Three-Day Rally and Consecutive Record Highs

Sustained Buying by Foreign and Institutional Investors

Strong MLCC Market and Robust Q3 Results Drive Gains

Samsung Electro-Mechanics has been hitting new record highs day after day. This sustained rally is being driven by expectations of an industry upturn and strong third-quarter results, leading to continued buying from institutional and foreign investors. The securities industry is also raising its outlook, believing that Samsung Electro-Mechanics has entered a full-fledged re-rating phase.

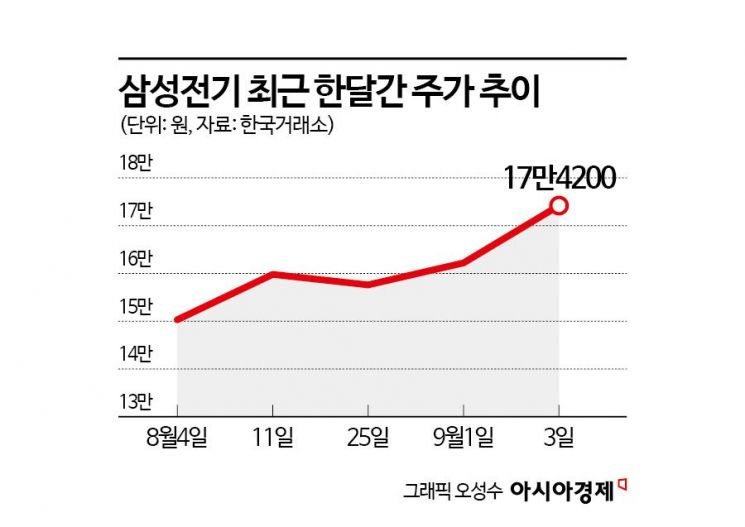

According to the Korea Exchange on September 4, Samsung Electro-Mechanics closed at 174,200 won on the previous day, up 2.53%. The stock has continued its upward trend for three consecutive days, setting new all-time highs each day. During the session, it rose as high as 176,500 won, marking a new 52-week high. Over the past month, Samsung Electro-Mechanics has risen by 15.9%. Notably, the stock has gained on all but one of the last eight trading days.

Continuous net buying by institutional and foreign investors is driving the share price higher. Institutions have recorded net purchases for eight consecutive days, while foreign investors have done so for five straight days. Over the past month, foreign investors have made a net purchase of 184.5 billion won, and institutions have net bought 150.7 billion won.

Expectations of an industry recovery appear to be the main driver behind the stock’s rise. Park Kangho, a researcher at Daishin Securities, analyzed, "There is a high possibility of a supply shortage of multilayer ceramic capacitors (MLCC) in certain areas next year," noting, "This is due to the expansion of automotive electronics and autonomous driving applications, as well as the increasing proportion of electric vehicles, which is driving up demand for high-capacity MLCCs. Additionally, rising power consumption in data centers and servers is generating further demand." He added, "If replacement demand for artificial intelligence (AI) devices in the smartphone and PC sectors picks up next year, demand for ultra-small, high-capacity MLCCs will increase. This could lead to a supply shortage and price hikes due to capacity constraints." The MLCC utilization rate at Samsung Electro-Mechanics was 96% in the first quarter and 98% in the second quarter of this year, with a similar level of 96-98% expected in the second half.

Kim Minkyoung, a researcher at Hana Securities, also projected, "Considering the launch of new AI server products and the rising penetration rate of 800-gigabit networks, the MLCC supply-demand situation is expected to become even tighter in 2026, likely resulting in a market that favors suppliers."

Expectations for strong third-quarter results are also supporting the stock’s rise. According to financial data provider FnGuide, the third-quarter consensus (average of securities firms’ forecasts) for Samsung Electro-Mechanics is sales of 2.8167 trillion won, up 7.7% year-on-year, and operating profit of 240.3 billion won, up 6.85%. Researcher Park stated, "Third-quarter operating profit is expected to increase by 11.5% to 250.7 billion won, surpassing consensus estimates. This would be the highest quarterly operating profit since the third quarter of 2022 (311 billion won), and third-quarter sales are also projected to reach a quarterly record of 2.85 trillion won."

Securities firms believe Samsung Electro-Mechanics has entered a valuation re-rating phase and are raising their price targets accordingly. Hana Securities raised its target price from 174,000 won to 240,000 won, iM Securities from 180,000 won to 220,000 won, and Kiwoom Securities from 190,000 won to 200,000 won. Kim Sowon, a researcher at Kiwoom Securities, explained, "The expansion of the AI server and network equipment markets is driving growth in Samsung Electro-Mechanics’ MLCC and package substrate businesses, boosting overall company performance. In 2026, the company is expected to expand its market share among hyperscaler clients and add new customers, further benefiting from the growth of the AI server and network markets."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.