Kiwoom Securities has projected South Korea's economic growth rate for this year at 1%, slightly above the Bank of Korea's revised August outlook of 0.9%. Despite the possibility of a slowdown in exports due to tariff burdens originating from the United States, the recovery in private consumption and the government's expansion of fiscal spending are expected to support growth. Regarding the base interest rate, the company anticipates only one additional cut early next year following a reduction in October.

Lee Changyong, Governor of the Bank of Korea, is attending the Monetary Policy Committee meeting held at the Bank of Korea in Jung-gu, Seoul on August 28, 2025. Photo by Joint Press Corps

Lee Changyong, Governor of the Bank of Korea, is attending the Monetary Policy Committee meeting held at the Bank of Korea in Jung-gu, Seoul on August 28, 2025. Photo by Joint Press Corps

On the 29th, Yumi Kim, a researcher at Kiwoom Securities, stated in the report "Moderate Growth Driven by Policy Effects Amid Tariff Risks," "We forecast South Korea's annual economic growth rate for 2025 at 1.0%. This is slightly higher than the projections by the government and the Bank of Korea (0.9%), but is not significantly different from the recent consensus in financial markets."

Kim explained, "In line with the Bank of Korea's outlook, the contribution of domestic demand to growth is expected to expand in the third quarter, driven by the distribution of consumption coupons and improved consumer sentiment. Exports, particularly of key items such as semiconductors, are also projected to perform well, so the quarterly economic growth rate in the third quarter is expected to rise to around 1%." However, she added, "In the fourth quarter, a slowdown in exports is anticipated due to the base effect and the impact of tariffs, which will likely lower the growth rate to the low 0% range."

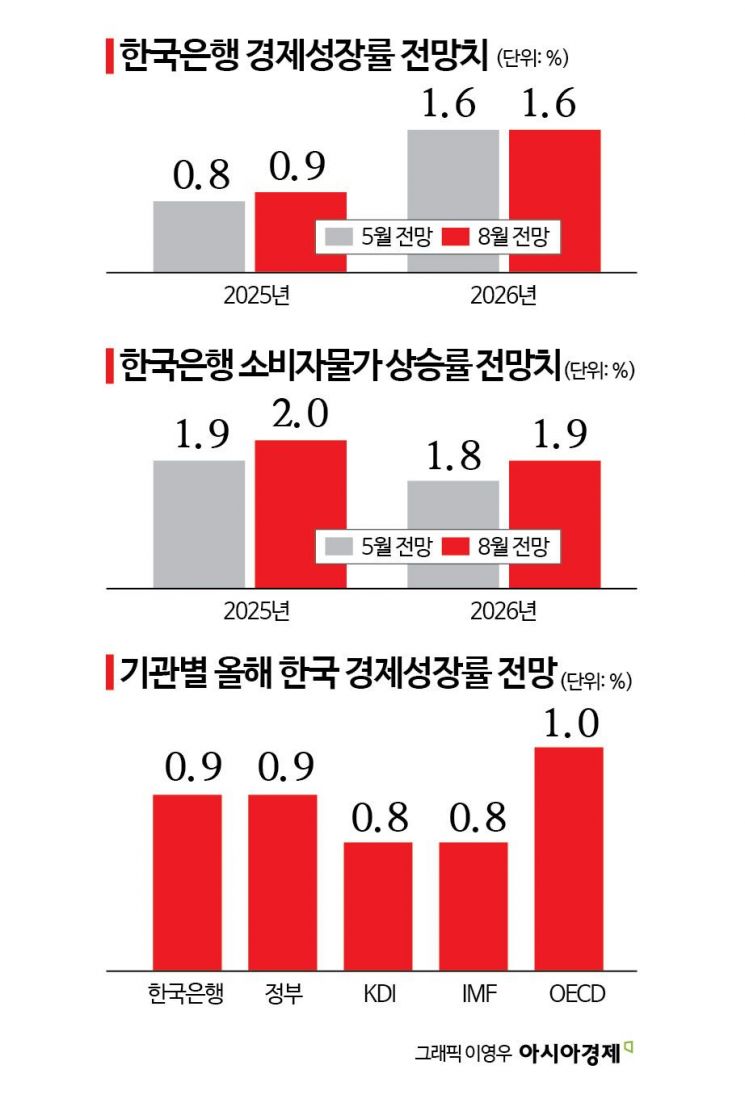

The previous day, the Bank of Korea slightly raised its economic growth outlook for this year from 0.8% to 0.9% in its revised August economic forecast. The growth projection for next year remained unchanged at 1.6%. In addition, the inflation outlook for this year was raised from 1.9% to 2.0% to reflect rising prices of agricultural, livestock, and fisheries products due to recent worsening weather conditions.

Kim noted, "According to the Bank of Korea's GDP forecast path, the year-on-year growth rates are projected at 0.2% in the first half of 2025, 1.6% in the second half of 2025, 2.0% in the first half of 2026, and 1.3% in the second half of 2026. This suggests that the first half of 2025 is expected to be the bottom of the economic cycle, with a gradual rebound anticipated thereafter." She added, "While leaving open the possibility of export slowdown due to tariff burdens, the continued recovery in private consumption and construction investment makes a rebound in next year's growth rate possible."

She further explained, "Considering the government's stance of driving growth even at the cost of increased national debt, it is likely that policy-driven recovery in domestic demand will be possible in the short term. The forecast for goods exports next year is set at -0.1%, reflecting a cautious stance regarding tariff impacts, but if the investment cycle in the United States continues, South Korea's key export items may perform better than expected."

Accordingly, the scope for future interest rate cuts is expected to be limited. The previous day, the Bank of Korea held the base rate steady at 2.5% per annum after the Monetary Policy Committee meeting. As a result, the prevailing view in the securities industry is that a rate cut will likely be implemented at the Monetary Policy Committee meeting in October. Kim stated, "Given that the Korean economy is not contracting as sharply as the market fears and considering the Bank of Korea's growth trajectory, the scope for future rate cuts is also likely to be limited. After a rate cut in October this year, only one additional cut is expected early next year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.