Fendi Exits Galleria Gwanggyo Store

Number of Fendi Stores in Korea Reduced to 21

Growth Slows for Luxury Bag and Fashion Brands

Shift Toward Practical Watches and Jewelry

The waves of economic recession are now reaching the luxury goods market. Luxury handbags, which sold explosively in the wake of the COVID-19 pandemic due to revenge spending, have recently lost popularity in the domestic market for most brands except for the high-end houses 'Hermes' and 'Chanel.' As luxury consumers shift from rapidly changing fashion trends to accessories such as jewelry and watches that can be worn for a long time, some luxury fashion brands have been unable to withstand worsening profitability and have begun closing underperforming stores.

According to the retail industry on August 19, Fendi at Galleria Gwanggyo closed its operations on August 17. A representative from Galleria Department Store explained, "The contract was terminated by mutual agreement," and added, "Moncler is expected to take over the existing Fendi store location." As a result, the number of Fendi stores operating in Korea has decreased from 22 to 21.

Fendi is an Italian luxury brand, with celebrities such as Song Hye-kyo serving as ambassadors. Its main products are women's handbags from the 'Peekaboo' and 'Baguette' lines. The FF monogram created by Karl Lagerfeld is the brand's symbol, and T-shirts, scarves, and shoes featuring this logo are also steady sellers for Fendi.

Fendi's Sales Decline and Profitability Worsens

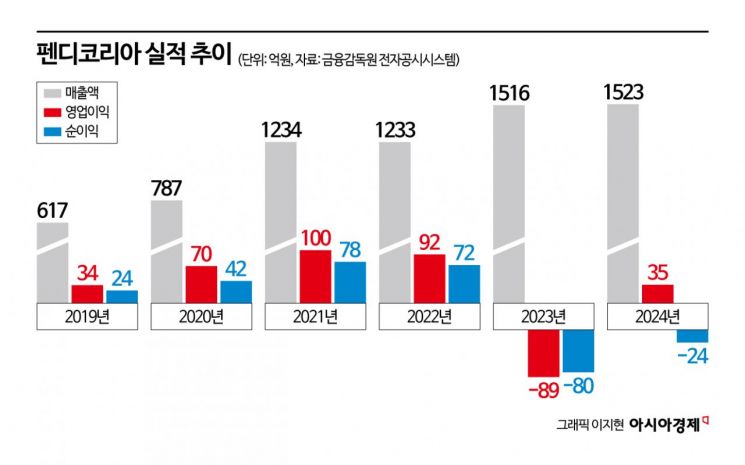

The background behind Fendi's store closures is the global decrease in consumption of luxury bags, shoes, and apparel. As the prolonged economic downturn has dampened demand for luxury fashion items such as handbags, Fendi's sales have been declining since last year. In 2024, Fendi's sales amounted to 118.8 billion KRW, a decrease of 22% (33.5 billion KRW) compared to the previous year's 152.3 billion KRW. After surpassing 100 billion KRW in sales in 2021 thanks to rapid post-pandemic growth, Fendi's growth slowed in 2023, and last year the company recorded negative growth.

There is also analysis that worsening profitability contributed to the situation. Fendi has been operating at a loss since 2023. Although Fendi recorded its highest-ever sales in 2023, both operating profit and net profit were in the red. In 2023, operating profit declined due to increased depreciation expenses (for leased facilities), salaries, entertainment expenses, and warehouse costs, as a result of store interior investments. Additionally, interest expenses from borrowing about 30 billion KRW from Citibank Korea in the same year further worsened profitability. Although operating profit turned positive last year, interest expenses rose from 800 million KRW to 1.4 billion KRW, so net profit remained in the red.

An official in the luxury industry commented, "Although the brand performed well after COVID-19, it does not have as strong a fan base as some other luxury brands," and added, "Demand is now concentrated only on expensive products and lines with high scarcity, such as luxury jewelry and watches, or brands like Hermes and Chanel."

Department Store Luxury Fashion Sales Decline

In fact, even popular luxury brands focused on fashion items such as handbags have seen their sales turn downward. Over the past several years, as high inflation persisted, the luxury industry repeatedly raised prices, but sales volumes dropped significantly, leading to a decline in revenue.

For example, British luxury brand Burberry (Burberry Korea) recorded sales of 279.6 billion KRW last year, a decrease of about 15% compared to 329.5 billion KRW the previous year. French luxury brand Celine (Celine Korea) also saw its sales drop by about 2% year-on-year to 303.3 billion KRW from 307.2 billion KRW. Italian luxury brand Tod's (Tod's Korea) recorded sales of 46.4 billion KRW last year, an 11% decrease from the previous year's 52.2 billion KRW.

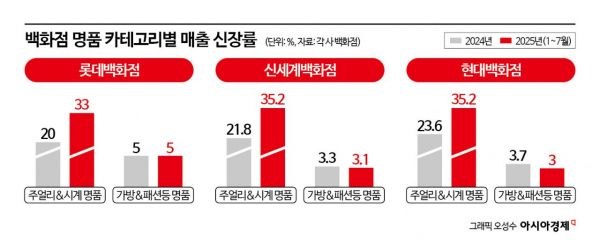

These brands are expected to see sluggish growth again this year. According to the department store industry, demand has shifted from luxury fashion to luxury jewelry and watches since the beginning of this year.

At Lotte Department Store, the growth rate of luxury fashion sales from January to July this year was only 5%. In contrast, sales growth for jewelry and watches reached 33%. This means more consumers are purchasing necklaces, earrings, watches, and bracelets rather than bags, clothing, or shoes. During the same period, Shinsegae Department Store saw a 3.1% growth rate for luxury fashion brands, while luxury jewelry and watch brands recorded a 35.2% growth rate. Similarly, Hyundai Department Store reported a 3% growth rate for luxury fashion brands during this period, compared to 35.2% for jewelry and watches.

An official in the luxury jewelry industry explained, "In the case of bags and fashion, products wear out quickly and are difficult to wear every day, but jewelry and watches are different," adding, "Luxury consumers with reduced purchasing power are quickly moving to jewelry and watch brands, as these items can be worn consistently for a long time, even at the same price point."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.