Average Daily Household Loan Growth at 170 Billion Won in August

Increase Only Half of June's Record Surge

Banks Warn "It's Too Early to Be Complacent" and Raise Lending Barriers

Banks are raising barriers across the board to curb loan demand, resulting in a 'loan cliff' becoming a reality. In the second half of the year, the five major commercial banks (KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup) have halved their household loan growth targets compared to their initial goals. Due to a range of price and non-price measures, even high-income and high-credit borrowers are now finding it difficult to secure loans. Concerns are also mounting that low-credit borrowers may be pushed out of the formal financial sector.

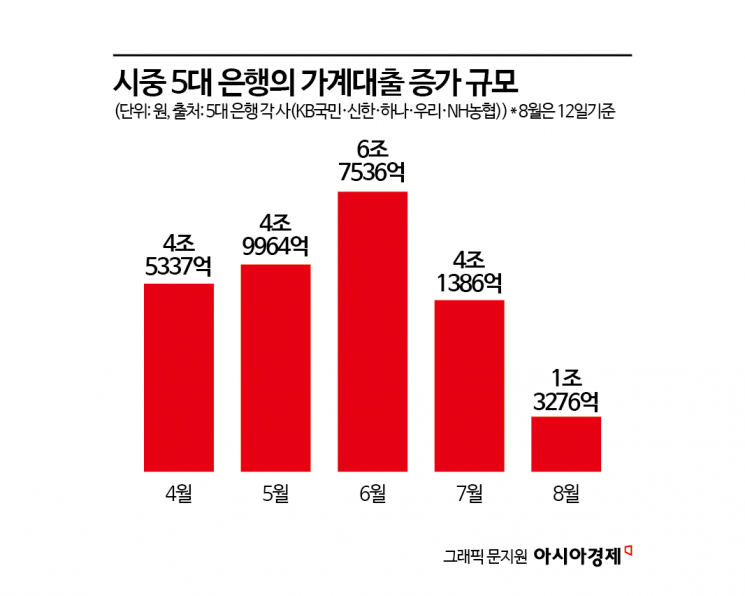

According to the financial sector on August 18, as of the 12th, the outstanding balance of household loans at the five major commercial banks increased by 1.3276 trillion won. This translates to an average daily increase of about 170 billion won, and if this trend continues, household loans in August are projected to grow by around 3.32 trillion won. This increase is only about half the size of June, when the monthly increase reached 6.7536 trillion won, the largest in eight months. However, banks remain on high alert, as loan demand could surge at any time due to seasonal factors such as autumn moving season and increased funding needs during the summer vacation period.

An official at one of the major banks stated, "Although the pace of household loan growth has slowed due to the June 27 loan regulations and the implementation of the three-stage stress Debt Service Ratio (DSR), it is too early to be complacent," adding, "We are executing loans as conservatively as possible to avoid harming genuine borrowers."

Previously, the five major commercial banks resubmitted their second-half household loan growth target to the Financial Supervisory Service, lowering it to 3.6 trillion won. This is a 50% reduction from the previous target of 7.2 trillion won. Before the June 27 policy measures were announced, the five major banks had set their annual loan growth targets at 4.5 trillion won for the first half and 7.2 trillion won for the second half.

With the second-half household loan growth target cut by about half, banks are independently raising their lending thresholds. Despite a downward trend in the Cost of Funds Index (COFIX) rate, which serves as the basis for interest rate calculations, banks are curbing loan demand by maintaining higher internal spreads. In fact, the COFIX rate has been declining for nine consecutive months since October last year (3.40%). The COFIX rate for June, announced on July 15, stood at 2.54%.

Banks are also using non-price measures to suppress loan demand. They have expanded the suspension of loan applications through loan brokers from just mortgage loans to now include jeonse loans as well, and are restricting new enrollments in Mortgage Credit Insurance (MCI). MCI is insurance that is taken out simultaneously with a mortgage loan; without this insurance, borrowers can only receive loans for the amount excluding the small deposit guarantee, effectively reducing the loan limit. Furthermore, since the implementation of the three-stage stress DSR in July, many believe that borrowers are already experiencing a tangible loan cliff.

In reality, even high-income and high-credit borrowers are finding it difficult to obtain loans. According to the Korea Federation of Banks, the average credit score for new household loans (mortgage loans plus credit loans) issued by the five major banks in June was 944. This is the highest level since related statistics began to be disclosed in July 2023. Even those with a top-tier credit rating (942 points or higher) are now struggling to get loans. The average credit score of borrowers in 2023 was in the 920s, but it has increased by about 20 points in just two years. For overdraft accounts, the average credit score was 962.3, the highest among all household loan products.

With credit score inflation expected to continue for the time being, concerns are growing that mid- and low-credit borrowers may be pushed out of the formal financial sector. The Korea Inclusive Finance Institute estimates that last year, between at least 29,000 and up to 61,000 low-credit borrowers were excluded from the formal financial system.

An official at a major bank commented, "With regulators ordering banks to cut their total loan growth targets by more than half, we are tightening our internal loan screening standards even further," adding, "If loan growth is not contained, regulators are also considering measures such as applying DSR regulations to jeonse loans, making it difficult for not only low-credit but also high-credit borrowers to obtain loans."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.