Bank of Korea’s “Household Credit (Provisional) for Q2 2025”

Outstanding Balance Hits Record 1,952.8 Trillion Won in Q2

Rise in Home Transactions in February and March Drives 14.9 Trillion Won Increase in Mortgages

Leveraged Investments via Secur

Household credit (debt) in South Korea surged by nearly 25 trillion won in just three months, once again reaching an all-time high. This was driven by a significant increase in mortgage loans and a rise in leveraged stock investments amid a stock market rebound. Although the government’s stringent regulations have slowed the pace of mortgage loan growth in the second half of the year and housing prices in the Seoul metropolitan area are stabilizing, experts note that it remains to be seen whether this will lead to a sustained trend of stability.

Minsu Kim, Head of the Financial Statistics Team at the Economic Statistics Division 1 of the Bank of Korea, is explaining the main features of household credit (provisional) for the second quarter of 2025 on the morning of the 19th at the Bank of Korea in Jung-gu, Seoul. Photo by the Bank of Korea

Minsu Kim, Head of the Financial Statistics Team at the Economic Statistics Division 1 of the Bank of Korea, is explaining the main features of household credit (provisional) for the second quarter of 2025 on the morning of the 19th at the Bank of Korea in Jung-gu, Seoul. Photo by the Bank of Korea

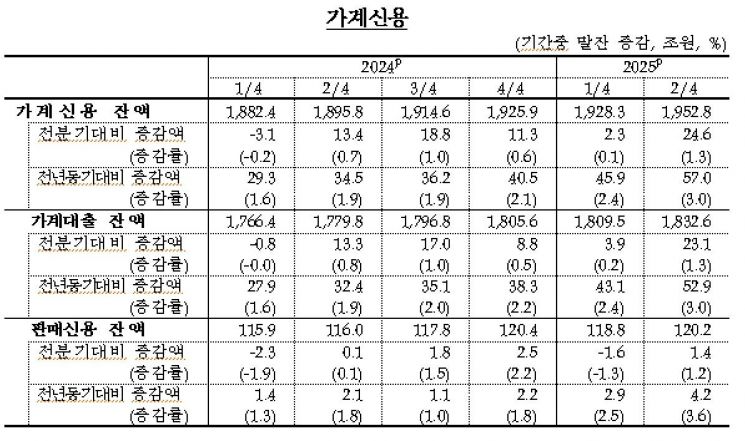

According to the “Provisional Household Credit for Q2 2025” released by the Bank of Korea on the 19th, the outstanding balance of household credit at the end of the second quarter stood at 1,952.8 trillion won. This represents an increase of 24.6 trillion won from the previous quarter, marking the largest quarterly rise since the relevant statistics began being published. The scale of this increase is the largest in three years and nine months, since the third quarter of 2021 (35 trillion won).

Household credit refers to comprehensive household debt, which includes loans taken out by households from banks, insurance companies, private lenders, and public financial institutions, as well as credit card spending (sales credit) prior to settlement.

Household credit in South Korea decreased by 3.1 trillion won quarter-on-quarter in the first quarter of last year, but then switched to an increase of 13.4 trillion won in the second quarter, and has now risen for five consecutive quarters. Notably, the Q2 2025 increase of 24.6 trillion won is the largest since the turnaround, surpassing the increases in Q3 2024 (18.8 trillion won), Q4 2024 (11.3 trillion won), and Q1 2025 (2.3 trillion won).

Excluding card payments (sales credit), the outstanding balance of household loans was 1,832.6 trillion won, up by 23.1 trillion won from the previous quarter. This is a much larger increase compared to the 3.9 trillion won rise in the first quarter.

Among household loans, the outstanding balance of mortgage loans was 1,148.2 trillion won, up by 14.9 trillion won from the previous quarter, leading the overall increase in household credit. Other loans, such as unsecured loans, increased by 8.2 trillion won during the same period, reaching 684.4 trillion won. Minsu Kim, Head of the Financial Statistics Team at the Economic Statistics Division 1 of the Bank of Korea, explained, “The increase in housing transactions since February has, with a time lag, affected mortgage loans. In addition, the seasonal factors in the first quarter, such as repayment of unsecured loans using bonuses, have dissipated, leading to a rebound in unsecured loans. The stock market rebound has also resulted in an increase in credit provided by securities firms.”

By lending institution, the outstanding balance of household loans at deposit banks was 993.7 trillion won, up by 19.3 trillion won from the previous quarter. This is a larger increase than the 8.4 trillion won seen in the first quarter, mainly due to a 16 trillion won rise in mortgage loans. The outstanding balance of household loans at non-bank deposit-taking institutions, such as mutual finance companies, mutual savings banks, and credit unions, was 314.2 trillion won, up by 3 trillion won from the previous quarter. The Bank of Korea explained that while the increase in mortgage loans (3.6 trillion won) continued, the growth of policy finance products for low-income households, such as Sunshine Loans, helped reduce the decline in other loans.

The outstanding balance of household loans at other financial institutions, such as insurance companies, securities firms, and asset securitization companies, was 524.7 trillion won, up by 900 billion won. Although mortgage loans continued to decline due to net repayments of mortgages funded by the Housing and Urban Fund and the securitized portion of Bogeumjari Loans by the Korea Housing Finance Corporation, the increase in credit provided by securities firms, driven by the stock market rebound, led to a larger increase in other loans.

In the first quarter of this year, the outstanding balance of sales credit (card payments) within household credit was 120.2 trillion won, up by 1.4 trillion won from the previous quarter as credit card usage expanded.

To accurately capture the scale of policy loans, the “Policy Loans of the Korea Housing Finance Corporation and Housing and Urban Fund”-which was revised to include all housing-related policy loans for individuals-stood at 331.1831 trillion won as of the end of the second quarter, accounting for 28.8% of all mortgage loans.

The Bank of Korea explained that while the increase in household credit is expected to slow in the second half of the year compared to the second quarter, it remains to be seen whether the trend toward stabilization of household debt will continue. Team leader Kim stated, “Considering that the increase in household loans in July was smaller than in June, it appears that the government’s household loan measures and the implementation of the third-stage stress DSR (Debt Service Ratio) from July are having an effect. However, since housing transactions remained high through June, the growth rate may remain elevated for some time, and while the upward trend in housing prices in the Seoul metropolitan area is stabilizing, it is too soon to say whether this will lead to a sustained trend.”

The Bank of Korea is focusing its policy objective on controlling the pace of household debt growth, rather than reducing its absolute size, taking into account the impact on the real economy. In terms of household debt growth, household credit increased by 1.3% in the second quarter. However, since the increase in the first quarter was only 0.1%, the growth rate for the first half of the year was 1.4%. Team leader Kim noted, “On a first-half basis, the ratio of household debt to nominal GDP is likely to show only a slight increase compared to the end of last year. Whether the trend toward stabilization of household debt continues in the second half, how much it decreases, and whether the nominal GDP growth rate rebounds will all determine whether the annual household debt ratio continues to stabilize.”

He added, “The Bank of Korea is closely monitoring household debt trends together with financial authorities. While we are maintaining an accommodative monetary policy in response to economic conditions, we are aware that this could affect financial stability, including household debt and the housing market. Therefore, the government’s policy responses and the Bank of Korea’s interest rate policy will be coordinated to simultaneously pursue economic growth, price stability, and financial stability.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.