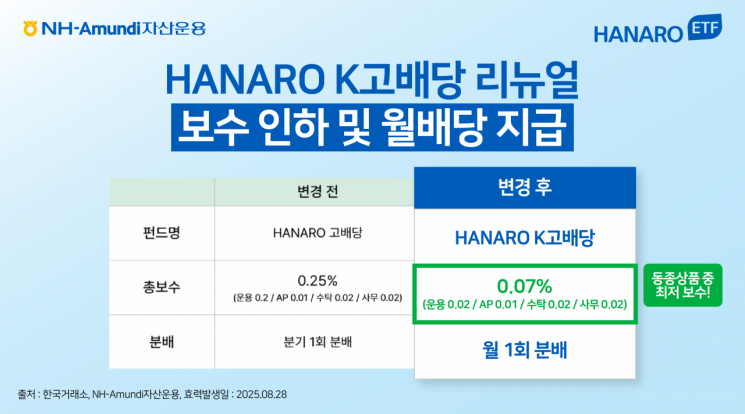

NH-Amundi Asset Management announced on the 28th that it has changed the name of its HANARO High Dividend product to 'HANARO K High Dividend' and lowered the total expense ratio to 0.07%.

The HANARO K High Dividend ETF is a fund that invests in domestic high-dividend stocks and was listed in 2019. NH-Amundi Asset Management changed the name from the previous HANARO High Dividend to allow investors to intuitively recognize that it is an ETF focused on domestic equities.

The underlying index is the 'FnGuide K High Dividend Index.' This index is composed of the 40 stocks with the highest dividend yields among KOSPI and KOSDAQ-listed companies that have paid dividends for more than three consecutive years and have not reduced their dividend amounts.

The fund invests in stocks with strong dividend sustainability and growth potential, resulting in a steady increase in annual distributions since its listing. The annual distribution increased from 365 won in 2020 to 650 won in 2025 (accumulated from January to July), showing consistent growth each year.

Along with the name change, the company also implemented a fee reduction. To enhance cost efficiency for long-term investors, the total expense ratio was reduced from 0.25% to 0.07%. This is the lowest level among domestic equity-type high-dividend ETFs. The distribution cycle will also be changed from quarterly to monthly, allowing investors to expect a steady cash flow every month.

Recently, institutional changes such as amendments to the Commercial Act and revisions to the dividend tax system have led companies to strengthen their shareholder return policies. As a result, the attractiveness of investing in high-dividend stocks has increased. The HANARO K High Dividend ETF is expected to become even more useful as a long-term investment tool, such as for retirement pensions, while reducing the cost burden for investors.

Kim Seungcheol, Head of ETF Investment at NH-Amundi Asset Management, said, "Recent government policies to advance the capital market have greatly improved the investment environment for domestic dividend stocks." He added, "HANARO K High Dividend ETF is a product that considers not only dividend yield but also dividend growth and sustainability. With this fee reduction, we expect its appeal as a long-term investment tool to increase even further."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)