Emart Launches "5K PRICE" Brand with All Products Under 5,000 Won

Secures Cost Competitiveness Through Integrated Purchasing

Counters Daiso, the Offline Ultra-Low-Price Leader

Moves to Curb Coupang's Dominance with Focus on Fresh Foods

Emart has joined the "5,000-won war." By benchmarking Daiso's "under 5,000 won" pricing policy for its fixed-price household goods stores, Emart is implementing an ultra-low price strategy aimed at attracting customers-who have shifted to online platforms-back to its brick-and-mortar stores. This is seen as a customer acquisition strategy, and attention is focused on whether it could become a game-changer capable of catching up with Coupang, which has emerged as a new powerhouse in Korea's retail industry.

According to the retail industry on August 18, Emart recently launched its private label (PL) brand "OK Price (5K PRICE)," featuring all products priced under 5,000 won. This is the first integrated brand introduced since the merger of Emart and Everyday. Emart absorbed Everyday last July and established an integrated purchasing system starting this January. By leveraging the synergy of integrated purchasing from the product development stage, Emart has introduced ultra-low-priced products with significantly reduced prices.

Emart Declares Price Disruption Amid Economic Downturn

OK Price is a private brand focused on processed foods and daily necessities. All products are priced between 880 won and 4,980 won, with none exceeding 5,000 won.

Product volumes have been reduced by about 25% to 50% compared to existing products, while prices are up to 70% lower than those of regular brand items. An Emart representative explained, "By selling simultaneously at Emart and Everyday, we were able to more than double our purchasing volume compared to existing PL products, and the economies of scale allowed us to achieve the industry's lowest cost competitiveness. We invested about a year in developing these products to fulfill the essential role of large supermarkets in stabilizing basket prices and to achieve price innovation amid high inflation."

This move is part of Emart's "price disruption declaration," which has been underway since last year to strengthen its core business competitiveness. Following the rapid growth of the online market during the COVID-19 pandemic, Emart saw a decline in store visitors and, coupled with sluggish domestic demand, launched large-scale discount events to attract customers. This year, Emart held the "Goraeit Festa," offering fresh foods, processed foods, and daily essentials at dramatically reduced prices.

Emart launched its private label (PL) brand "OK Price (5K PRICE)" on the 14th, featuring all products priced under 5,000 won. Photo by Emart

Emart launched its private label (PL) brand "OK Price (5K PRICE)" on the 14th, featuring all products priced under 5,000 won. Photo by Emart

The results have been solid. In the second quarter of this year, Emart recorded total standalone sales (transaction volume) of 4.2906 trillion won and an operating profit of 15.6 billion won. Sales grew by 12% year-on-year, and the company returned to profitability. During the Goraeit Festa in June, both sales and customer visits increased by 33% and 18%, respectively, compared to the same period last year.

However, Emart recognizes that mega discount events may only result in temporary sales spikes. Therefore, the company has introduced PL products priced under 5,000 won as a hidden card to encourage customers to visit stores regularly.

The 5,000-Won War Sparked by Daiso

Emart's OK Price closely resembles Daiso's pricing policy. Daiso has maintained its ultra-low-price policy of keeping products under 5,000 won, making it the only offline retailer to continue growing. This success is attributed to targeting price-sensitive consumers amid high inflation. Asung Daiso's annual sales last year reached 3.9689 trillion won, a 14.7% increase year-on-year, putting it on track to join the "4 trillion won club." During the same period, its operating profit was 371.1 billion won, up 41.8% year-on-year, with an operating margin of 9.35%. This is overwhelmingly higher than the average operating margin of 1-2% seen at major competitors such as Emart and Coupang.

Similarly, Emart aims to increase repeat store visits through PL products priced under 5,000 won. However, while Emart has also set the price ceiling at 5,000 won, a significant portion of its products are processed foods, which differentiates it from Daiso. Of the 162 items in the first OK Price launch, most are processed foods such as canola oil, sunflower oil, dried noodle ramen, and Himalayan pink salt seaweed. In contrast, Daiso primarily offers household essentials such as kitchenware, bathroom supplies, and cleaning products.

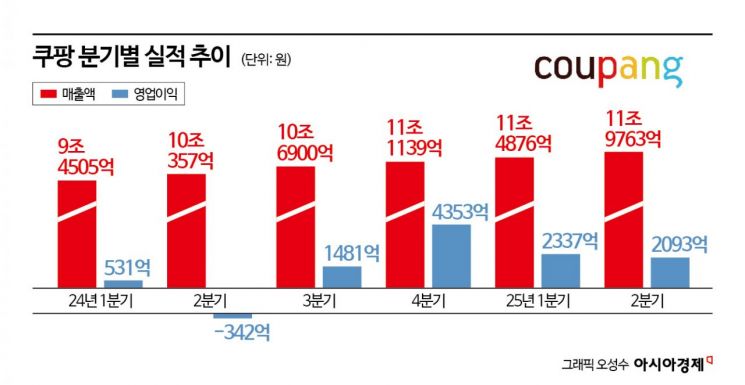

This strategy is interpreted as a move to counter Coupang, which has experienced rapid growth in the online market. As online consumption patterns have spread, Coupang’s consolidated sales last year surpassed 38 trillion won, overtaking Emart’s 29 trillion won. For the second quarter of this year, Coupang Inc.-the US-listed parent company-reported consolidated sales of 11.9763 trillion won, a 19% year-on-year increase, maintaining double-digit growth. The growth in the fresh food category was particularly notable, with Coupang’s fresh food sales in the second quarter rising by about 25% compared to the same period last year.

Since fresh foods are items that consumers prefer to inspect for freshness in person, large supermarkets like Emart have a competitive advantage. Emart is expanding new store formats focused on fresh foods, such as "Emart Food Market" and "Starfield Market," while also aiming to draw customers back to physical stores with ultra-low-priced processed foods like OK Price.

The retail industry is currently engaged in fierce ultra-low-price competition. Chinese e-commerce platform AliExpress recently opened the "1,000-Won Mart Korea Shipping Center," operating a permanent ultra-low-price section for products under 5,000 won. Convenience stores have also increased their "1+1" promotional events this year and launched "ultra-low-price marketing" campaigns, offering discounts of up to 50% on key food and daily necessities.A retail industry insider commented, "As the consumer trend of prioritizing value for money continues to spread, ultra-low-price product strategies will become an essential response for retailers."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.