US and Overseas Sales Account for 57% in H1, Surpassing Domestic Revenue

Shares Hit 52-Week High as Pension Funds Increase Buying

As the domestic construction industry continues to face a prolonged downturn, HanmiGlobal, a leading global project management (PM) company, nearly doubled its net profit in the second quarter of this year, driven by strong performance in the United States and Saudi Arabia. PM refers to comprehensive consulting services that oversee every stage of a construction project on behalf of the client, from planning to completion.

According to the Financial Supervisory Service's electronic disclosure system on August 17, HanmiGlobal's consolidated sales for the first half of this year reached 231 billion KRW, a 13% increase compared to the same period last year. Operating profit rose by 4% to 17.2 billion KRW, and net profit for the period increased by 29% to 13.4 billion KRW.

U.S. and Saudi Performance Drive Growth... Q2 Net Profit Doubles

In the second quarter alone, net profit stood at 6.7 billion KRW, nearly double the 3.4 billion KRW recorded in the same period last year. The strong contributions from the U.S. and Saudi Arabian businesses were key factors. HanmiGlobal's U.S. subsidiary Otak posted a second-quarter net profit of 1.3 billion KRW, up 62.5% year-on-year, while the Saudi subsidiary's net profit rose 58.3% to 1.9 billion KRW.

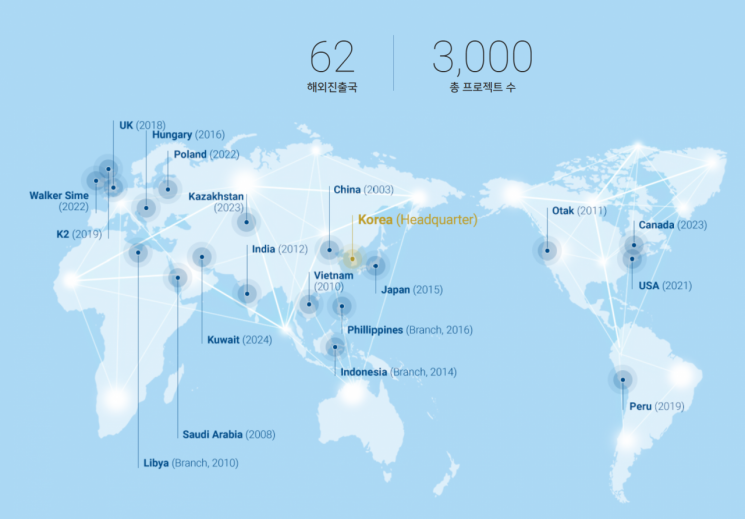

Overseas sales in the first half totaled 131.4 billion KRW, accounting for 57% of total sales. HanmiGlobal operates subsidiaries in 12 countries, including the United States, Canada, the United Kingdom, Saudi Arabia, Hungary, China, Vietnam, India, Japan, Kazakhstan, Poland, and Kuwait. For the first time last year, overseas sales (244.1 billion KRW) exceeded domestic sales (180.7 billion KRW).

The United States is HanmiGlobal's largest overseas market. U.S. sales in the first half of this year reached 61.4 billion KRW, making up about half of the company's overseas sales and more than a quarter of total sales. A HanmiGlobal representative explained, "Revenue from large-scale projects won in the U.S. and other countries was fully reflected in this half."

HanmiGlobal made its full-fledged entry into the U.S. market in 2011 by acquiring Otak. Otak is a comprehensive U.S. engineering firm, and in 2017, HanmiGlobal further strengthened its U.S. infrastructure project competitiveness by acquiring Day CPM, a public building PM specialist, and Loris, a civil and structural engineering company.

Managing 12 U.S. Projects Including Samsung and LG... Overseas Expert Kim Yongshik Leads Operations

Currently, HanmiGlobal is managing 12 industrial and high-tech projects across the U.S., commissioned by major Korean companies. Notable among these is Samsung Electronics' semiconductor foundry plant in Taylor, Texas, with a total investment of $17 billion (about 23.6 trillion KRW). In Tennessee, HanmiGlobal is overseeing the construction of LG Chem's cathode material plant, a key hub in the North American electric vehicle battery supply chain, where it is also acting as the PM contractor.

Other projects include a cosmetics manufacturing facility in Pennsylvania, a battery recycling plant in Indiana, a secondary battery production facility in Michigan, and a cable manufacturing facility in Virginia. HanmiGlobal has already completed seven projects, including an automotive sales hub, theater interior, and port terminal in California, as well as a luxury condominium in Hawaii.

