8,636,000 pension recipients aged 65 and over in 2023

Consistent annual growth trend since 2016

1,710,000 pension subscribers aged 60 to 64

In 2023, the average monthly pension payment for recipients aged 65 and over was 695,000 won, marking a 6.9% increase from the previous year. The median monthly payment also rose to 463,000 won, reflecting the impact of the basic pension increase. Among all recipients, 50.9% received between 250,000 and 500,000 won per month, making up the majority. For those aged 60 to 64 who received a pension, the average monthly payment was 1,004,000 won, higher than that for recipients aged 65 and over.

8.636 million recipients aged 65 and over in 2023

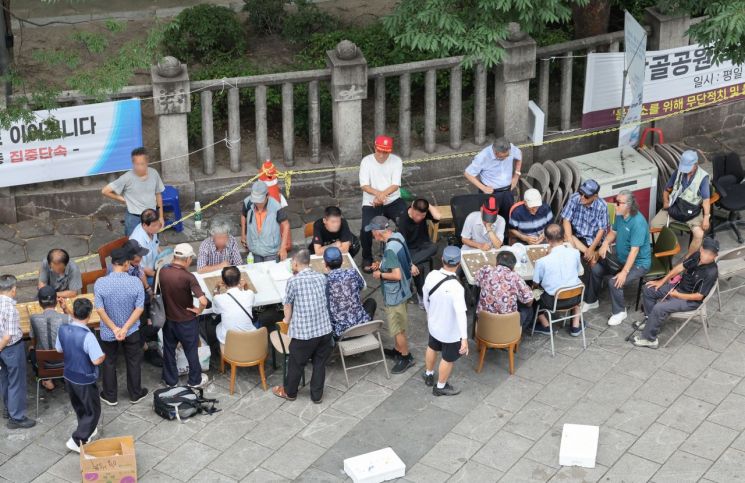

According to the "2023 Pension Statistics Results" released by Statistics Korea on August 25, 2025, the number of people aged 65 and over who received at least one of 11 types of pensions, including the basic pension and the national pension, reached 8.636 million in 2023, a 5.6% increase from the previous year. The pension recipient rate among those aged 65 and over was 90.9%. Among them, 37.7% received two or more types of pensions simultaneously. The number of recipients, the recipient rate, and the simultaneous recipient rate have all continued to rise since 2016.

The average monthly pension payment was 695,000 won, up 6.9%. While the upward trend continues each year, the growth rate has slightly declined from the previous year (8.3%). The average payment was relatively higher among men (901,000 won), those aged 65 to 69 (807,000 won), registered employees (779,000 won), and homeowners (873,000 won). Registered employees are wage and non-wage workers listed in administrative job records, with a recipient rate of 93.1% among them.

The median monthly payment was 463,000 won, up from 419,000 won the previous year. The largest share of recipients (50.9%) received between 250,000 and 500,000 won. This was followed by 500,000 to 1 million won (31.3%), 1 million to 2 million won (8.2%), over 2 million won (5.9%), and less than 250,000 won (4.0%). While the shares of those receiving 250,000 to 500,000 won and 1 million to 2 million won increased, the share of those receiving less than 250,000 won dropped by 15.9 percentage points from the previous year (19.9%).

Choi Jae-hyuk, Director of Administrative Statistics at Statistics Korea, explained, "The basic pension covers the lower end of the total payment spectrum. In 2022, many recipients were near the 250,000 won mark, but as the basic pension partially reflected inflation, more people crossed the 250,000 won threshold." He added, "A large number of people who were previously receiving less than 250,000 won have now moved into the 250,000 to 500,000 won range."

By pension type, recipients of the basic pension and national pension accounted for 6.461 million (74.8%) and 4.76 million (55.1%), respectively. Among national pension recipients, 2.392 million (50.3%) had contributed for 10 to 20 years. The number of private pension recipients rose by 5.0% to 435,000. Although the number of retirement pension recipients was only 30,000 (0.4%), this represented an 86.8% increase from the previous year.

