinhan, Hyundai, KB Kookmin, Woori, Hana, Lotte, and BC Card) was 1.76%. This is the highest quarterly figure since the end of the third quarter of 2014 (1.83%).

Compared to the end of last year (1.65%), the rate increased by more than 0.1 percentage points in just six months. It is also 0.07 percentage points higher than the previous record high at the end of 2014 (1.69%). This indicates a rapid deterioration in the financial soundness of credit card companies. The delinquency rate here refers to the ratio of receivables overdue by more than one month, including card payments, installment payments, revolving credit, long-term card loans (card loans), and personal loans.

The proportion of non-performing loans also increased. The ratio of substandard and below loans at the end of the first half was 1.30%, up 0.14 percentage points from the end of last year (1.16%). This figure has been steadily rising, from 0.85% at the end of 2022, to 1.14% at the end of 2023, and 1.16% at the end of last year.

Financial institutions classify asset quality into five categories: normal, precautionary, substandard, doubtful, and presumed loss. The ratio of the sum of loans classified as substandard, doubtful, and presumed loss to total loans is called the substandard and below loan ratio. A higher figure indicates a larger proportion of non-performing loans.

The loan loss provision coverage ratio for credit card companies stood at 106.3%, down 1.8 percentage points from the end of last year (108.1%). A higher ratio indicates a greater ability to absorb potential future losses.

On the other hand, capital adequacy indicators remained sound. The adjusted capital adequacy ratio was 20.7%, with all card companies far exceeding the management guidance ratio of 8%. The leverage ratio was 5.2 times, lower than at the end of 2023 (5.4 times) and the same as at the end of last year (5.2 times), well below the regulatory limit of 8 times.

An official from the Financial Supervisory Service explained, "Although the delinquency rate and the substandard and below loan ratio for card companies in the first half increased compared to the end of last year, the loan loss provision coverage ratio and the adjusted capital adequacy ratio exceeded regulatory requirements, so the ability to absorb losses was generally sound."

Credit Card Companies' Net Profit Down 18.3% Due to Decline in Merchant Fees

The profitability of credit card companies deteriorated. The net profit of the eight standalone credit card companies in the first half was 1.2251 trillion won, down 18.3% (273.9 billion won) compared to the same period last year.

Although revenue increased, it failed to keep pace with the growth in expenses. Total revenue was 14.3358 trillion won, up 2.4% (331.1 billion won) from the same period last year, but total expenses rose by 4.8% (604.9 billion won) to 13.1106 trillion won.

By revenue category, income from card loans (268.6 billion won) and installment card fees (71.4 billion won) increased, while income from merchant fees (291.1 billion won) decreased.

On the expense side, loan loss expenses (264.3 billion won) and interest expenses (101.3 billion won) rose significantly.

An official from the Financial Supervisory Service explained, "The decline in net profit for card companies in the first half was influenced by a decrease in merchant fee income and an increase in loan loss expenses."

The amount of card loans used decreased slightly. The card loan usage amount for the eight standalone credit card companies and 11 affiliated banks in the first half was 51.5 trillion won, down 0.6% from the same period last year (51.8 trillion won).

Among these, the amount of card loans, often referred to as a "lifeline for low-income borrowers," was 23.2 trillion won, down 1.1% (300 billion won) from the same period last year. The amount of cash advances (short-term card loans) was 28.3 trillion won, maintaining the same level as the first half of last year.

In contrast to standalone credit card companies, non-card specialized credit finance companies such as installment finance companies, leasing companies, and new technology finance companies saw an increase in net profit. Their net profit in the first half was 1.7829 trillion won, up 14.5% (226.4 billion won) from the same period last year (1.5564 trillion won). However, asset quality indicators worsened. The delinquency rate was 2.43%, up 0.33 percentage points from the end of last year (2.10%) and 0.55 percentage points from the end of 2023 (1.88%). The substandard and below loan ratio also rose by 0.13 percentage points to 2.99% from 2.86% at the end of last year.

The loan loss provision coverage ratio fell by 4.4 percentage points to 129.1% from 133.5% at the end of last year. However, the adjusted capital adequacy ratio improved by 0.5 percentage points to 19.1% from 18.6% at the end of last year.

Non-card companies also maintained an adjusted capital adequacy ratio above the management guidance ratio (7%). The leverage ratio was 5.6 times, up 0.1 times from the end of last year (5.5 times), but still within the regulatory limit of 8 times.

An official from the Financial Supervisory Service stated, "We will strengthen monitoring of asset quality in anticipation of a continued deterioration in the asset quality of specialized credit finance companies in the second half of the year," adding, "We plan to encourage proactive reduction of non-performing loans and sufficient provisioning to enhance loss absorption capacity."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)