Fines for Intentional Accounting Manipulation to Match Those for Embezzlement and Breach of Trust

Company Fines Expected to Rise 1.5 Times, Individual Fines Up to 2.5 Times

Implementation Targeted for First Half of Next Year

The maximum fine for accounting fraud will be increased up to 2.5 times, and the standards for sanctions will also be strengthened.

On August 27, the Securities and Futures Commission of the Financial Services Commission announced that it held its 15th regular meeting and discussed the "Measures to Strengthen Sanctions on Accounting Fraud."

This plan was prepared to specifically implement President Lee Jaemyung's directive that "in order to revitalize the capital market, unfair trading practices must be eradicated to restore market trust."

Accounting fraud is considered a serious crime that undermines trust in the capital market and hinders its development. Intentional accounting manipulation is often closely linked to unfair trading practices such as embezzlement and breach of trust, misuse of undisclosed material information, and fraudulent transactions.

Kwon Daeyoung, Vice Chairman, who presided over his first Securities and Futures Commission meeting after taking office, emphasized, "Accounting fraud crimes, such as false disclosure of financial statements that undermine market trust, should be strictly sanctioned by imposing fines sufficient to eliminate any economic incentive."

Fines: Companies '1.5 times', Individuals '2.5 times'

First, the Securities and Futures Commission decided to significantly strengthen the scope and amount of fines to eliminate the incentive for accounting manipulation and strictly sanction major accounting fraud.

For intentional accounting manipulation that undermines market trust, such as falsification or concealment of audit materials, the maximum fine will be raised to the highest level, equivalent to those imposed for embezzlement, breach of trust, and unfair trading-related cases. Specifically, the importance weighting of violations (currently 40%) will be raised from "medium" (2 points) to "high" (3 points) when determining sanctions. As a result, the total importance score will increase, leading to a higher base rate and thus a larger fine.

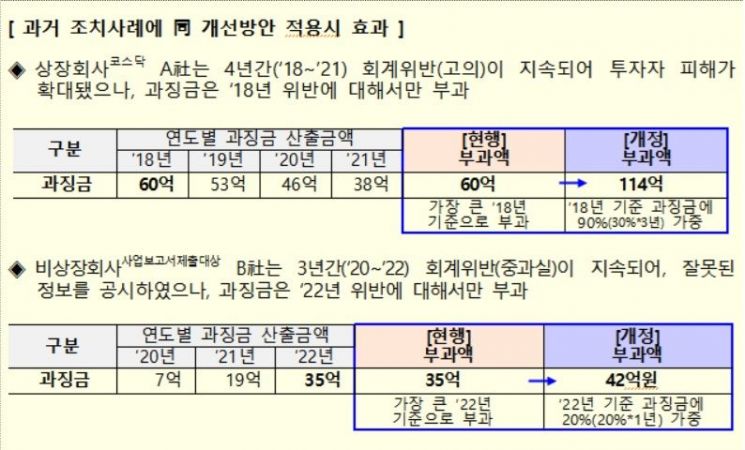

In addition, if accounting fraud is found to have continued "over a long period," the fine will be increased according to the duration. For "intentional" accounting violations, if the violation period exceeds one year, the fine will be increased by 30% for each additional year. For "gross negligence" accounting violations, if the violation period exceeds two years, the fine will be increased by 20% for each additional year.

The legal basis will be supplemented and improved so that a reasonable level of fines can be imposed on those with "substantial" responsibility for accounting violations. Even if there was no direct compensation received from the company, fines can be imposed if there was any "economic benefit" such as private misuse of funds or embezzled amounts resulting from accounting manipulation.

If compensation, dividends, or other benefits were received from an affiliate (a group of companies subject to consolidated financial statements under accounting standards), such amounts will also be included as "economic benefit." This applies even if compensation, dividends, or other benefits were received from an affiliate (a group of companies subject to consolidated financial statements under accounting standards).

Conversely, in cases where an individual participated in accounting fraud but it is difficult to calculate the fine, or where the monetary compensation is considered extremely low by social standards, a "minimum fine standard" will be introduced and applied by referencing other laws such as the Capital Markets Act.

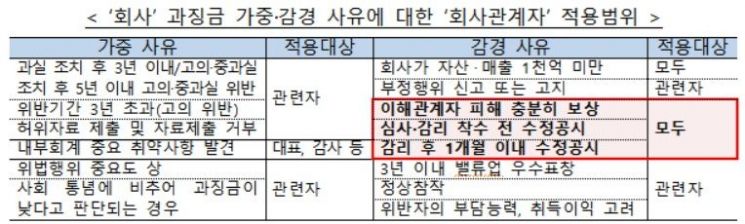

The effectiveness of personal fines for those involved in accounting manipulation will also be strengthened. Reasons for fine reductions due to post-incident efforts such as correcting financial statements (20-30% reduction) or compensating victims (50% reduction) will not be applied to "former management" who committed accounting fraud. The cap on fines imposed on company insiders who participated in "intentional" accounting manipulation will be doubled from the current 10% to 20% of the fine imposed on the company.

Stronger Penalties for Audit Obstruction... Incentives for Active Auditing

Strong sanctions will also be imposed for obstruction of internal audits, external audits, and accounting review or supervision. This is due to the persistent and repeated occurrence of illegal acts such as obstruction of external audits, which undermines the accounting oversight system, and interference with official review or supervision. From 2019 to 2023, there were an average of 2.6 cases of external audit obstruction per year. Since last year, this number has increased to six cases.

The authorities plan to impose strong sanctions at the same level as those for intentional accounting manipulation in cases of "obstruction of accounting oversight by internal oversight bodies (audit committees or auditors)," "obstruction of external audits by auditors," or "obstruction of review or supervision of financial statements by authorities," to ensure the proper functioning of the accounting oversight system.

Additionally, effective sanctions will be introduced for cases where multiple violations due to negligence occur, to fundamentally improve companies' internal accounting information systems and prevent recurrence of erroneous financial disclosures. Specifically, if there are three or more negligence violations and the total amount of violations exceeds eight times the importance threshold, the following will be imposed: ▲ appointment of an external auditor (for one to three years) ▲ external audit of the internal accounting management system (for one to three years).

Companies that operate their internal audit functions independently and effectively will be given incentives in accounting supervision and sanctions. Specific procedural standards will be established for reducing sanctions on companies and internal audit bodies. If the internal audit body has made efforts to prevent accounting violations, those efforts will be taken into account as grounds for reducing sanctions on the company or the internal audit body.

If accounting fraud is promptly investigated and corrected, the company’s fine will also be reduced. If the major shareholders and management are completely replaced, and the new management, which is unrelated to the accounting fraud, ▲ promptly investigates and corrects past accounting fraud, ▲ replaces responsible executives, ▲ prepares measures to prevent recurrence, and ▲ reports to and cooperates with the authorities in subsequent supervision, the fine may be "fully exempted," thereby expanding sanction incentives. Furthermore, to support the recovery and growth of companies, the authorities plan to consider reducing or exempting fines in the future, or substituting them with "restrictions on securities issuance."

The Securities and Futures Commission emphasized, "We plan to swiftly push forward with institutional improvements aiming for implementation in the first half of next year. Amendments to the law will be submitted to the National Assembly within this year, and for matters that do not require legal amendments, procedures such as legislative notice will be carried out within this year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.