MBK’s Dual Strategy: Streamlining Unprofitable Stores and Improving Profitability

MDM Group: Accelerated Development Timeline, But Heightened Risks

Homeplus, which is currently undergoing corporate rehabilitation proceedings, has decided to close 15 of its stores nationwide after failing to reach agreements on rent adjustments. However, it has been confirmed that two stores owned by DL Group will continue operating under the existing rent terms. There is analysis suggesting that this decision to close stores is not simply the result of failed rent negotiations, but rather a calculated strategy by Homeplus owner MBK Partners to also eliminate unprofitable locations.

MBK’s Dual Strategy: Streamlining Unprofitable Stores and Improving Profitability

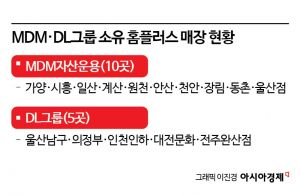

According to the real estate and retail industries on August 17, of the five Homeplus stores owned by DL Group, three-Ulsan Namgu, Daejeon Munhwa, and Jeonju Wansan-are included in the list of closures. In contrast, the Uijeongbu and Incheon Inha stores will continue to operate under the current rent conditions. A DL Group representative stated, "It was agreed that these two stores would continue operating without any rent adjustments."

For this reason, industry observers believe that rent negotiations were merely a tool, and that MBK Partners' true intention was to weed out stores with low profitability. There are also reports that Homeplus proposed conditions such as a '50% rent reduction,' which were realistically unacceptable, in order to induce negotiation breakdowns. In fact, all three DL Group-owned stores slated for closure rejected these terms and will now be shuttered.

Analysts say that MBK pursued rent negotiations with unprofitable stores, aiming to improve profitability if rent was adjusted, and to close underperforming locations if negotiations failed-thus achieving a win-win outcome. At the same time, MBK adopted a dual strategy by freezing rent terms for stores with healthy profits. Regarding this, a Homeplus representative explained, "The details of the negotiations are confidential and known only to the working-level staff, so we were not aware that some stores would maintain their existing rent terms." The representative added, "Our top priority has been to restore profitability through rent reductions for the normalization of the company, and in the process, some stores with low profitability were inevitably closed."

Homeplus currently operates 68 leased stores, of which 15 will be closed. Among the remaining stores that are not closing, it is highly likely that there are additional locations, besides those owned by DL Group, that will retain their existing rent terms. Industry insiders expect that over the next year, as Homeplus proceeds with the closure process, the company will also undertake 'precision restructuring,' which will include inventory liquidation, workforce adjustments, financial structure improvement, and mergers and acquisitions (M&A).

MDM Group: Accelerated Development Timetable, but Heightened Risks

Of the 15 stores slated for closure, 10 are owned by MDM Asset Management, an affiliate of MDM Group. These include the Gayang, Siheung, Ilsan, Gyesan, Woncheon, Ansan Gojan, Cheonan, Jangnim, Dongchon, and Ulsan Bukgu locations. MDM has consistently rejected Homeplus’s proposals for a '50% rent reduction and shortening of contract period to one year,' and as a result, all of its stores are now set to close. An MDM representative commented, "We acquired these stores based on the premise of long-term mixed-use development, so the start of our projects has actually been accelerated." However, if vacancies persist, MDM will face annual rent losses and financial costs amounting to tens of billions of won. Additionally, considering the current real estate market, active development will not be easy, which adds to the burden.

MDM is considering both attracting new retail tenants and commencing development, but given the high risk of prolonged vacancies in commercial properties, the company is likely to prioritize long-term asset value enhancement over short-term profits. Furthermore, small business owners and tenants operating in the stores scheduled for closure are expected to face a livelihood crisis. There are also growing concerns that the collapse of local commercial districts will inevitably lead to a contraction of the regional economy.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.