Gudai Global Set to Enter Cosmetics Industry's Top 3 This Year

Aggressive M&A Continues Following Last Year

Expected Sales to Reach 1.7 Trillion Won, Surpassing Aekyung and APR

Gudai Global, which operates the cosmetics brands Beauty of Joseon and TirTir that have made a splash in the U.S. market, is expected to rise to third place in domestic cosmetics sales rankings this year. In recent years, APR has experienced rapid growth and overtook Aekyung Industrial last year to enter the "Big 3." Now, Gudai Global, which has embarked on aggressive mergers and acquisitions (M&A), is set to scale up its annual sales to nearly 2 trillion won, signaling another major shift in the domestic cosmetics market.

According to the cosmetics industry on August 19, Gudai Global is projected to achieve consolidated sales of 1.7 trillion won this year. Last year, Gudai Global's sales amounted to only 330.9 billion won. However, when adding the sales of TirTir (approximately 280 billion won) and Craver Corporation (approximately 320 billion won), which were acquired last year, the total sales reached 980 billion won. With the completion of this year's acquisitions of Seorin Company (600 billion won) and Skinfood (150 billion won), sales are expected to nearly quintuple within a year.

Founded in 2016, Gudai Global has expanded rapidly since acquiring Beauty of Joseon in 2019, earning the nickname "the L'Oreal of Korea." In January 2022, it acquired House of Her and went on to acquire Laka Cosmetics, TirTir, and Craver Corporation last year. This year, the company is pursuing the acquisition of Seorin Company, known for its "Dokdo Toner," and Skinfood.

Last year, the combined sales of Gudai Global's brands reached about 940 billion won, with Beauty of Joseon accounting for 320 billion won, Skin1004 for 280 billion won, and TirTir for around 270 billion won. Once the acquisitions of Seorin Company (600 billion won) and Skinfood (150 billion won) are finalized this year, the total sales are expected to rise to 1.7 trillion won.

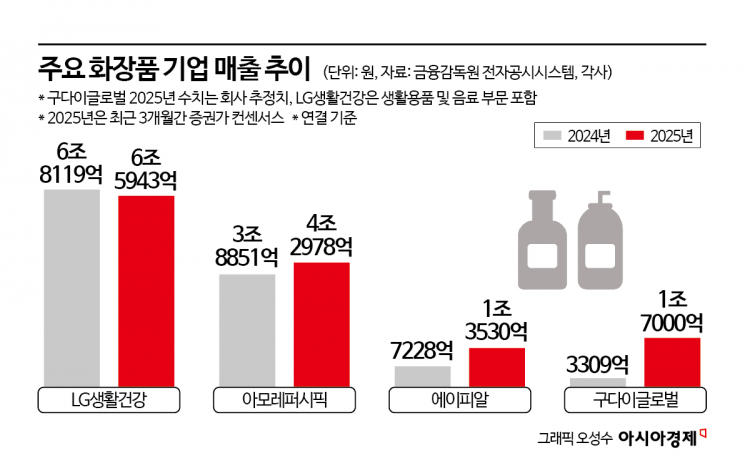

As a result, Gudai Global is expected to surpass APR this year and solidify its position as one of the "Big 3" in the cosmetics industry. This year, LG Household & Health Care is expected to record sales of 6.5943 trillion won (including household goods and beverages), Amorepacific 4.2978 trillion won, APR 1.353 trillion won, and Aekyung Industrial 661.7 billion won.

Until now, the domestic cosmetics industry has maintained a "Big 3" structure consisting of Amorepacific, LG Household & Health Care, and Aekyung Industrial. However, the rapid growth of smaller brands is reshaping the market landscape. While major cosmetics companies have complex decision-making structures for launching new products, emerging beauty brands have the advantage of making quick decisions in response to changing trends, fueling their rapid growth.

In particular, Gudai Global is rapidly expanding by aggressively acquiring K-beauty brands that have gained popularity overseas. Its main brand, Beauty of Joseon, has recorded an average annual growth rate of 130% from 2022 to 2025, while Craver Corporation (Skin1004) has achieved 110%, and TirTir has reached 50%.

Industry insiders estimate Gudai Global's corporate value at around 10 trillion won. This month, Gudai Global successfully raised large-scale investment by issuing 800 billion won in convertible bonds (CB). Investors include a variety of domestic private equity fund (PEF) managers such as IMM Private Equity, IMM Investment, and JKL Partners.

Gudai Global plans to pursue an initial public offering (IPO) within the next three years following this investment. If Gudai Global goes public, it is expected to set a record for the highest valuation in the cosmetics industry. APR, which was listed on the Korea Exchange last year, recently surpassed a market capitalization of 8 trillion won, overtaking Amorepacific (7.1712 trillion won) and LG Household & Health Care (4.7713 trillion won) to become the leading cosmetics stock, but the rankings are likely to change.

Meanwhile, Gudai Global plans to relocate its headquarters to Gangnam-gu, Seoul early next year. Since the brands it acquired last year are currently scattered across the country, the company aims to bring them together at the Gangnam office to enhance brand synergy and strengthen global competitiveness.

The company is also in the process of restructuring underperforming brands. On the 21st, it initiated a deal to sell the "Laka" brand for 53 billion won. This comes about a year after acquiring approximately 88% of Laka's shares for 42.5 billion won in June last year. Laka's average annual growth rate (2022-2025) was reportedly lower than that of Beauty of Joseon (130%), Skin1004 (110%), and TirTir (50%). A Gudai Global representative stated, "After an internal review, we concluded that Laka did not meet our initial expectations," adding, "Following the sale, Laka will operate independently as a separate company from Gudai Global."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)