Growth Rate Rose 0.2%P After 100bp Cut

Side Effects of Preemptive Cuts, Such as Real Estate Overheating, Outweigh the Benefits

Recovery in Consumption and Robust Exports Each Raise Growth Rate by 0.2%P

Current Account Surplus Expected to Reach Record $110 Billion

Pilot Project to Manage 110 Trillion Won in Treasury Funds, Second Han River Test

"Will Work with Banks Willing to Invest Actively"

Lee Changyong, Governor of the Bank of Korea, stated on the 28th, "Given the current economic growth outlook, it is highly likely that the interest rate cut stance will be maintained through the first half of next year."

At a press conference held after the Monetary Policy Committee meeting that day, Governor Lee explained, "We are projecting next year's growth rate at 1.6%. On a quarterly basis, we expect low growth to continue through the first half of next year, then rise closer to the potential growth rate in the second half. Because there is a high possibility that low growth will persist through the first half of next year, it is highly likely that the current interest rate cut stance will be maintained until then."

Lee Changyong, Governor of the Bank of Korea, is answering questions at a press conference held after the Monetary Policy Committee meeting on the 28th. Bank of Korea

Lee Changyong, Governor of the Bank of Korea, is answering questions at a press conference held after the Monetary Policy Committee meeting on the 28th. Bank of Korea

Growth Rate Rose 0.2%P After 100bp Cut... Side Effects of Preemptive Cuts, Such as Real Estate Overheating, Outweigh the Benefits

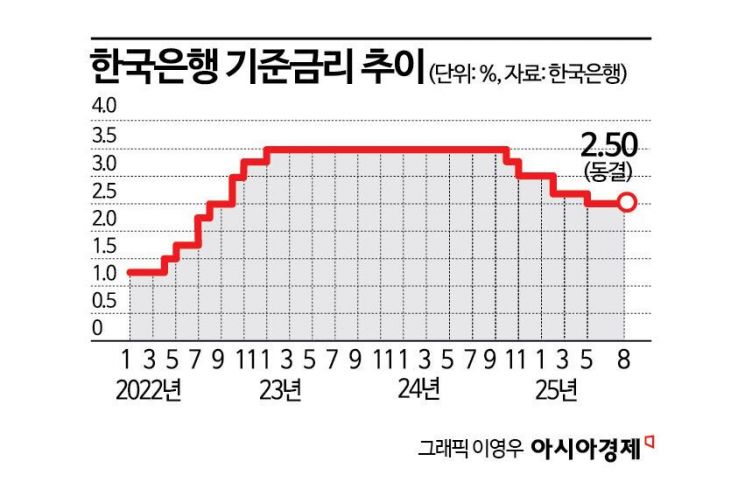

The Bank of Korea's Monetary Policy Committee decided to keep the base interest rate at 2.5% per annum on this day. At this meeting, Shin Sunghwan, a committee member, expressed a minority opinion that it would be desirable to lower the base rate to 2.25% (one dissenting opinion). The decision to hold the rate was based on the assessment that housing prices in the Seoul metropolitan area and the trend in household debt have not stabilized sufficiently. The committee also took into account the need for policy coordination if the government introduces additional real estate measures, as well as the 2.00 percentage point interest rate gap with the United States. Of the six committee members, five believed it was necessary to keep open the possibility of lowering the rate within the next three months. The remaining member expressed the view that the rate should likely be maintained at 2.5% even after three months.

In response to criticism that the timing of the rate cut may have been missed, Governor Lee drew a clear line, saying he does not agree. He stated, "Since entering the rate cut cycle, we have lowered the rate by 1.0 percentage point (100bp) so far, which is faster and more preemptive than other countries. Even internationally, Korea's real interest rate level is actually lower." Statistically, a 0.25 percentage point cut in the base rate is believed to raise the growth rate by 0.06 percentage points, so the cumulative rate cuts are estimated to have raised the growth rate by 0.24 percentage points. Governor Lee noted, "Although details vary by period, I believe that the rate cuts so far have raised the growth rate by about 0.2 percentage points."

However, Governor Lee explained, "If we cut rates more rapidly at this stage, the negative side effects-such as rising real estate prices and increasing household debt-would outweigh the positive effect of boosting the economy, so we are adjusting the timing." He reiterated, "The Bank of Korea does not intend to excessively supply liquidity through rate cuts and fuel expectations of rising home prices." He added that the Bank is taking a cautious approach to rate cuts to curb expectations of rising home prices, and is allowing time to maximize the effectiveness of real estate policies.

Recovery in Consumption and Robust Exports Each Raise Growth Rate by 0.2%P... Current Account Surplus Expected to Reach Record $110 Billion

