Combined Operating Profit Falls to KRW 190.3 Billion, Down 38%

Construction Slump Hits Domestic Demand Hard

Shipments Reach 18.88 Million Tons in First Half

Stricter Environmental Regulations Add to Facility Investment Burden

"Downturn Likely

The domestic cement industry continued to post dismal results in the second quarter. The sector has been facing a triple whammy of a construction market slump, raw material price volatility, and strengthened environmental regulations, all of which have contributed to its worsening performance. Experts predict that the market may see a slight uptick in activity in the second half of the year as large-scale construction projects begin in the Seoul metropolitan area, but they also expect the impact to be limited.

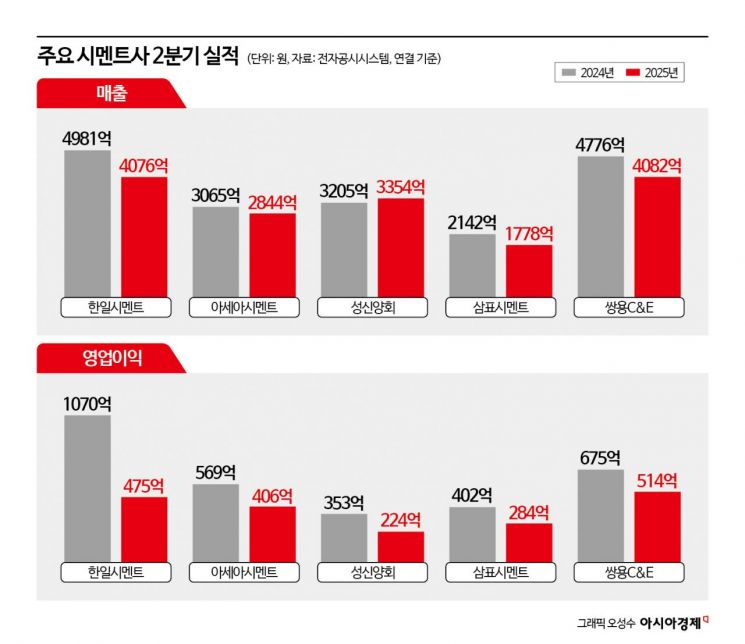

According to industry sources on August 19, the combined operating profit (consolidated basis) of the six major cement companies-Halla Cement, Hanil Cement, Asia Cement, Sampyo Cement, Sungshin Cement, and Ssangyong C&E-stood at 190.3 billion won in the second quarter, down about 38% from 306.9 billion won a year earlier. While the decline has narrowed compared to the first quarter, when combined operating profit plummeted 96.2% year-on-year, performance remains weak. Hanil Cement saw the steepest drop, with operating profit falling 55.6% to 47.5 billion won from 107 billion won a year earlier. Sungshin Cement (-36.5%), Sampyo Cement (-29.4%), Asia Cement (including Halla Cement, -29.6%), and Ssangyong C&E (-23.9%) also posted declines of over 20% each.

The domestic cement industry has been hit hard by the construction market downturn, which began in earnest in the second half of last year, and the resulting drop in demand. According to the Korea Cement Association, domestic shipments by major member companies totaled 18.88 million tons in the first half of this year (January to June), down 17.4% from the previous year. This is the lowest figure since records began in 1992. While exports (cement and clinker) increased 82.6% to 2.1 million tons during the same period, partially offsetting the decline, the slump in domestic demand was too great to reverse the overall downward trend. An industry official said, "We have entered an emergency management mode, cutting back on production and facility investment to weather the storm. We are seeking breakthroughs through new product development and business diversification, but the situation remains challenging."

To make matters worse, strengthened government environmental regulations are rapidly depleting industry resources. In September last year, the Ministry of Environment announced a legislative notice of the revised Air Quality Control Zone Act Enforcement Rules, which require cement companies in North Chungcheong Province to gradually reduce nitrogen oxide emissions from 135 ppm in 2025 to 115 ppm by 2029. The rules have been fully enforced since this year. As a result, cement companies must invest billions of won to install Selective Catalytic Reduction (SCR) equipment to reduce nitrogen oxides generated during the manufacturing process. Over the past five years, the major cement companies have spent an average of 430.2 billion won annually on facility investments to comply with environmental regulations-an amount nearly equal to their average annual net profit for the same period.

Experts believe that the situation may improve somewhat as large-scale construction projects gradually break ground in the second half of the year, but they also expect it will not be enough to reverse the overall trend. Song Changyoung, a professor of architecture at Gwangju University, said, "The construction projects are limited to certain areas in the Seoul metropolitan region, and the population cliff in regional areas is severe, so the impact will be limited. While the construction market may recover somewhat and create ripple effects in related industries, it is impossible to return to the boom years of three or four years ago." An industry official emphasized, "Given the extremely difficult situation caused by the construction market slump, government support for facility investment costs related to environmental regulations needs to be significantly strengthened."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)