Fine-Tuning NCCs Proves Challenging, with Diverse Concrete Plans Emerging

Hybrid Solutions Expected as Discussions Shift to Industrial Complexes

Government Aims to Finalize Restructuring Plan by Year-End

With the government and the petrochemical industry officially agreeing to a "25% reduction in ethylene," a variety of domestic naphtha cracking center (NCC) restructuring scenarios are now coming to the forefront. The key issue is not simply reducing facility capacity, but rather determining which industrial complexes will retain facilities and which companies will bear the burden of reduction. This decision is seen as both a signal for restructuring and a turning point for structural improvement in the domestic NCC industry, which has been operating at a utilization rate in the 70% range amid oversupply.

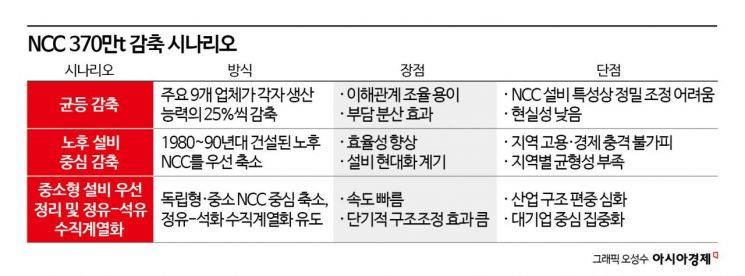

According to the petrochemical industry on August 21, the restructuring options under consideration include: △ proportional reduction, △ adjustment centered on outdated facilities, and △ prioritizing the shutdown of small-scale facilities. The "proportional reduction" method, in which each of the nine major companies reduces its production capacity by 25%, is being discussed as a primary option. While this approach makes it easier to coordinate interests, it is considered less realistic due to the nature of NCCs, which makes fine-tuned adjustment of production facilities difficult.

There is also a high likelihood of reducing outdated facilities built in the Yeosu region during the 1980s and 1990s. While shutting down outdated facilities would improve efficiency, it is expected to have a negative impact on local employment and the regional economy. Another option is to prioritize the closure of smaller NCCs, such as Daehan Yuhwa and SK Geocentric. Although this approach could proceed rapidly, there are concerns that it may lead to excessive concentration within the industry structure. The industry expects that, ultimately, a hybrid solution combining these approaches will be proposed.

Future restructuring discussions are likely to be conducted by industrial complex rather than by individual company. The reason lies in the "direct delivery network" issue. Most of the ethylene produced by NCCs is delivered in liquefied form directly to downstream plants within the same industrial complex. The transportation process incurs significant cooling, compression, and storage costs, and long-distance transport involves losses and risks. Therefore, the argument that at least one NCC must remain in each major industrial complex-such as Yeosu, Daesan, and Ulsan-is gaining traction. As a result, the industry is even discussing specific scenarios such as "leave only one NCC in Ulsan" or "improve efficiency in Daesan through refinery-chemical integration."

Each industrial complex faces a different situation. Yeosu, for instance, is considered the largest domestic production base, with an annual production capacity of 6.42 million tons. Major conglomerates such as LG Chem, Lotte Chemical, Yeocheon NCC, and GS Caltex are concentrated there, creating significant agglomeration effects, but at the same time, Yeosu faces the greatest pressure to reduce capacity. Daesan is characterized by integrated refinery and petrochemical operations. Hanwha TotalEnergies, LG Chem, and HD Hyundai Chemical have value chains that connect crude oil refining to naphtha cracking, offering high potential for efficiency improvements through a "refinery-petrochemical convergence model." Ulsan and Onsan are relatively smaller in scale, and many companies there-such as Daehan Yuhwa and SK Geocentric-operate independently or have PDH-based business models, making them the focus of integration discussions.

The government plans to finalize a concrete business restructuring plan by the end of the year and announce a comprehensive restructuring plan in the second half. However, industry insiders remain cautious, saying, "Actual discussions on consolidation are only just beginning." The industry anticipates fierce competition and negotiation until the end of the year, given the complex web of interests among companies and industrial complexes.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)