Otak is expanding its presence from its headquarters in Portland, Oregon, to cities such as Seattle, Everett, Salem, Bend, Louisville, and Denver in the western and central regions. Last year, Otak recorded sales of $76.6 million (about 10.65 billion KRW) and operating profit of $4.7 million (about 650 million KRW), representing increases of 25.9% and 106.1%, respectively, over five years.

Jonghun Kim, Chairman of HanmiGlobal, has positioned the U.S. as a core growth axis for the company and has consistently pursued expansion in the North American market. Following the establishment of a U.S. corporation in January 2022, HanmiGlobal appointed Kim Yongshik, a former executive vice president of Hyundai Engineering & Construction with 40 years of experience in overseas operations and project sites, as president overseeing North American business in August 2023. President Kim now manages all of HanmiGlobal's operations and joined the board of directors as an inside director following the shareholders' meeting in March this year.

Full-Scale Entry into Overseas Nuclear Power Projects

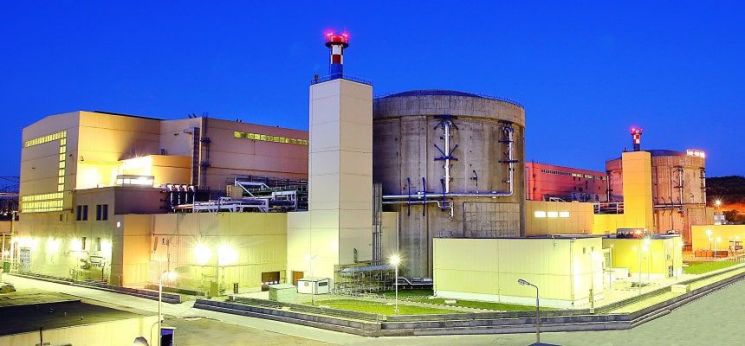

HanmiGlobal is also accelerating its entry into the global nuclear power sector. With President Donald Trump announcing plans to quadruple U.S. nuclear power capacity by 2050, the market is expected to expand. Recently, HanmiGlobal secured its first overseas nuclear power project by winning a PM contract for facility upgrades at the Cernavoda Nuclear Power Plant in Romania.

In 2022, HanmiGlobal acquired Walker Sime, a UK-based PM specialist with experience in nuclear power construction, and last year established a dedicated nuclear power department to prepare for related business. Last month, HanmiGlobal signed a memorandum of understanding (MOU) for cooperation in nuclear power projects with Korea Power Engineering Company, a Korean nuclear power design institution, aiming to strengthen its capabilities in project management, including nuclear power plant design.

In Saudi Arabia, HanmiGlobal is expanding another pillar of its overseas business by securing projects related to NEOM City. The Saudi subsidiary's net profit for the first half of this year rose 68% year-on-year to 3.7 billion KRW, compared to 2.2 billion KRW in the same period last year. In June, HanmiGlobal won a PM contract for the development of a premium high-rise residential complex in Mecca. The contract is worth about 25 billion KRW, which is equivalent to about 10% of HanmiGlobal's total overseas sales last year.

In July last year, HanmiGlobal became the first Korean company to establish a Middle East Regional Headquarters (RHQ) in Saudi Arabia, securing a competitive edge in local bidding. Since last year, the RHQ has been a mandatory requirement for bidding on Saudi government projects, and only a few Korean companies, including Samsung C&T, Hyundai Engineering & Construction, and Doosan Enerbility, possess this license.

Securities Firms Highlight 'Global Growth Potential'... Pension Funds Also Buying

The market is focusing on HanmiGlobal's expanding overseas performance, particularly in the U.S. and U.K., as well as its entry into nuclear power PM, as key investment points. The U.K. subsidiary's sales for the first half of this year reached 31.9 billion KRW, a 28.6% increase from 24.8 billion KRW in the same period last year.

The stock price is also on the rise. HanmiGlobal's share price has climbed 22.5% so far this year, reaching a 52-week high of 23,750 KRW on June 20. According to SK Securities, pension funds ranked HanmiGlobal seventh in net purchases among listed companies on July 14, and second on July 13.

Korea Investment & Securities stated, "Due to sluggish domestic construction investment, a recovery in domestic orders is expected to be limited," and analyzed, "HanmiGlobal will focus on expanding overseas orders based on its global business competitiveness, enabling continued sales growth."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.