South Korea Leads China in Process and Mass Production Technologies

But Is Overtaken in Fundamental and Design Technologies

Korea Eximbank: "Urgent Need to Enhance Semiconductor Technology"

It has been found that a significant portion of South Korea's core semiconductor technology is already lagging behind China. While South Korea leads in process and mass production technologies, it falls behind in fundamental and design technologies. Despite U.S. restrictions on China's semiconductor industry, China's semiconductor sector continues to develop rapidly, prompting urgent calls for South Korea to enhance its semiconductor technological capabilities.

According to the Korea Eximbank Overseas Economic Research Institute's report, "Challenges and Achievements of China's Semiconductor Industry," released on August 25, U.S. sanctions on China's semiconductor sector have paradoxically accelerated technological advancement in China. The United States has tightened restrictions on advanced semiconductor manufacturing equipment, EDA (Electronic Design Automation software), and high-performance computing and artificial intelligence (AI) semiconductors, identifying these as critical pressure points for China's semiconductor industry. In response, the Chinese government is seeking breakthroughs in semiconductor manufacturing equipment through cooperation between Chinese semiconductor and equipment companies, while easing some regulations on EDA and AI semiconductors by measures such as rare earth export controls.

The Chinese government is increasing the self-sufficiency rate in semiconductors by investing directly and indirectly in numerous semiconductor companies, effectively nationalizing them and aligning individual corporate goals with national strategic objectives. In particular, Huawei is emerging as a key hub, acting as both the technical advisor and control tower for China's domestic semiconductor ecosystem, supporting self-reliance across the entire semiconductor industry value chain.

Huawei has become a leading company in research and development (R&D) and technology development in China, hiring hundreds of engineers who previously worked at companies such as Taiwan's TSMC and expanding its technology development efforts. Additionally, Huawei currently operates at least 11 semiconductor fabs (fabrication plants) in China, either directly or indirectly, and is moving toward becoming an integrated device manufacturer (IDM) like Samsung Electronics.

In addition to Huawei, major semiconductor companies such as SMIC (Semiconductor Manufacturing International Corporation) and YMTC (Yangtze Memory Technologies) are also posing a threat to South Korea's semiconductor industry. SMIC, leveraging domestic demand and mature process technology, rose to become the world's third-largest foundry in 2024, following TSMC and Samsung Electronics. YMTC holds a 2.9% share of the global NAND flash market, ranking sixth, and is expanding its production capacity with technological capabilities at the level of global leading companies, supported by favorable policies.

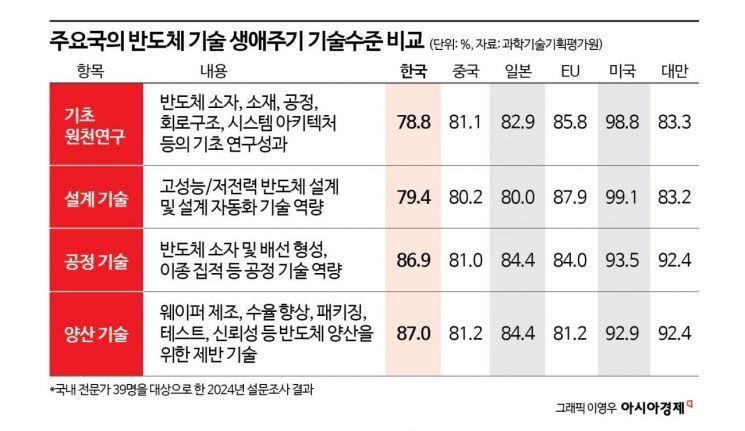

The rapid rise of Chinese semiconductor companies, backed by proactive government support, is considered a catalyst for China's dramatic improvement in semiconductor technology. The research institute assessed that while South Korea ranks third after the United States and Taiwan in process and mass production technologies, China has surpassed South Korea in fundamental research and design technologies. According to a survey by the Science and Technology Policy Institute of 39 domestic semiconductor technology experts, the United States ranked first in all areas: fundamental research, design, process, and mass production technologies. South Korea had the lowest levels among the countries surveyed, with fundamental research at 78.8% and design technology at 79.4%. China currently ranks lowest in process and mass production technologies among the countries compared, but with its vast domestic market, increased semiconductor sales are expected to improve yield and other metrics.

Im Mihae, senior researcher at the Korea Eximbank Overseas Economic Research Institute, emphasized, "As semiconductors are now recognized as a strategic industry, major countries are actively fostering their semiconductor sectors. Our companies must enhance their technological capabilities not only to counter China's pursuit but also to prepare for the restructuring of the semiconductor supply chain."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.