'Public Opinion Battle' by Kolmar BNH... "Seunghwa Lee Lacks Qualifications as Internal Director Candidate"

"September 26 General Meeting Blockade"... Donghan Yoon and Daughter File Multiple Lawsuits

Kolmar Holdings to Convene Extraordinary General Meeting on October 29 to Appoint Additional Internal Directors

Stock Return Lawsuit Hearing on October 23... The Key Issue Is the 'Management Rights Agreement'

The management rights dispute among the owner family of Kolmar Group, an ODM (Original Design Manufacturer) cosmetics company, is intensifying. Donghan Yoon, Chairman of Kolmar Holdings, and his daughter Yewon Yoon, CEO of Kolmar BNH, have filed a series of lawsuits against Sanghyun Yoon, Vice Chairman of Kolmar Holdings, and have now launched a full-scale public opinion campaign outside the courtroom.

According to the industry on August 28, Kolmar BNH has raised questions about the qualifications of Seunghwa Lee, former Executive Vice President of CJ CheilJedang, who was recommended as an internal director candidate and CEO by Kolmar Holdings and Vice Chairman Sanghyun Yoon. They claim that Seunghwa Lee received a written warning and resigned following a management review due to poor management of the subsidiary 'Batavia' during his tenure at CJ CheilJedang.

Donghan Yoon, Chairman of Kolmar Holdings; Sanghyun Yoon, Vice Chairman; Yeowon Yoon, CEO of Kolmar BNH.

Donghan Yoon, Chairman of Kolmar Holdings; Sanghyun Yoon, Vice Chairman; Yeowon Yoon, CEO of Kolmar BNH.

'Public Opinion Battle' by Kolmar BNH... "Seunghwa Lee Lacks Qualifications as Internal Director Candidate"

Kolmar BNH pointed out that in October 2024, Seunghwa Lee, while serving as an executive, caused operating losses at Batavia and received a written warning, resulting in his exclusion from the regular executive appointments the following year. They argued that he is not an expert capable of improving Kolmar BNH's performance. Batavia, a CDMO company based in the Netherlands acquired by CJ, recorded a net profit of 19.4 million won in 2022, the year after its acquisition, but posted a net loss of 12.2 billion won in 2023 and a net loss of 18.6 billion won in 2024.

Kolmar BNH strongly argued, "The introduction of a professional manager for performance improvement is just a pretense, and the procedures to convene the extraordinary general meeting should be halted immediately."

Kolmar Holdings countered Kolmar BNH's claims, calling them excessive attempts to undermine reputations. Kolmar Holdings stated, "Candidate Seunghwa Lee was not directly involved in the acquisition of Batavia," and added, "The eligibility of an internal director candidate is a matter for the general meeting of shareholders to decide." They further warned, "If actions that unilaterally damage the reputation of the candidate and the company through the media continue, there will be legal and social consequences."

Previously, Kolmar Holdings had announced plans to shift to a professional management system, citing Kolmar BNH's performance and stock price as issues.

"September 26 General Meeting Blockade"... Donghan Yoon and Daughter File Multiple Lawsuits

This move by Kolmar BNH to raise suspicions is aimed at blocking the extraordinary general meeting requested by Kolmar Holdings. In May, Kolmar Holdings filed a lawsuit with the Daejeon District Court seeking permission to convene an extraordinary general meeting of Kolmar BNH, including the appointment of a temporary chairperson, the appointment of Sanghyun Yoon as an internal director, and the appointment of Seunghwa Lee as an internal director. Kolmar BNH filed for an injunction, claiming illegality, but last month the Daejeon District Court ruled in favor of Holdings.

As a result, an extraordinary general meeting of Kolmar BNH will be held on September 26. It is highly likely that the agenda items requested by Kolmar Holdings, the largest shareholder, will be approved at the meeting. Kolmar Holdings currently holds a 44.63% stake in Kolmar BNH, giving it overwhelming influence. Even when considering the shares held by Yewon Yoon (7.78%), Donghan Yoon (1.11%), Donghan Yoon's wife, Kim Seongae (0.05%), Yewon Yoon's husband, Hyunsoo Lee (0.01%), Yewon Yoon's eldest son, Minseok Lee (0.01%), and second son, Youngseok Lee (0.01%), it is not enough to challenge Holdings in a vote.

For this reason, Kolmar BNH is filing successive lawsuits to block the general meeting. On August 11, Chairman Donghan Yoon filed a special appeal with the Supreme Court, seeking to prevent Vice Chairman Sanghyun Yoon from convening the extraordinary general meeting. After the Daejeon District Court dismissed the injunction request, eliminating legal avenues, a special appeal was filed to seek a Supreme Court judgment. Additionally, on August 13, Chairman Yoon and his daughter, CEO Yewon Yoon, filed an injunction with the Seoul Central District Court against Vice Chairman Sanghyun Yoon and Kolmar Holdings to prevent the convening of the extraordinary general meeting. A hearing on this injunction was held last week, and a decision is expected next week.

Furthermore, on August 19, Chairman Yoon and four others filed with the Daejeon District Court for permission to convene an extraordinary general meeting of Kolmar BNH to appoint five additional internal directors, including himself. As an outside non-executive director of Kolmar BNH, Chairman Yoon is seen as attempting to take direct control of the board and lead Kolmar BNH's decision-making. Currently, the Kolmar BNH board is evenly split, with three members aligned with Vice Chairman Sanghyun Yoon (outside directors Sangmin Oh and Jinsu So, and internal director Hyunjun Kim) and three aligned with Chairman Donghan Yoon (internal directors Yewon Yoon and Youngjoo Cho, and outside non-executive director Donghan Yoon).

