Inventage Lab and KoBioLabs Hit Upper Price Limits

Big Pharma Partnerships and International Patents Fuel Rally

Caution Advised Amid High Volatility and Overhang Risks

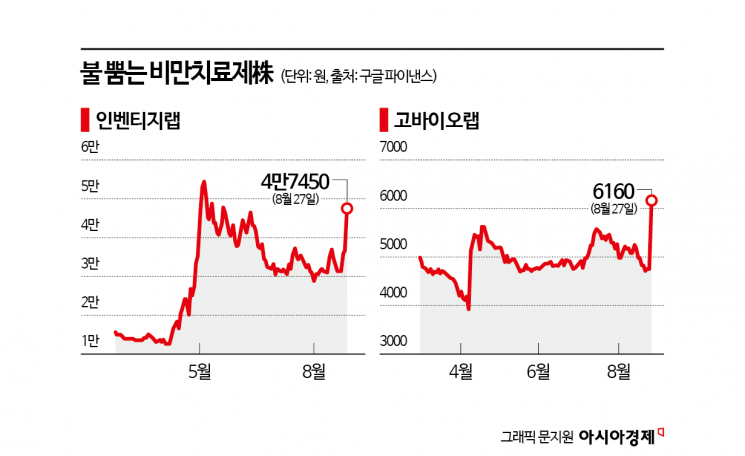

Domestic obesity treatment stocks surged dramatically. Amid a stagnant domestic stock market, positive news such as international patent acquisitions and partnerships with global big pharma companies has sparked renewed investor sentiment.

According to the Korea Exchange on August 28, the obesity treatment theme rose by 3.79% the previous day. It ranked among the top gainers, following shipbuilding stocks, which climbed over 6%. Out of 35 stocks in the theme, 23 saw gains. Inventage Lab, KoBioLabs, and Quratis hit their upper price limits.

Expectations for overseas market expansion drove stock prices higher. On this day, Inventage Lab announced in its semi-annual report that it had signed a material transfer agreement (MTA) with German pharmaceutical company Boehringer Ingelheim, with whom it has been jointly developing long-acting therapeutic formulations. This is at the stage of verifying the efficacy of candidate substances, which could potentially lead to a technology transfer agreement. Industry insiders believe that the drug in question is likely Boehringer Ingelheim’s next-generation glucagon-like peptide (GLP)-1 obesity treatment currently under clinical development.

KoBioLabs also attracted strong buying interest after announcing that its international patent for the core anti-obesity strain (Akkermansia muciniphila) 'KBL983' has now been registered in the United States, following approvals in China, Japan, Australia, Russia, and Canada. Expectations are rising for the development of an oral treatment that can effectively manage major metabolic diseases caused by obesity, such as diabetes, arteriosclerosis, and fatty liver, in overseas markets.

An official from a securities firm commented, “Obesity treatment is emerging as one of the hottest themes, with expectations for global market opportunities comparable to those for shipbuilding, defense, and nuclear power. With a constant flow of news, related stocks are experiencing cyclical rallies, and the obesity treatment theme continues to benefit from positive developments.”

The market outlook is also optimistic. Morgan Stanley estimated that the global obesity treatment market, which was worth $15 billion last year, will grow nearly fivefold to $77 billion (about 108 trillion won) by 2030.

However, there are also significant warnings about the high volatility characteristic of pharmaceutical and biotech stocks. Wi Haejoo, a researcher at Korea Investment & Securities, cautioned, “Eli Lilly’s stock price fell 14% on the day it announced the results of the phase 3 trial for orforglipron. Viking’s stock price also plummeted 42% on the day it released phase 2 results for the oral VK2735. Companies developing obesity treatments tend to see large fluctuations in their share prices.”

Concerns have also been raised about the growth potential of the oral obesity treatment market and the possibility of price competition starting sooner than expected. Except for Hanmi Pharmaceutical, most obesity treatment companies have yet to receive investment opinions or target price estimates from securities firms, which is another burden.

Additional share issuances for individual stocks also warrant attention. In the case of Inventage Lab, the company issued convertible bonds (CB) worth 39 billion won (at a conversion price of 18,984 won per share) in September last year and 4.8 billion won (at 19,702 won per share) in January this year. The convertible bonds issued in September last year can be converted starting from the 20th of next month. Experts generally agree that, since the current share price (closing at 47,450 won on the 26th) is much higher than the conversion price, it is highly likely that all bonds will be converted.

Kim Seona, a researcher at Hana Securities, analyzed, “2,054,361 shares, equivalent to 16% of the total issued shares, could act as an overhang.” However, she added, “With numerous academic events scheduled for the second half of this year, obesity treatments are likely to attract renewed attention. The converted shares are expected to be gradually released into the market as investors anticipate further price increases.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)