"Real Estate Overheating Remains a Concern"

Base Rate Frozen in August

"Supplementary Budget Boosts Private Consumption"

Bank of Korea Raises Growth Forecast by 0.1 Percentage Point

This Year in the 0% Range, Next Year at 1.6%: "Trap of Lo

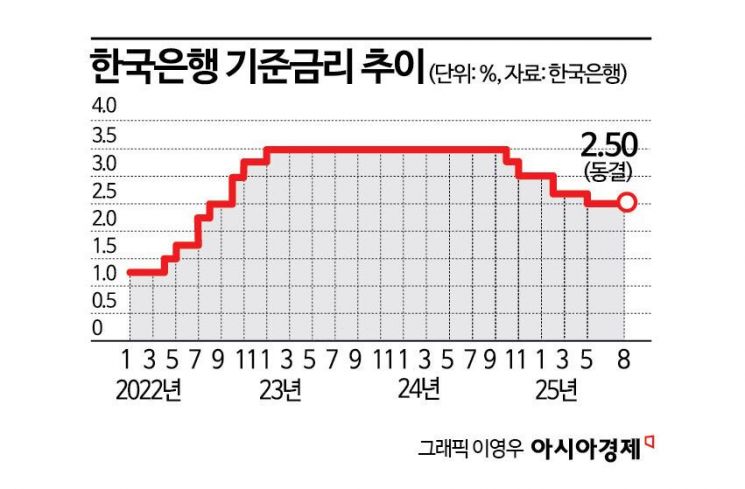

The persistent embers of an overheated housing market have led to the Bank of Korea’s decision to freeze the base interest rate for a second consecutive month. On August 28, the Monetary Policy Committee of the Bank of Korea maintained the base rate at 2.50% per annum. Ongoing concerns about overheating in the housing market were the key factor behind this month’s rate freeze. Although the real estate market has shown signs of slowing following the government’s June 27 measures, expectations for price increases in certain regions, including Seoul, remain strong. The Monetary Policy Committee determined that more time is needed to confirm whether trends in housing prices and household debt have stabilized.