Kolmar Holdings also responded on August 18 by filing an injunction with the Daejeon District Court to allow inspection and copying of the shareholder registry. Kolmar Holdings is seeking permission to inspect and copy Kolmar BNH's stock ledger and requests that, if this is not complied with, a penalty of 100 million won per day of violation be imposed until completion. The hearing for this case has concluded, and a verdict is expected next week.

Kolmar Holdings plans to convene an extraordinary general meeting on October 29, accepting a shareholder proposal by Chairman Donghan Yoon to appoint 10 additional new directors, including himself. This would increase the number of directors by 10. The current board consists of three internal directors, three outside non-executive directors, and three outside directors. If all 10 new directors are appointed, the board will expand to 19 members.

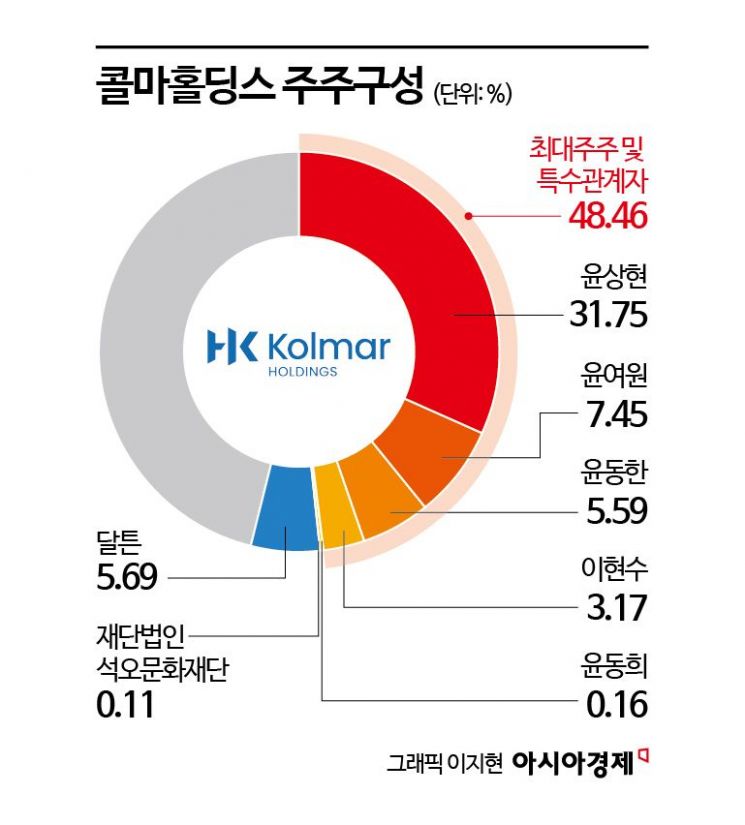

However, it is expected to be difficult for Chairman Yoon's candidates to join the board. In terms of shareholding, Vice Chairman Sanghyun Yoon is the largest shareholder with 31.75%, and the second-largest shareholder, Dalton Investment (5.69%), is also considered an ally of Vice Chairman Yoon. Minority shareholders hold about 38% of the shares.

Stock Return Lawsuit Hearing on October 23... The Key Issue Is the 'Management Rights Agreement'

Some believe that Kolmar BNH will employ every possible measure to postpone the extraordinary general meeting until the outcome of the stock return lawsuit is determined.

On May 30, Chairman Donghan Yoon notified Vice Chairman Sanghyun Yoon of the cancellation of the gift contract for 4.6 million shares of Kolmar Holdings and filed a lawsuit with the Seoul Central District Court demanding the return of the shares. In June, the court issued an injunction prohibiting Vice Chairman Sanghyun Yoon from disposing of the shares, effectively freezing them, as it found grounds to examine Chairman Yoon's claims. The first hearing is scheduled for October 23.

The core issue in the stock return lawsuit is the 'three-party management rights agreement' signed in September 2018. Chairman Yoon claims that Vice Chairman Sanghyun Yoon violated this agreement. Kolmar BNH argues that a clause in the agreement requires Sanghyun Yoon, as a shareholder and manager of Kolmar Holdings, to provide support or cooperation within legal bounds so that Yewon Yoon, having received Kolmar BNH's business management rights from Donghan Yoon, can exercise those rights appropriately, or to ensure Kolmar Holdings provides such support or cooperation. They assert that Vice Chairman Yoon violated this agreement.

The key question is whether this provision constitutes a 'burdened' contract, making it a condition of the gift. A gift is an act of transferring property to another without compensation, accepted by the recipient. Generally, a gift cannot be revoked at the donor's discretion. However, if it is considered a burdened gift and the recipient fails to fulfill the obligations, the contract can be canceled.

An industry insider commented, "Kolmar BNH seems intent on quickly improving its performance to dispel doubts about its management capabilities. If they win the stock return lawsuit, they may believe a vote showdown is possible."

If Chairman Yoon wins the stock return lawsuit, he will regain 4.6 million shares and return as the largest shareholder of Kolmar Holdings. His stake will increase to 6,518,726 shares, or 19.01%, while Vice Chairman Sanghyun Yoon's stake will decrease to 18.34% (6,290,316 shares).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)