Merger Synergy to Boost Defense and Special-Purpose Vessels

Enhancing Global Competitiveness in Line with MASGA

Reshaping the Shipbuilding Landscape Through Scaling Up

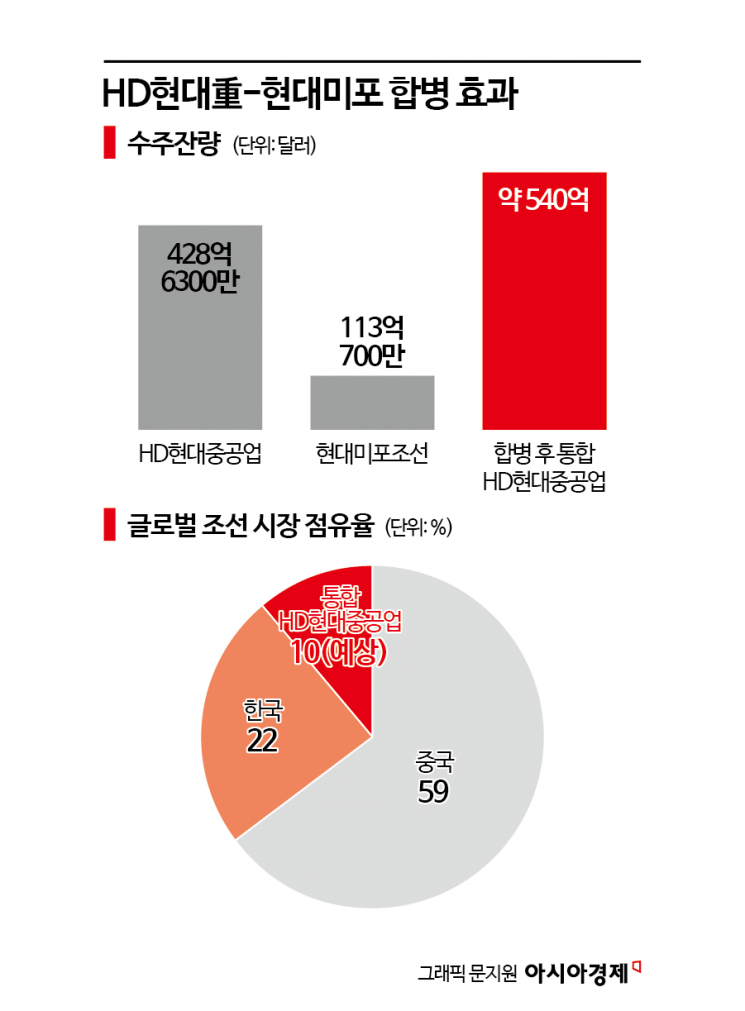

HD Korea Shipbuilding & Offshore Engineering has initiated a large-scale restructuring of its shipbuilding business ahead of the full-scale launch of the United States' "MASGA (Make American Shipbuilding Great Again)" project. The merger between HD Hyundai Heavy Industries and Hyundai Mipo Dockyard is seen as more than just scaling up; it is interpreted as a strategic move aimed at strengthening overall competitiveness in defense, special-purpose vessels, eco-friendly new technologies, and overseas expansion.

Merger Between the World’s Leading Shipbuilders... Competing in Scale with China and Japan

On August 27, HD Korea Shipbuilding & Offshore Engineering and its two subsidiaries, HD Hyundai Heavy Industries and Hyundai Mipo Dockyard, each held board meetings and approved the merger plan. After completing the necessary procedures, the newly integrated "HD Hyundai Heavy Industries" will be launched in December. The merger will be carried out by issuing new shares of the surviving company, HD Hyundai Heavy Industries, to Hyundai Mipo Dockyard shareholders, with a merger ratio of 1 to 0.4059146.

The industry views this decision as a strategic move in response to mounting pressure for scaling up. China has already enhanced its shipbuilding competitiveness through the merger of CSSC and CSIC, while Japan has done the same by integrating JMU and IHIMU. HD Hyundai’s choice aligns with this global trend. The merger of mid- and large-sized shipbuilders within the world’s top shipbuilding group signifies an intention to strengthen market dominance and directly compete with global rivals leveraging scale advantages.

Targeting the Defense Market... "Supplementing Warship Licenses and Linking with U.S. MASGA"

The main driving force behind the merger is the defense sector. While Hyundai Heavy Industries has accumulated technological expertise as the domestic leader in warship construction, Hyundai Mipo Dockyard has faced limitations in entering the defense market due to the lack of warship licenses. With this merger, Hyundai Mipo Dockyard’s mid-sized dock and workforce capabilities will be combined with Hyundai Heavy Industries’ warship know-how, laying the groundwork for expanding their presence in the global warship market.

In particular, as the U.S. government seeks to revive its warship construction capabilities through the MASGA project, the enhanced competitiveness of the integrated entity is expected to create new opportunities for collaboration in the U.S. market.

The global market outlook is also positive. According to the British military journal Janes, demand for new warships over the next decade is projected to reach 2,100 vessels, with a market size of $360 billion. HD Hyundai aims to achieve 10 trillion won in defense sector sales by 2035 and is accelerating efforts to expand "K-Defense" exports.

Yard views of HD Hyundai Heavy Industries (top) and HD Hyundai Mipo (bottom). Provided by HD Hyundai

Yard views of HD Hyundai Heavy Industries (top) and HD Hyundai Mipo (bottom). Provided by HD Hyundai

Three-Pronged Strategy: Special-Purpose Vessels, Eco-Friendly Technologies, and Overseas Subsidiaries

The integrated entity will pursue a "three-pronged growth strategy" centered on special-purpose vessels, eco-friendly ship technologies, and overseas subsidiaries, in addition to the defense sector. The company plans to secure a technological edge by expanding advanced technologies for eco-friendly fuel ships, such as LNG and ammonia, to large vessels, as well as targeting the special-purpose vessel market for Arctic routes, including icebreakers.

The overseas expansion strategy is also concrete. HD Korea Shipbuilding & Offshore Engineering will establish an investment corporation in Singapore to oversee overseas production bases in countries like Vietnam and the Philippines, and will seek new shipyard opportunities and partnerships. This move is interpreted as an effort to regain market share in the bulk carrier and tanker segments, which have been lost to Chinese shipbuilders, and to streamline decision-making processes for overseas operations.

The industry views this merger not merely as an internal efficiency measure but as an "industrial diplomacy strategy" in line with international developments. With the MASGA project gaining traction following the Korea-U.S. summit, the role of Korean shipbuilders is expected to expand. Supplementing warship construction licenses and combining technologies and facilities are seen as steps toward meeting the requirements for entering the U.S. market.

An industry insider commented, "This merger targets both 'economies of scale' and 'strengthening defense competitiveness.' As K-Defense aligns with the global trend of naval power enhancement, HD Hyundai’s actions could trigger a market reshuffle."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)