Listed on KOSDAQ at an Offering Price of 16,000 Won on November 7 Last Year

Stock Price Up 160% This Year, Surpassing 40,000 Won

Second Quarter Sales Reach 3.1 Billion Won, Up 83% Year-on-Year

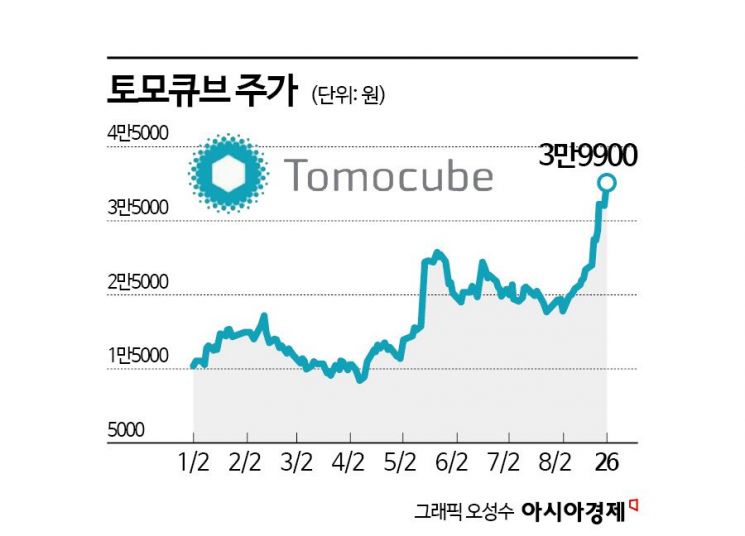

TomoCube, which was listed on the KOSDAQ market in November last year, has reached its highest stock price since going public. The company's corporate value is growing alongside rapidly increasing sales, driven by its advanced technology. Since the beginning of this year, both foreign and individual investors have shown net buying dominance, fueling the stock's upward momentum.

According to the financial investment industry on August 27, TomoCube's stock price has risen by 160% since the start of the year. While the stock hovered around 15,000 won at the end of last year, it surpassed 40,000 won during intraday trading yesterday. Foreign investors and individuals have recorded cumulative net purchases of 11.9 billion won and 16.7 billion won, respectively, in TomoCube shares this year. Both groups have achieved a return on investment per share exceeding 70%.

TomoCube was listed on the KOSDAQ market on November 7 last year at an offering price of 16,000 won per share.

The company specializes in cell imaging and possesses proprietary "holotomography" technology, which enables high-resolution, real-time observation of living cells without loss or deformation. Holotomography is TomoCube's unique technology that allows for high-resolution, real-time observation of living cells or organoids without causing loss or deformation. By utilizing 3D imaging technology, it enables long-term observation of living three-dimensional cell structures and detects intracellular toxicity that is difficult to identify with conventional microscopes.

TomoCube expects its holotomography technology to be applied to organoid analysis and cell therapy product quality control (QC). The organoid analysis sector is seeing increasing demand for precise imaging of mini-organ structures that mimic organs such as the liver, intestines, and brain. The company anticipates rapid growth in this field, especially as alternatives to animal testing become more widespread. In the cell therapy product quality control market, there is a surging demand for technology that can assess quality without destroying living cells. Analyses of cell morphology, division status, and organelle structure are directly related to determining cell viability.

In the second quarter of this year, TomoCube posted sales of 3.1 billion won and an operating loss of 1.1 billion won. Compared to the same period last year, sales increased by 82.8%, while the scale of losses decreased. Exports accounted for 69.3% of second-quarter sales. With its U.S. subsidiary launching direct sales operations in earnest, revenue in the Americas is on the rise. The company stated, "Sales are increasing due to the normalization of operations following organizational restructuring," and added, "The impact of new product launches is now being fully realized."

As more cases globally demonstrate the effectiveness of holotomography technology, expectations are rising for improved performance through commercialization. Na-Yeon Lee, a researcher at the Korea IR Council, commented, "Holotomography (HT) technology is a foundational technology that is changing the analytical paradigm in life sciences," adding, "It is the only commercial solution capable of overcoming the structural limitations of conventional 2D optical microscopes in organoid analysis." She continued, "TomoCube is currently conducting an organoid analysis project as an alternative to animal testing in collaboration with the National Center for Advancing Translational Sciences (NCATS) under the U.S. National Institutes of Health (NIH), and is jointly developing a T-cell-based artificial intelligence (AI) image analysis project with a global pharmaceutical company."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)