TIGER China Science and Technology Innovation Board STAR50 ETF Achieves 23.5% One-Month Return

Domestic Asset Management Industry Sees Bright Prospects for China's Advanced Industries

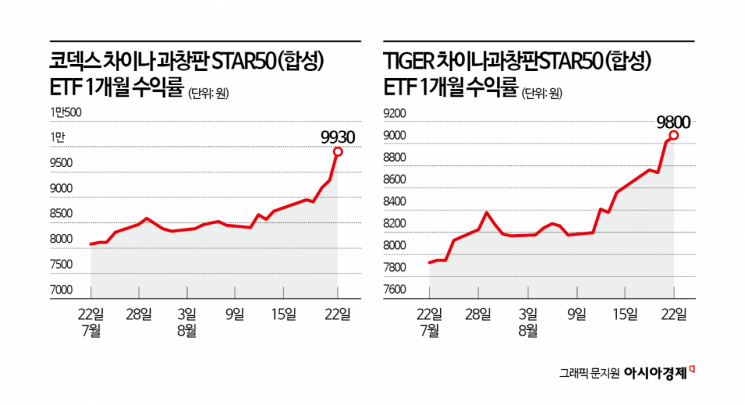

As the Shanghai Composite Index in China has reached its highest level in a decade, exchange-traded funds (ETFs) related to the Chinese stock market are also delivering high returns. ETFs such as TIGER China Science and Technology Innovation Board STAR50 (Synthetic) and KODEX China Science and Technology Innovation Board STAR50 (Synthetic) have risen by more than 20% in the past month. Major domestic asset management companies expect the bullish trend in the Chinese stock market to continue, supported by liquidity and government backing.

According to ETF Check on August 25, the TIGER China Science and Technology Innovation Board STAR50 ETF recorded a one-month return of 23.5%. The KODEX China Science and Technology Innovation Board STAR50 ETF and the ACE China Science and Technology Innovation Board STAR50 ETF also rose by 22.8% and 21.5%, respectively, over the same period.

The TIGER China Science and Technology Innovation Board STAR50 ETF, which tracks the STAR50 Index-often referred to as "China's Nasdaq"-invests in leading Chinese innovation companies such as Cambricon, known as the "Nvidia of China," and SMIC, the country’s largest foundry company.

Kim Jiyeon, Senior Manager of the ETF Management Team at Mirae Asset Global Investments, explained, "The recent strength of the STAR50 Index is due to the Chinese government's 'AI+ policy drive,' which is directly boosting supply and demand in industries centered on semiconductors, robotics, and AI." She added, "In response to U.S. semiconductor export restrictions, China’s strong push for technological self-reliance and localization appears to have had a positive impact on the share prices of related companies."

Experts in the asset management industry advised that, given the Chinese government's focus on fostering advanced industries, investors should carefully select promising ETFs.

Nam Yongsoo, Head of ETF Management at Korea Investment Management, said, "The upward momentum in the Chinese stock market is likely to continue for the time being," and predicted, "Policy support for the Science and Technology Innovation Board, which is the core platform for nurturing national strategic industries, will persist." He went on to say, "As China accelerates efforts to secure technological sovereignty-such as semiconductor self-sufficiency and AI development-large-scale investments through the third phase of the semiconductor Big Fund and institutional improvements will combine to provide structural growth momentum."

ETFs such as the KODEX China Humanoid Robot ETF and the TIGER China Humanoid Robot ETF, both listed on the Korean stock market in May this year, have also risen by more than 10% this month. The KODEX China Humanoid Robot ETF selected 20 stocks not only based on complete humanoid robots but also by analyzing the actual importance of key components. The portfolio is primarily composed of companies that manufacture essential parts, based on cost analysis of humanoid robots. The TIGER China Humanoid Robot ETF invests in companies closely related to humanoids. When major humanoid firms such as Unitree go public, they can be immediately included in the ETF.

Lee Kahyun, Manager at Samsung Asset Management, said, "Recently, expectations for commercialization in the Chinese humanoid robot industry have increased, thanks to large-scale government support policies and the hosting of the largest-ever robot expo and Olympics." She added, "Since the industry is still in its early stages, long-term policy support, concentrated supply and demand, and improvements in fundamentals within the AI value chain mean that the medium- to long-term investment appeal remains strong."

SOL China Growth Industry Active ETF, the first China-focused active ETF in Korea, is also posting solid returns. Chun Kihun, Head of ETF Consulting at Shinhan Asset Management, said, "A key strength of active ETFs is their ability to quickly and flexibly adjust themes and strategies in response to rapidly changing global market conditions." He added, "By identifying policy directions and industry growth trends, we can continue to deliver differentiated performance going forward."

KB Asset Management will list the RISE China Tech Top 10 Weekly Target Covered Call ETF on September 2. This ETF is designed to diversify risk using a covered call strategy, considering the high uncertainty in the Chinese market due to regulations and policy changes. No Areum, Head of the ETF Business Division at KB Asset Management, analyzed, "Some Chinese tech companies possess technology that surpasses that of American tech firms. In the case of autonomous driving technology, the Chinese government shares all data, enabling development at an unimaginable level." She added, "Some investors completely avoid investing in China due to political risks, but it is important to continuously monitor the market and look for investment opportunities."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)