FSN announced on August 14 that it achieved a turnaround on a consolidated basis in the first half of the year, posting its highest-ever operating profit and a double-digit operating margin since its founding.

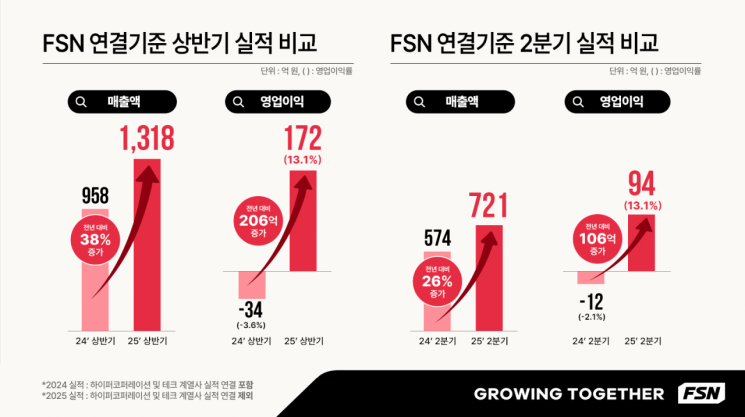

In the first half of 2025, FSN recorded consolidated sales of 131.8 billion KRW, operating profit of 17.2 billion KRW, and an operating margin of 13%. Compared to the same period last year, when the results of Hyper Corporation and tech affiliates were included in the consolidated financial statements, sales increased by 38%, and operating profit turned positive. Both operating profit and operating margin reached record highs for a first half.

This achievement is significant as it demonstrates that FSN has overcome past setbacks, completed its business structure reorganization, and firmly established a foundation for rapid future growth. The rapid growth of its brand co-prosperity business, based on core competencies accumulated in advertising and marketing, along with focused investments in new platform businesses, has led to tangible results.

FSN has successfully transformed itself from an advertising agency-centered structure into a brand and platform builder based on that foundation, proving its growth potential through direct performance improvements. In fact, one partner brand collaborating with FSN's subsidiary Boosters surpassed its entire previous year's sales and operating profit within just the first half of this year.

Outstanding results were also seen in the platform and marketing segments. The mobile ad network 'Cauly' secured a stable revenue base, and key metrics for vertical platforms such as 'Daedamo', 'MyOnePick', and 'CashPlay' showed significant year-on-year growth.

As all three of FSN's main businesses-marketing, brand, and platform-recorded profits, each has secured a stable foundation for sales and earnings. For the second half of the year, the company expects even greater growth in both revenue and profitability, driven by the peak season effect for major brands, an increase in new orders in the advertising agency segment, and the expansion of the platform business.

FSN's financial structure continues to improve. The company has steadily repaid and converted its convertible bonds (CB), reducing the outstanding CB balance from 46.4 billion KRW to below 9 billion KRW. Excluding call option amounts, the remaining balance available for conversion or redemption is around 700 million KRW. Additional amounts set to mature for conversion or redemption in October this year and January next year total only 4.2 billion KRW, so the potential for equity dilution is limited.

Seo Jeonggyo and Park Taesoon, Co-CEOs of FSN, stated, "FSN has boldly addressed inefficiencies and reorganized its organization and strategy around core growth businesses, which enabled us to achieve the highest results since our founding in the first half of this year. We will continue to do our best to maximize shareholder value by simultaneously improving our financial structure and pursuing sustainable growth."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.