The average monthly payment by pension type was 292,000 won for the basic pension, 452,000 won for the national pension, and 1,152,000 won for retirement pensions. Among basic pension (90.4%) and national pension (40.0%) recipients, the majority received between 250,000 and 500,000 won. For retirement pension (41.7%) and private pension (46.0%) recipients, the largest share received less than 250,000 won.

Slight decrease in subscribers aged 18-59... Most pay 100,000 to 250,000 won in premiums

The number of people aged 18 to 59 subscribed to at least one pension was 23.741 million, a 0.4% decrease. The subscription rate among this age group was 81.0%, down 0.8 percentage points from the previous year. The number of non-subscribers among those aged 18 to 59 was 5.556 million, a 5.3% decrease, accounting for 19.0% of the population in this age group.

The average monthly premium for pension subscribers was 344,000 won, up 2.9%. After a one-time decrease in 2020 (-0.8%), premiums have increased for three consecutive years since 2021 (1.9%). Notably, in 2023, the premium growth rate rose by 1.9 percentage points from the previous year (1.7%), surpassing the 2% mark after remaining in the 1% range.

The largest share of subscribers (32.9%) paid monthly premiums between 100,000 and 250,000 won. This was followed by 250,000 to 500,000 won (31.7%), less than 100,000 won (20.0%), 500,000 to 1 million won (10.8%), and over 1 million won (4.6%). The share of those paying 100,000 to 250,000 won decreased from 34.9% the previous year, while the share paying 500,000 to 1 million won increased from 29.6%.

Among pension subscribers aged 18 to 59, 21.567 million (90.8%) were enrolled in the national pension, and 7.581 million (31.9%) in retirement pensions. While the number of national pension subscribers declined by 0.3% from the previous year, the number of retirement pension subscribers increased by 2.4%. The number of private pension subscribers fell by 7.2% to 4.88 million.

The average monthly premium by pension type was 231,000 won for the national pension and 337,000 won for private pensions. Among national pension subscribers, the largest share (39.3%) paid monthly premiums between 250,000 and 500,000 won. For private pension subscribers, the largest share (30.8%) paid between 100,000 and 250,000 won.

Payments for those aged 60-64 are higher than for those 65 and over

Among those aged 60 to 64, 1.773 million received at least one of 11 types of pensions, including the basic and national pensions, with a recipient rate of 42.7%. The share receiving two or more types of pensions simultaneously was 5.8%. Since the starting age for the national pension's old-age pension increased from 62 to 63 in 2023, the recipient rates were 24.8% for those aged 60 to 62 and 69.9% for those aged 63 to 64.

The average monthly payment for recipients aged 60 to 64 was 1,004,000 won, higher than the 695,000 won average for those aged 65 and over. Director Choi noted, "While the recipient rate increases with age, the payment amount tends to decrease."

Among the 60 to 64 age group, 1.71 million were subscribed to at least one pension, representing 41.2% of the population in this age group. The subscription rate was 50.9% for those aged 60 to 62 and 26.6% for those aged 63 to 64. The average monthly premium for subscribers aged 60 to 64 was 373,000 won, similar to that of those in their 50s.

6.514 million pension recipient households with members aged 65 and over

The number of households with at least one pension recipient aged 65 or older was 6.514 million, a 5.2% increase. Among households with members aged 65 and over, the share of pension recipient households was 95.8%. Their average monthly payment was 898,000 won, up 7.3%. Payments were relatively higher among two-person households (1.06 million won), married couple households (1.239 million won), homeowner households (1.036 million won), and in Sejong region (1.087 million won).

The number of households with at least one pension subscriber aged 18 to 59 was 15.313 million, a 0.3% increase. The subscription rate was 92.1%, up 0.1 percentage points. The average monthly premium for these households was 529,000 won, a 2.3% increase. The number of non-subscriber households among those with members aged 18 to 59 was 1.308 million, a 2.1% decrease, with a non-subscription rate of 7.9%.

Pension statistics are compiled to track pension enrollment and payment status by individual and household, using data from 11 types of pensions, including the basic and national pensions, as well as the statistical registry. The statistics cover Korean nationals aged 18 and over residing in Korea as of November 1 each year, including pension subscribers, recipients, and their households.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.