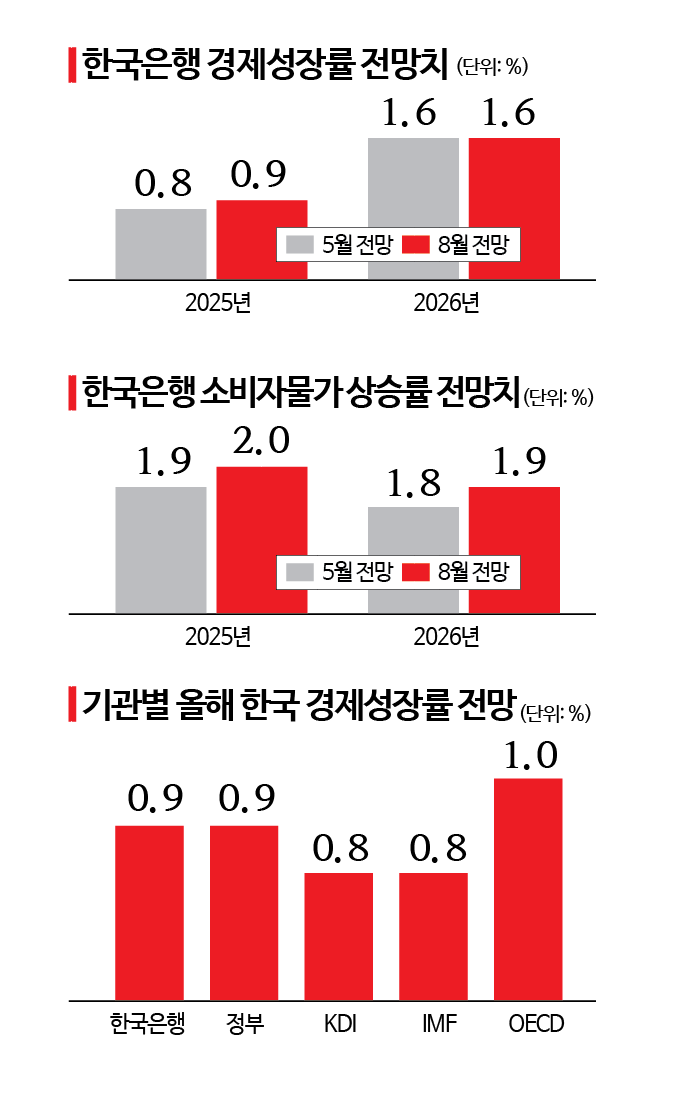

The upward revision of the economic growth forecast also created an environment that allowed the Bank of Korea to prioritize financial stability, further supporting the decision to hold rates steady. On this day, the Bank of Korea slightly raised its growth forecast for South Korea from 0.8% to 0.9%. This improvement in consumer sentiment, which had been dampened by the martial law crisis, was driven by the government’s supplementary budget and other measures to boost the economy, resulting in a recovery in private consumption. The fact that major tariff negotiations between South Korea and the United States concluded at expected levels also helped prevent a downward revision of the growth outlook. The inflation forecast for this year was raised from 1.9% to 2.0%.

Lee Changyong, Governor of the Bank of Korea, is striking the gavel at the Monetary Policy Committee meeting held at the Bank of Korea in Jung-gu, Seoul on the 28th. Photo by Joint Press Corps

Lee Changyong, Governor of the Bank of Korea, is striking the gavel at the Monetary Policy Committee meeting held at the Bank of Korea in Jung-gu, Seoul on the 28th. Photo by Joint Press Corps

"Real Estate Overheating, Embers Remain" August Base Rate Frozen

The Monetary Policy Committee of the Bank of Korea announced at its monetary policy meeting held at the Bank’s headquarters in Jung-gu, Seoul, that it would keep the base rate at 2.50% per annum. This marks the second consecutive freeze, in line with market expectations. In a recent survey of experts by Asia Economy, 10 out of 14 respondents (71.4%) predicted a rate freeze this month.

Concerns over the continued overheating of Seoul’s real estate market were a major reason for this month’s rate freeze. According to weekly apartment price trends released by Korea Real Estate Board on August 21, apartment prices in Seoul rose by 0.09% in the third week of August (as of August 18). Although transaction volume decreased due to a wait-and-see attitude following the June 27 measures, prices continued to rise locally in preferred complexes, such as newly built or redevelopment projects, where contracts were signed. Expectations for further price increases have also resurfaced. The Bank of Korea’s recently released August Housing Price Outlook Consumer Sentiment Index (CSI) stood at 111, up 2 points from the previous month and above the long-term average of 107. After slowing in June (120), the index rebounded within a month. Governor Lee Changyong previously emphasized, “It is the shared view of the Monetary Policy Committee members that the speed and scale of the Bank of Korea’s rate cuts should not stimulate market sentiment in a way that drives up real estate prices.”

Analysts also point out that the government’s expansionary fiscal policy, including supplementary budgets, is supporting economic recovery, creating an environment where financial stability can be prioritized as consumer sentiment improves. The fact that the outcome of tariff negotiations with the United States was within predictable bounds also supported the decision to freeze rates. The interest rate gap with the United States was another concern. If the Bank of Korea lowers rates ahead of the U.S. Federal Reserve, the Korea-U.S. interest rate gap, already at a record high of 2.00 percentage points, would widen to 2.25 percentage points. This could lead to a rise in the won-dollar exchange rate and capital outflows from foreign investors.

The Bank of Korea plans to continue its rate-cutting stance but will adjust the pace while monitoring the real estate market, household lending, the U.S. Federal Open Market Committee (FOMC) rate decision in September, the effects of supplementary budget execution, and the progress of U.S.-China trade negotiations and tariffs by item. The market generally expects the next rate cut to occur in October. Ahn Jaekyun, a researcher at Korea Investment & Securities, commented, “If a rate cut accompanies the execution of the supplementary budget, it could boost growth through the first half of next year. In addition, if the government announces measures to increase housing supply, further stabilization in real estate prices can be expected, making October a likely environment for a base rate cut.”

The Monetary Policy Committee shifted to a rate-cutting cycle in October last year, lowering rates for the first time in three years and two months, and has since cut rates four times, in November last year and February and May this year. The prevailing view in the market is that the final rate for this year will be 2.25% per annum, which would be reached with one additional 0.25 percentage point cut from the current rate.