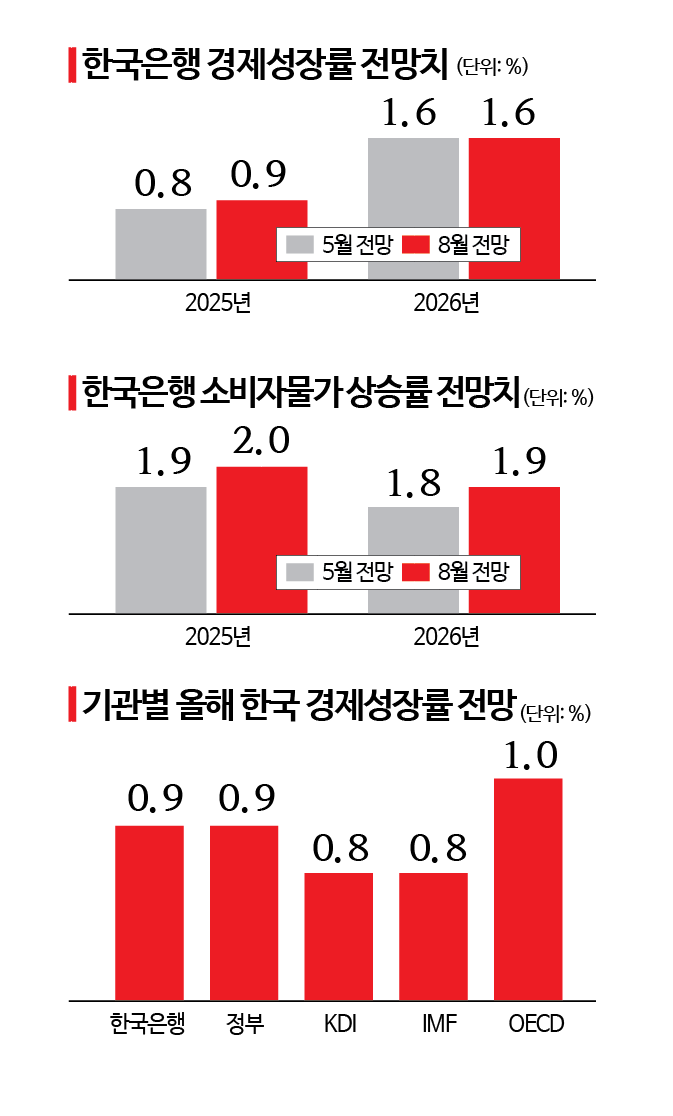

In its revised economic outlook released that day, the Bank of Korea projected this year's growth rate at 0.9%, up 0.1 percentage points from the 0.8% forecast in May. Governor Lee explained that "the second supplementary budget and improved economic sentiment led to a greater-than-expected recovery in consumption, which contributed about 0.2 percentage points to this year's growth. On the export side, the semiconductor market remained strong longer than expected, and automobile exports also showed a favorable trend, each adding about 0.2 percentage points." On the other hand, "the construction sector performed worse than expected, which lowered this year's growth outlook by about 0.3 percentage points," he added.

He stated, "The low growth forecast for this year is largely due to political factors in the first half, and although tariffs have been lowered, they remain quite high compared to the past. Given these external conditions, it is natural for this year's growth to fall below the potential growth rate, and we should accept this to some extent." He continued, "We will supplement with fiscal, financial, and interest rate policies to prevent growth from falling too low, but if we try to boost growth to the potential rate through excessive stimulus in adverse external conditions, various side effects may occur."

By quarter, the Bank of Korea forecasts growth rates of -0.2% in the first quarter, 0.6% in the second, 1.1% in the third, and 0.2% in the fourth. This year's private consumption growth rate is projected at 1.4%, and facility investment at 2.5%. Compared to the May forecast, private consumption is up by 0.3 percentage points and facility investment by 0.7 percentage points. Goods exports were revised up from -0.1% to 2.6%, and goods imports from 0.2% to 1.8%. In contrast, construction investment was revised downward from the previous forecast of -6.1% to -8.3%.

The current account surplus is expected to reach $110 billion this year, which would be the largest ever. This is a significant upward revision from the $82 billion forecast in May. The revision reflects stronger-than-expected semiconductor exports and reduced imports due to falling raw material prices. A notable change from the past is the significant increase in primary income from residents' overseas securities investments.

The number of new jobs is expected to increase by 170,000, a substantial rise from the 120,000 forecast in May. The unemployment rate forecast for this year was also lowered from 2.9% to 2.8%. The growth rate forecast for next year remains at 1.6%. The consumer price inflation rate was revised up by 0.1 percentage points for both this year and next, to 2.0% and 1.9%, respectively. However, it is expected that inflation will remain close to the price stability target (2.0%) amid weak demand pressure this year and next.

Pilot Project to Manage 110 Trillion Won in Treasury Funds, Second Han River Test... "Will Work with Banks Willing to Invest Actively"

Regarding the Ministry of Economy and Finance and the Bank of Korea's plan to use the Bank's digital currency (institutional CBDC) system, "Project Han River," to manage 110 trillion won in annual government subsidies in a pilot project during the first half of next year, Governor Lee explained, "When Deputy Prime Minister Koo Yooncheol visited the Bank of Korea, he suggested the idea of using artificial intelligence (AI) and blockchain to find ways to efficiently distribute government subsidies (about 110 trillion won annually) while increasing transparency, which is how the project started."

Governor Lee stated, "In the past, when the government provided subsidies to prime contractors, it could not control the flow of funds to subcontractors at the government level. However, with blockchain technology, it is possible to program the system so that as soon as a contract is made with a prime contractor, funds are automatically sent to the subcontractor. It is also possible to restrict the use of subsidies according to their intended purpose. The Han River Project is about embedding programmable functions into electronic money through deposit tokens, and we plan to test this in the second Han River pilot."

Governor Lee emphasized that the second project will not be open to all banks, but will be approached with banks that are willing to invest actively and are committed to technological development.

He stated that discussions regarding stablecoins are ongoing with the Ministry of Economy and Finance. "We have held working-level discussions with the Ministry on the impact of capital liberalization and regulatory direction, and discussions are continuing at higher levels. Direct legislation such as the Virtual Asset Act falls under the jurisdiction of the Financial Services Commission, but since the chairman's confirmation hearing has not yet been completed, there have been no discussions at the top level. However, we have sufficiently conveyed the Bank of Korea's position, and we hope it will be well reflected," he said.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.