"Solar Power Is the Scam of the Century"

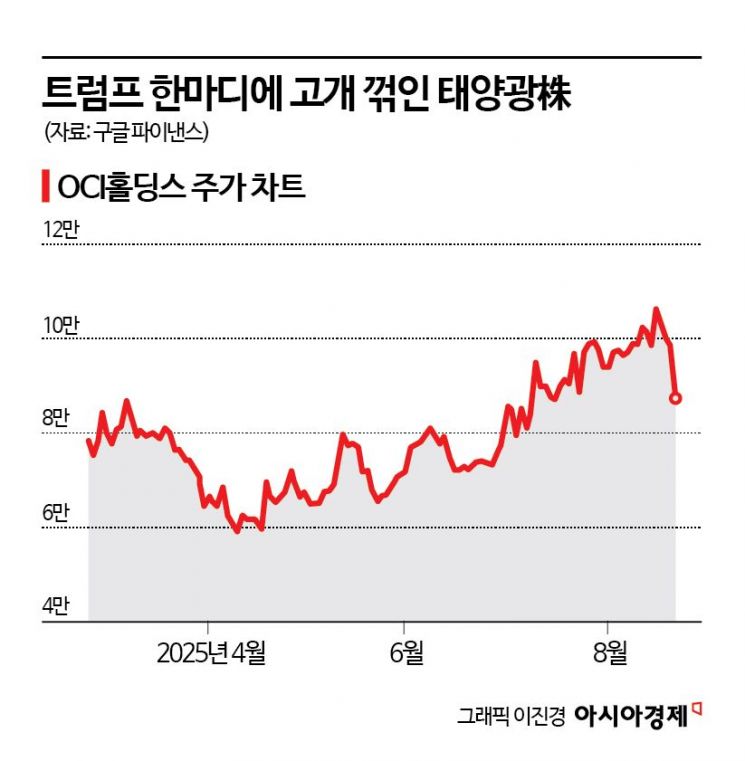

OCI Holdings Plunges After Hitting Record High

Korean solar energy stocks, which have been considered beneficiaries of the Donald Trump administration in the United States, are now facing a crisis. Tension is mounting in the industry, which has made aggressive local investments, as President Trump has dismissed solar power as a "scam."

According to the Korea Exchange on August 25, OCI Holdings closed at 87,200 won on August 22, plunging 11.29%. Just a few days earlier, on August 19, the stock had hit a 52-week high of 108,900 won, continuing its strong momentum before suffering a sudden blow overnight. Hanwha Solutions also fell by about 2% on the same day.

The incident was triggered by a single comment from President Trump. On August 20, he posted on his social media platform, Truth Social, stating, "We will not approve solar power, which destroys wind and farmers," and criticized wind and solar power generation as "the scam of the century." As a result, investor sentiment toward related stocks weakened. OCI Holdings, a producer of polysilicon for solar power, appeared to defend its share price until August 21, immediately after the remarks. However, on August 22, institutional investors dumped shares worth 17.7 billion won (ranking third in net selling), sending the stock price tumbling.

For Korean solar energy stocks, which had once been spotlighted in the securities market as the biggest beneficiaries of the U.S. tax cut bill, the "One Big Beautiful Bill Act (OBBBA)," the situation has become bewildering. This is because expectations for indirect benefits had been high as supply restrictions on "Prohibited Foreign Entities (PFE)" led to a clear trend of excluding Chinese materials from the eco-friendly energy supply chain.

In fact, Hanwha Solutions (Hanwha Qcells), which has entered the U.S. solar market, is investing 3.2 trillion won to build a solar production base called "Solar Hub" in Georgia. OCI Holdings recently sold a 100MW solar power project through its subsidiary OCI Energy and is accelerating the development of energy storage system (ESS) linked projects.

Kang Dongjin, a researcher at Hyundai Motor Securities, commented, "With the passage of OBBBA, companies will not be able to procure materials from countries classified as PFEs in order to receive investment tax credits. As a result, the proportion of non-PFE materials such as polysilicon in the cost of solar modules will gradually increase." He also predicted that OCI Holdings would achieve a 100% facility utilization rate next month. Lee Jin-ho, a researcher at Mirae Asset Securities, also raised his target price for OCI Holdings from 93,000 won to 128,000 won, stating that the company is expected to rebound after bottoming out in the second quarter.

Despite President Trump's remarks, some analysts remain optimistic about robust U.S. demand for solar installations. They point out that the "Safe Harbor" provision, which allows companies to receive investment tax credits (ITC) if they spend more than 5% of a solar project’s cost in a given year, will remain in place for four years, significantly easing mid- to long-term demand uncertainty. Kang noted, "For utility-scale solar, it appears that ITC can be received for projects completed through 2030. For residential solar, since the construction period is short, even the resolution of uncertainty is a positive factor."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.