Hitejinro and Lotte Chilsung See Decline in Soju Sales in First Half

Impact of Reduced Alcohol Consumption and Diversification of Beverages

Exports Also Falter... Attention on Whether $100 Million Export Mark Can Be Maintained for Third Consecutive

In the first half of this year, both of Korea's leading soju companies saw a decline in soju sales. Changes in drinking culture, such as the diversification of alcoholic beverages and a decrease in overall alcohol consumption, have contributed to the contraction of domestic soju consumption. Although targeting overseas markets has become an increasingly important task for the continued growth of soju, Korea's signature spirit, even exports have shown signs of slowing down this year.

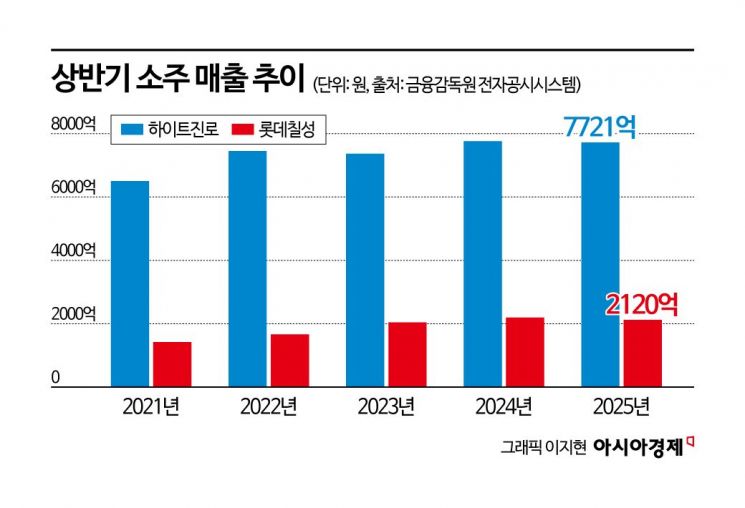

According to the Financial Supervisory Service's electronic disclosure system on August 28, Hite Jinro's soju sales in the first half of this year amounted to 772.1 billion won, a 0.5% decrease from the same period last year (776 billion won). During the same period, Lotte Chilsung Beverage's soju sales amounted to 212 billion won, down 3.4% from 219.4 billion won a year earlier. This decline is attributed to a decrease in overall demand for alcoholic beverages, including soju, as the economic downturn has led to a slump in the dining-out sector. In particular, soju is more sensitive to economic fluctuations than beer, as it holds a higher share in the entertainment market.

Additionally, the possibility of price increases before the 21st presidential election in June led to preemptive purchases in the first quarter, which affected the decrease in sales in the second quarter. Previously, in May, Hite Jinro raised the shipment prices of its major beer products by an average of 2.7%. While the company also considered raising soju prices, the increase has been put on hold in the name of price stability. However, due to the impact of preemptive purchases, domestic soju sales in the first half declined by 2.8% year-on-year, surpassing the overall decline in soju sales.

The recent decline in soju sales is mainly due to the changing drinking culture that has accelerated since the COVID-19 pandemic, such as the reduction in company gatherings. According to Korea Credit Data's "Small Business Trends for Q2 2025" report, the average sales per small business in the second quarter of this year were about 45.07 million won, down 0.8% from the same period last year. While most segments within the food service industry saw a decrease in sales, bars were hit the hardest with a 9.2% drop.

As drinking habits diversify from group gatherings such as company dinners to home drinking and solo drinking, the preference for soju and beer is declining, while demand for whiskey, wine, and traditional liquors is relatively increasing. In addition, growing health consciousness, especially among younger generations, is leading to a decrease in the overall population consuming alcohol, further reinforcing this trend.

Some point out that the ambiguous identity of soju is also a factor in the stagnation of the market. With the growing trend toward lower-alcohol beverages in the liquor industry, soju, once known for its high alcohol content, has continuously lowered its alcohol percentage. Last month, Lotte Chilsung Beverage announced that it would lower the alcohol content of "Chum Churum" from 16.5% to 16%. Previously, Hite Jinro reduced the alcohol content of "Jinro Is Back" in 2023 and "Chamisul Fresh" last year from 16.5% to 16%.

While lowering the alcohol content of soju has the advantage of appealing to those who prefer a smoother taste and expanding the consumer base, it can also weaken differentiation from competing alcoholic beverages. In fact, as soju's alcohol content, which used to exceed 20%, has dropped to around 15%, it has become similar to fermented drinks like wine and sake. Above all, as prices continue to rise each year while alcohol content falls, there are concerns that soju's key competitive edge-its value for money-is diminishing. This could lead to the loss of loyal customers.

As the business environment for soju companies deteriorates, expanding overseas sales has become a necessity rather than a choice. Han Yoojeong, a researcher at Hanwha Investment & Securities, commented, "In the past, food and beverage manufacturing was dominated by a few large companies, but now, the number of businesses responding to diverse demands is rapidly increasing. In an oversupplied market, it is no longer reasonable to take premium status for granted simply because a product was considered premium in the past." She added, "If companies continue to focus only on the domestic market, it will be difficult for sales to grow faster than the inflation rate, and profitability is likely to gradually decline."

However, soju exports have shown signs of slowing down this year. According to Korea Customs Service trade statistics, soju exports have steadily increased in recent years, fueled by the global popularity of Korean content, surpassing 100 million dollars for the first time in 2023 with 101.41 million dollars, and continuing this growth in 2024 with 104.09 million dollars, marking two consecutive years of exports exceeding 100 million dollars. However, as of July this year, exports stood at 53.76 million dollars (about 75 billion won), a 7.3% decrease from 57.66 million dollars in the same period last year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)