Bloomberg News reported on September 3 (local time), citing sources, that Chinese authorities are considering measures to cool down the recent surge in the stock market.

According to the sources, among the measures proposed to top officials in recent weeks to curb overheating in the stock market is a partial relaxation of short-selling restrictions. In addition, Chinese authorities are reviewing ways to limit speculative trading, as there are concerns about large-scale losses for individual investors due to sharp fluctuations in stock prices.

Bloomberg News noted that Chinese authorities, unable to forget the stock market crash that followed a surge in 2015, are now seeking to foster a "stable upward trend" in the stock market to help revive the economy and consumer sentiment. The report added that Chinese authorities have typically introduced capital market stabilization measures around major national events, and that the latest discussions coincide with the military parade held the previous day to mark the 80th anniversary of victory in the Chinese People's War of Resistance Against Japanese Aggression.

Earlier, Wu Qing, Chairman of the China Securities Regulatory Commission, expressed his commitment to stabilizing the stock market at a symposium held in Beijing at the end of last month, stating that he would promote "long-term investment, value investing, and rational investment."

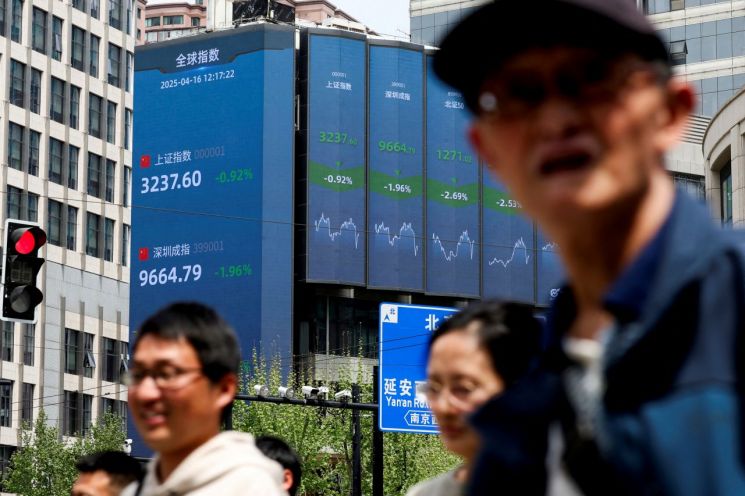

Since rebounding in April, the Chinese stock market has continued a strong rally, with major indices rising more than 20 percent. The benchmark Shanghai Composite Index even reached its highest level in a decade last month. As the Chinese stock market has surged in a short period, indicators such as margin financing balances and trading volume are warning of overheating. In response, at the end of last month, Chinese commercial banks banned stock investments using credit card cash advances, and securities firms raised the margin requirement for margin trading from 80 percent to 100 percent, among other measures to limit overheating.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)