Lisa Cook Faces Fraud Allegations

Democratic-Leaning Board Member

Resignation Could Strengthen Trump's Grip on the Fed

Lisa Cook, a member of the U.S. Federal Reserve Board (Fed), is holding a work meeting at the Fed building located in Washington D.C. in September 2022. On the 20th (local time), U.S. President Donald Trump urged Cook, who is accused of mortgage fraud, to resign. Photo by AP Yonhap News

Lisa Cook, a member of the U.S. Federal Reserve Board (Fed), is holding a work meeting at the Fed building located in Washington D.C. in September 2022. On the 20th (local time), U.S. President Donald Trump urged Cook, who is accused of mortgage fraud, to resign. Photo by AP Yonhap News

On the 20th (local time), U.S. President Donald Trump urged Federal Reserve (Fed) Board member Lisa Cook, who is facing allegations of mortgage fraud, to resign. If Cook, who is known for her Democratic leanings, steps down, it is expected that President Trump’s influence over the Fed will increase and that monetary policy decisions, including policy rates, could be affected.

President Trump posted on his self-created social networking service, Truth Social, on the same day, calling on Cook, who is facing these allegations, to "resign immediately."

Earlier, Bloomberg reported that the Federal Housing Finance Agency (FHFA) determined that Cook had applied for loans to purchase real estate in Michigan and Georgia by submitting documents stating the properties were for primary residence, but found potential illegality in the process. In particular, the Georgia property was reportedly put up for rent in 2022, leading to the suspicion of fraud, and the case was referred to Attorney General Pam Bondi for investigation.

FHFA Director Bill Fult claimed in a letter to Attorney General Bondi that Cook "obtained a mortgage that did not meet certain loan requirements and may have received favorable loan terms under fraudulent circumstances." Regarding the rental advertisement for Cook's Georgia property, he pointed out that "it shows she intended to use it for investment or rental purposes, not as a primary residence." Fult has also been classified as a "pro-Trump figure" by outlets such as AFP.

Cook made it clear that she would not yield to President Trump’s demand for her resignation. In an email statement sent through a Fed spokesperson, she emphasized, "I have absolutely no intention of succumbing to threats to resign over questions raised in a tweet." She added, "As a member of the Fed, I will take any questions about my financial history seriously," and "I will collect accurate information and provide facts in response to legitimate inquiries."

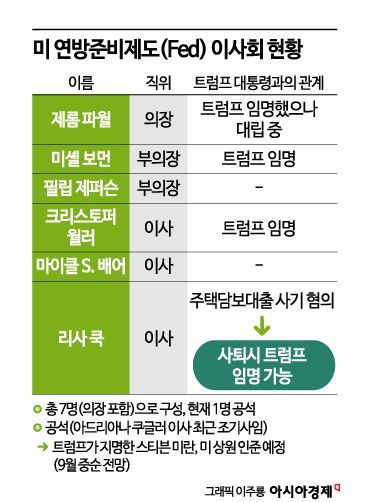

The Fed Board, which is composed of a total of seven members including Chair Jerome Powell, is currently operating with six members. Recently, the seat became vacant when Adriana Kugler, known for her hawkish (tightening) stance, resigned early without providing a reason. Among the current members, two are considered pro-Trump: Vice Chair Michelle Bowman and Board member Christopher Waller. Both advocated for rate cuts and reportedly voted against the decision to hold rates steady at last month’s Federal Open Market Committee (FOMC) meeting. Steven Miran, a close aide to President Trump and White House economic adviser, has been nominated as Kugler’s successor and is currently awaiting Senate confirmation. According to political media outlet Politico, Miran is in behind-the-scenes discussions with senators on the banking committee ahead of the confirmation vote.

Amid these developments, there is growing speculation that if Cook, who is known for her Democratic orientation, resigns, President Trump’s control over the Fed will further increase. Cook previously served as a member of the Council of Economic Advisers under former President Barack Obama and was appointed to the Fed Board by former President Joe Biden. She is the first Black woman to serve as a Fed Board member, and her term runs until 2038. Cook is an ex officio participant in the FOMC, which determines the U.S. benchmark interest rate. For this reason, the FHFA’s investigation into Cook and President Trump’s calls for her resignation are being interpreted as pressure targeting the Fed itself, rather than just a personal issue for Cook.

Since the launch of his second administration in January this year, President Trump has consistently clashed with Fed Chair Jerome Powell. Ahead of the Jackson Hole meeting starting on the 21st and the September FOMC meeting, he has been ramping up pressure by calling for a "big cut" (a 0.5 percentage point rate reduction). On the 19th, he publicly criticized Powell, saying, "Will someone please tell 'Too Late' Jerome Powell that he is severely damaging the housing market," and "because of him, people are unable to get mortgages."

Meanwhile, U.S. Treasury Secretary Scott Besant is reportedly searching for a successor to Chair Powell, whose term ends in May next year. Interviews with 11 candidates are scheduled for next month. According to a survey of experts conducted by financial media outlet CNBC ahead of the Jackson Hole meeting, White House economic adviser Kevin Hassett is considered the most likely candidate for the next chair. On the 5th, President Trump also expressed interest, saying he was considering "two people named 'Kevin' and two others" as potential candidates for the chairmanship.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.