Yellow Envelope Act and Corporate Tax Hikes Weigh on Firms

Seeking Overseas Solutions for Capital Management

Diminished Incentive to Repatriate Dividends

"Profits Earned Abroad to Be Reinvested Abroad"

Inevitable Reduction of Domestic Infrastructure

Third Round of Amendments Pushed Forward Amid Uncertainty

"Money earned overseas will be spent overseas."

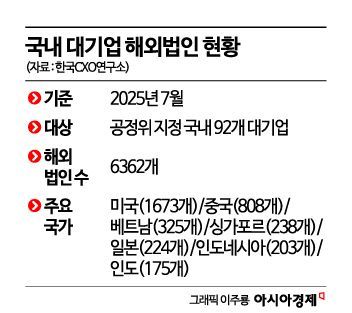

As the Commercial Act has been revised repeatedly, companies are considering shifting the focus of their capital management and operations from the domestic market to overseas markets. Due to the amended regulations, it has become increasingly difficult to freely utilize funds within Korea, prompting companies to seek breakthroughs in comparatively business-friendly foreign markets. Within the business community, there are growing concerns that this could lead to an 'exodus' of companies leaving the domestic market one after another.

According to the business community on August 26, major Korean companies have begun to reexamine their strategies for capital management, including overseas stock listings and investments. A company official stated, "With the government and the ruling party discussing not only the Yellow Envelope Act and revisions to the Commercial Act, but also a potential increase in corporate taxes, the incentive to repatriate dividends to headquarters has diminished." The official continued, "As a result, more companies are choosing to keep profits earned overseas and utilize them locally for investment or operations." In this context, the CEO of a power equipment manufacturing company commented, "Ultimately, money serves as investment capital, but there are now too many restrictions in Korea, making expansion investments difficult." He added, "For this reason, we are considering expanding production facilities at our overseas sites."

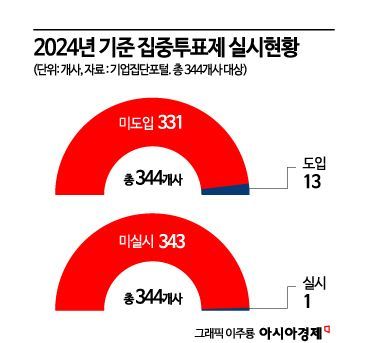

There is growing analysis that the trend of reinvesting profits earned overseas back into local operations is strengthening among companies. The revision of the Commercial Act, which has expanded the separate election of audit committee members and made cumulative voting mandatory, has significantly reduced management autonomy. If discussions on making the buyback and retention of treasury shares subject to mandatory cancellation proceed, the defensive function could be further weakened.

A CEO of a major corporation, who requested anonymity, said, "Policy should avoid a trade-off and instead strike a balance between competing interests, but the current amendments to the Commercial Act have disrupted this balance." He added, "If there are no supplementary measures to restore balance, companies will have no choice but to pursue profits by relocating abroad or seeking alternative methods."

Until now, companies have typically brought money earned overseas back to Korea to use as dividends and investment capital. However, as means of defending management rights have weakened and the tax burden has increased, the perception that local reinvestment is more rational than repatriation to headquarters is spreading.

If companies shift the focus of their operations overseas, domestic infrastructure and governance will inevitably be reduced. Scenarios are being discussed in which only minimal domestic functions are retained, while core factories and offices are relocated abroad. The business community sees this as the full-scale beginning of a 'Korea exit.' In fact, a similar trend has been observed, with more companies voluntarily delisting from the stock market even before the latest amendments to the Commercial Act took effect.

While expanding overseas capital management has long been considered as a strategy, both the business community and experts agree that the recent amendments to the Commercial Act have accelerated this trend. In order to address management issues and carry out large-scale investments, companies need to inject capital quickly, but under the revised law, board decision-making can be delayed.

In particular, after two rounds of amendments, the operation of boards of directors has changed significantly. The threshold for outside directors has been lowered, and management's discretionary authority has been reduced. In addition to the 3% rule introduced in the first amendment, the second amendment now allows minority shareholders to elect directors through cumulative voting, and the number of separately elected audit committee members has increased. The business community assesses that these changes have further restricted management's flexibility.

Lee Hosun, a professor at Kookmin University Law School and an attorney, stated, "The essence of the first and second rounds of Commercial Act amendments is to bring management, which is based on choice and risk-taking, into the realm of criminal liability." He continued, "As a result, management becomes more passive, creating a structure that shrinks corporate activity itself."

Recent improvements in the business environment overseas have also played a significant role. In fact, major Korean companies have shown strong preferences for the United States, which is making a national effort to revive manufacturing and actively attract corporate factories; Vietnam, which is not hesitating to implement 'fast-track' measures for investment and establishment of production facilities; and India, which has significantly lowered the barriers for local stock market listings.

Meanwhile, the Democratic Party of Korea has immediately begun work on a third amendment to the Commercial Act, which would make the cancellation of treasury shares mandatory. It is also reported that through the Economic Criminal Civil Liability Rationalization Task Force, the party will discuss ways to ease or abolish the crime of breach of trust.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.