"Supplementary Budget Boosts Private Consumption"... Bank of Korea Raises Growth Forecast by 0.1 Percentage Points for This Year

In its revised economic outlook released today, the Bank of Korea forecast South Korea’s economic growth rate for this year at 0.9%. After sharply lowering the forecast from 1.5% to 0.8% in May, the Bank has now slightly raised it for the first time in three months. This matches the government’s projection released on August 22 and is higher than the recent forecasts of 0.8% by the Korea Development Institute (KDI) and the International Monetary Fund (IMF). The upward revision reflects the effects of the second supplementary budget, among other factors. The Bank of Korea has stated that the second supplementary budget will boost this year’s growth rate by 0.1 percentage points. The May forecast had only factored in the effects of the first supplementary budget.

The situation for the Korean economy has somewhat improved compared to May, when weak domestic demand and tariff uncertainties prevailed. Domestic demand is showing a clear recovery, especially in private consumption. After being subdued following the martial law crisis at the end of last year, private consumption rebounded in the second quarter. In June, retail sales rose by 0.5% from the previous month, driven by increased sales of semi-durable and non-durable goods. Last month, domestic credit card approvals rose by 6.3% year-on-year, marking the highest growth rate since February (6.8%). The execution of livelihood recovery consumption coupons included in the second supplementary budget has also lifted consumer sentiment. The Bank of Korea’s Composite Consumer Sentiment Index (CCSI) recorded 111.4 this month, the highest level in about seven and a half years. A reading above 100 indicates that consumer sentiment is more optimistic than average.

Exports have also been relieved by the fact that tariff negotiations with the United States did not deviate significantly from previous expectations. The agreement of “15% reciprocal tariffs and 15% automobile tariffs” is not much different from the scenario assumed by the Bank of Korea in its May economic outlook. Export performance so far in the second half of the year has also been solid. According to the Korea Customs Service, total exports in July, based on customs clearance, reached a record high for July at $60.8 billion, up 5.8% year-on-year, and in August, exports rose 7.6% ($35.5 billion).

The inflation forecast for this year was slightly raised to 2.0% from 1.9% in May. The forecast for next year was also raised from 1.8% to 1.9%. The Bank of Korea expects inflation to remain near its target of 2.0%, given rising prices for agricultural, livestock, and fisheries products, but subdued demand pressure and stable international oil prices.

Growth Stuck in the 0% Range This Year, 1.6% Next Year: Fundamental Changes Like Industrial Restructuring Needed

However, downside risks to growth remain significant. The reciprocal tariffs with the United States began to be imposed on August 7, and the negative impact of tariff increases is expected to become more pronounced in the second half of this year and beyond. Tariff uncertainties have not been completely eliminated. The Trump administration in the United States has also announced plans to impose additional tariffs on items such as semiconductors and pharmaceuticals. While these items are to receive most-favored-nation treatment, meaning South Korea is not at a disadvantage compared to other countries, the fact that Korean semiconductors are used as intermediate goods in Taiwan and ASEAN (Association of Southeast Asian Nations) countries means there could be multiple negative impacts on the Korean economy. The outcome of U.S.-China tariff negotiations will also have a significant impact on the Korean economy, making it difficult to let down our guard.

On the domestic front, sluggish construction investment is restricting the recovery of growth. According to the Bank of Korea, domestic construction investment has declined for four consecutive years, remaining in a prolonged slump. In the first quarter of this year, construction investment fell by 13.3% year-on-year, and in the second quarter, it dropped by 11.7%, dragging down the growth rate. While the Bank of Korea expects some recovery in the construction sector in the second half, uncertainties remain high due to delayed normalization of the real estate project financing (PF) market, stricter lending regulations, and the impact of safety accidents at construction sites, making the timing and speed of recovery uncertain.

Despite two rounds of supplementary budgets, this year’s growth rate is expected to remain in the 0% range, and next year’s forecast of 1.6% is below the potential growth rate (in the upper 1% range). This is different from the past, when the economy rebounded due to base effects after a low-growth shock. Kang Sungjin, professor of economics at Korea University, stated, “Breaking out of the low-growth trap depends on how quickly restructuring toward new growth industries can occur. Now is the time for policies and corporate support that can transform the industrial structure.”

Son Jongchil, professor of economics at Hankuk University of Foreign Studies, also noted, “South Korea’s growth rate has fallen below 1% only twice in history: during the 2008 global financial crisis and the 2020 COVID-19 crisis. Even if there is a recovery trend, various uncertainties persist, so expansionary fiscal policy is needed. However, given the high level of national debt, it is necessary to be selective and focused in its application.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)