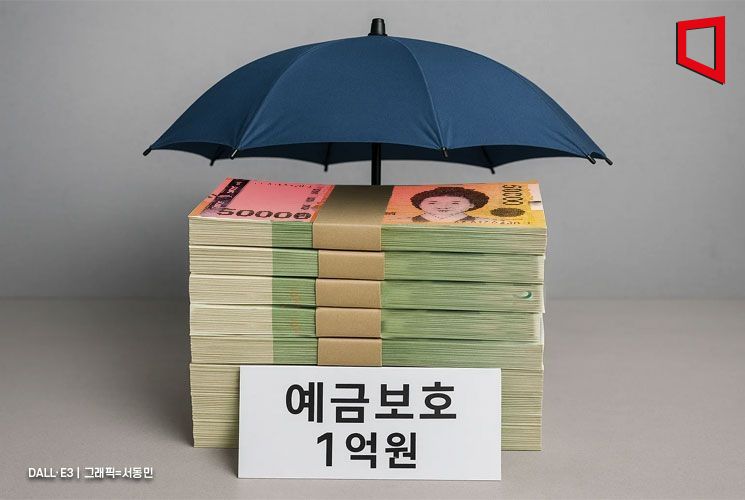

Deposit Protection Limit Raised from 50 Million to 100 Million Won

First Increase in 24 Years Since 2001

Stronger Protection for Depositors, Less Inconvenience from Spreading Funds

Watchful of Potential Fund Shift to Secondary Financial Ins

On the first day of the 100 million won deposit protection limit implementation, Kwon Daeyoung, Vice Chairman of the Financial Services Commission, is subscribing to a deposit product at the Hana Bank headquarters in Jung-gu, Seoul on September 1, 2025. Photo by Kang Jinhyung

On the first day of the 100 million won deposit protection limit implementation, Kwon Daeyoung, Vice Chairman of the Financial Services Commission, is subscribing to a deposit product at the Hana Bank headquarters in Jung-gu, Seoul on September 1, 2025. Photo by Kang Jinhyung

The deposit protection limit, which was previously set at 50 million won, will now be raised to 100 million won. The government expects that this increase will provide greater protection for citizens' assets and reduce the inconvenience caused by having to split deposits among multiple institutions. However, there are concerns that funds may shift toward secondary financial institutions, which generally offer higher deposit interest rates than commercial banks.

The Financial Services Commission announced that, starting September 1, the deposit protection limit of 100 million won (including both principal and interest) will be implemented. This is the first change to the system in 24 years, since the limit was raised from 20 million won to 50 million won in 2001.

The new 100 million won protection limit will apply not only to banks, savings banks, and insurance companies, but also to mutual financial institutions such as credit unions and NH Nonghyup. The limit applies to all principal-guaranteed products, such as deposits and installment savings, regardless of when they were opened. Separately protected products, such as retirement pensions, pension savings, and accident insurance payouts, will also be protected up to 100 million won. However, investment products whose returns depend on performance, such as funds, performance-based products, and comprehensive asset management accounts (CMA) at securities firms, are excluded from protection.

On the first day of the new system, Kwon Daeyoung, Vice Chairman of the Financial Services Commission, visited the Hana Bank headquarters in Jung-gu, Seoul, to personally subscribe to a deposit product and check the system's implementation status. Vice Chairman Kwon and a small business depositor both signed up for a deposit product, listened to the bank staff's explanation of the deposit protection system, and confirmed the "100 million won deposit protection limit" phrase printed in the passbook.

Vice Chairman Kwon stated, "As the person in charge of practical operations during the 2011 savings bank crisis, I have personally experienced the importance of the deposit insurance system, so I find this increase in the deposit protection limit after 24 years to be very meaningful." He added, "I am here today to inform many citizens about the implementation of the new system and to see for myself whether banks have prepared well." He explained, "With the implementation of the 100 million won deposit protection limit, depositors' valuable assets will be more strongly protected, the inconvenience of splitting deposits will be reduced, and the stability of the financial market will be enhanced."

He continued, "With the increase in the deposit protection limit, financial companies, including banks, have gained the valuable asset of public trust, which is at the core of their business. This is not something that can be achieved solely through the deposit insurance premiums paid by financial companies, but rather a benefit that can be enjoyed thanks to the foundation of the deposit protection system established by the country and its citizens."

While the increase in the deposit protection limit strengthens the financial safety net and reduces the inconvenience of splitting deposits, there are also concerns that funds may shift toward secondary financial institutions.

Both the government and the market believe that the higher deposit protection limit could lead to an increased inflow of funds into savings banks, which offer higher deposit interest rates than commercial banks. About 90% of all deposits at savings banks are within the protection limit, so the impact of the system change will be significant and depositors are expected to respond quickly. According to a report submitted to the National Assembly by the Financial Services Commission and the Korea Deposit Insurance Corporation, if the deposit protection limit is raised to 100 million won, deposits at savings banks could increase by 16% to 25%.

However, according to government monitoring, there has not yet been a noticeable shift of funds. As of the end of July, the total deposits at savings banks stood at 100.9 trillion won, a slight increase since the announcement of the higher deposit protection limit in May, but still lower than at the end of last year (102.2 trillion won). Deposits at mutual financial institutions such as credit unions and agricultural and fisheries cooperatives have also continued to increase steadily, but at an average rate, and the total deposits at commercial banks, where outflows were a concern, have not deviated significantly from the five-year average.

An official from the Financial Services Commission explained, "We are operating a permanent task force to respond to the increase in the deposit protection limit. We will manage the implementation of the system while communicating with the financial industry, and together with relevant agencies such as the Financial Supervisory Service, we will continue to monitor fund movements."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.