Concerns Over Jeonse Supply Shortage

Acceleration of Shift to Monthly Rent

Sharp Rise in Delinquency Rates Amid Slower Loan Growth

As stricter lending regulations prompt prospective homebuyers to delay purchases and turn to the rental market, the lease market is rapidly shifting toward monthly rent contracts. The acceleration of the shift from lump-sum deposit leases (jeonse) to semi-jeonse and monthly rent has been further fueled by the reduction of the jeonse loan guarantee limit. Meanwhile, although the growth in home mortgage loans has slowed, the delinquency rate has reached its highest level since 2015, raising concerns about financial soundness.

According to the August edition of the 'KB Housing Market Review' published by the KB Financial Group Management Research Institute on August 15, nationwide housing sale prices in July rose by 0.16% compared to the previous month. In Seoul, prices increased by 0.80%, but the rate of increase slowed from the previous month (0.93%).

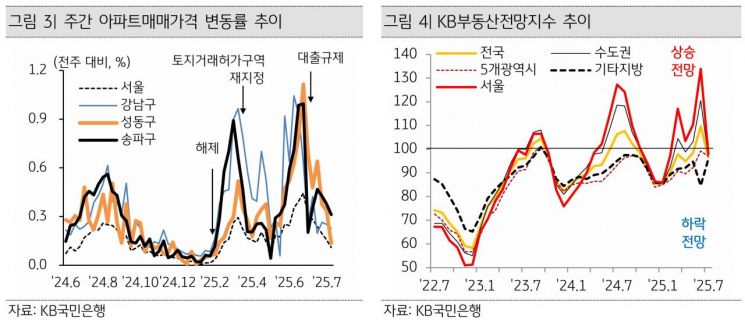

After lending regulations were announced on June 27, which included a 600 million won loan limit and a mandatory move-in requirement after taking out a loan, the upward trend in home prices in the three Gangnam districts-where high-priced apartments are concentrated-slowed sharply. In Gangnam District, the price increase dropped to 1.51%, less than half of the previous month's 3.64%. The KB Real Estate Outlook Index for the Seoul metropolitan area also turned downward for the first time in five months.

In June, the nationwide number of housing transactions reached approximately 73,000, the highest in 44 months. In Seoul, transactions increased by 45.1% compared to the previous month, and in Gyeonggi Province by 31.2%, with the Seoul metropolitan area leading the growth. However, the report noted that a decline in transactions is inevitable following the implementation of new regulations. In fact, according to the Seoul Real Estate Information Plaza, as of August 10, the number of reported apartment transactions in Seoul for July stood at 3,649, a 69.5% decrease from June’s 11,980 transactions.

Concerns Over Jeonse Supply Shortage... Acceleration of Monthly Rent Shift

The jeonse market remained unstable as increased demand coincided with a decrease in new housing supply. Jeonse prices in the Seoul metropolitan area rose by 0.15%, marking 24 consecutive months of increases. The number of new units scheduled for occupancy over the next three months is 23,000, only about 56% of the figure from the same period last year, raising significant concerns about supply shortages. The report analyzed that, "As stricter lending criteria make it harder to buy, more people are choosing jeonse, which may push prices even higher."

However, as the jeonse loan guarantee limit in the Seoul metropolitan area was reduced to 80%, the trend toward monthly rent has become more pronounced. In June, monthly rent accounted for 63.3% of all nationwide lease transactions, the highest since statistics began in June 2021. The share of apartment leases on monthly rent also hit a record high at 46.1%. Both the Seoul metropolitan area (44.8%) and non-metropolitan areas (48.2%) far exceeded their five-year averages. In the non-apartment market, monthly rent accounted for 72.2% in the Seoul metropolitan area and 82.4% in non-metropolitan areas, firmly establishing itself as the dominant contract type.

Weekly Apartment Sale Price Change Rate Trend (left), KB Real Estate Outlook Index Trend. KB Financial Group Management Research Institute

Weekly Apartment Sale Price Change Rate Trend (left), KB Real Estate Outlook Index Trend. KB Financial Group Management Research Institute

Sharp Rise in Delinquency Rate Amid Slower Loan Growth

In July, the outstanding balance of bank home mortgage loans stood at 926.4 trillion won, up by 3.4 trillion won from the previous month, but the increase was smaller than in June (5.1 trillion won). The average interest rate on newly issued home mortgage loans was 3.93%, up 0.06 percentage points from the previous month.

The mortgage loan delinquency rate in May reached 0.32%, the highest since 2015. Delinquency rates for household loans (0.47%) and unsecured household credit loans (0.94%) also rose, increasing the financial burden on households.

The presale market is expected to become more volatile in the second half of the year. In July, the number of new apartment units offered for presale nationwide reached 28,000, the highest so far this year. Although supply increased in both the Seoul metropolitan area and non-metropolitan regions, demand was concentrated in the metropolitan area, raising concerns about unsold units in provincial areas.

In June, the number of unsold apartments nationwide stood at 63,000, down from the previous month. However, the report analyzed that the decrease was largely due to reduced supply in the first half of the year and a recovery in the Seoul metropolitan area, especially in Gyeonggi Province. The report projected that, "If economic growth slows and supply increases in the second half of the year, the number of unsold units could rise again."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)