95% of Exports Headed to China in First Half

"Surplus Amid Recession" as Domestic Downstream Falters

Ethylene Export Volume Up 18%, Value Rises Only 11%

Exports of ethylene, a key basic material for South Korea's petrochemical industry, approached record-high levels in the first half of this year. This surge was the result of sluggish domestic demand and reduced downstream (intermediate and finished goods) production, which forced companies to export surplus volumes at low prices. Notably, 95% of all ethylene exports were shipped to China. While South Korea's petrochemical sector is struggling with declining competitiveness, China's ethylene production has failed to keep up with demand. As a result, concerns are mounting that South Korean companies will become locked into a pattern of "recessionary exports," selling at rock-bottom prices.

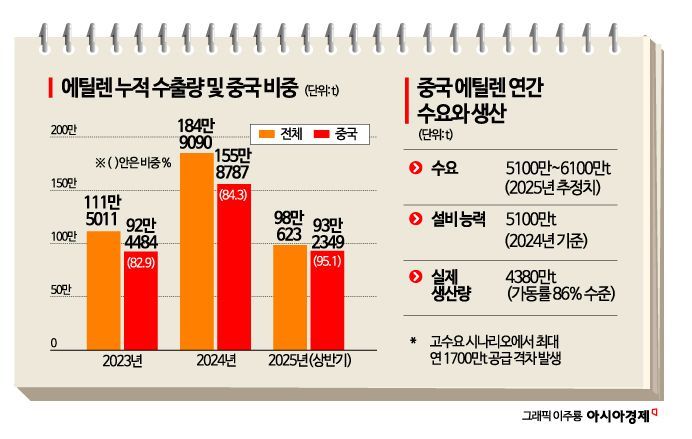

According to the Korea International Trade Association on August 14, cumulative ethylene exports for January to June this year reached 980,623 tons, an 18.3% increase from the same period last year. The industry had already described last year as the worst downturn in its history, yet exports have increased even further since then. In the first half of last year, exports had already surged by 91.4% year-on-year to 829,014 tons. However, in terms of value, exports rose by only 11.4% compared to the same period last year, indicating that unit export prices have fallen even further.

The vast majority of ethylene exports were destined for China. In the first half of this year, 932,349 tons were shipped to China, accounting for 95.1% of total exports. This figure is significantly higher than in 2023 (82.9%) and 2024 (84.3%). In terms of volume, exports to China increased by 38.3% year-on-year, while export value rose by 30.8%. Last year, exports to China already reached an all-time high of 1,558,787 tons, and this record is likely to be surpassed this year.

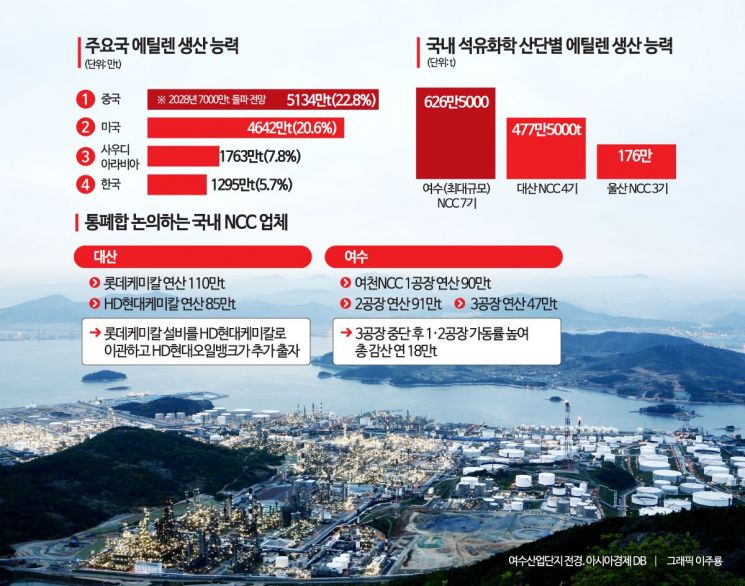

The increase in ethylene exports is due to weak production among downstream companies that use ethylene as a raw material. Ethylene is used in the production of general-purpose intermediates such as polyethylene (PE), ethylene glycol (EG), and styrene monomer (SM). However, as downstream products have lost competitiveness and operating rates have declined, even naphtha cracking center (NCC) companies have been affected. The operating rates of major NCC operators such as Yeochun NCC, Lotte Chemical, Hanwha TotalEnergies, and LG Chem have fallen to the 70% range. While this is a significant drop compared to the recent average of 80%, it is not an extreme fluctuation. Completely halting production would result in high fixed costs, so companies are forced to continue operating despite the unfavorable conditions.

An industry official commented, "The ethylene-naphtha spread has been below the break-even point for a long time." Because ethylene is a gaseous substance, it must be liquefied at temperatures below minus 104 degrees Celsius for export, making transportation costs high and long-distance exports difficult. As a result, South Korean companies are heavily dependent on nearby markets such as China and Japan.

The domestic petrochemical industry is concerned that the pattern of "China-dependent, low-priced exports" will become entrenched. Repeated forced exports inevitably lead to worsening profitability for companies. For Chinese firms, this allows them to strengthen their price competitiveness in general-purpose products, making them more competitive even in the South Korean market. This, in turn, weakens the competitiveness of domestic downstream companies and further shrinks domestic demand for ethylene. Ultimately, this intensifies a vicious cycle of "domestic demand slump → expanded low-priced exports to China → reduced production by South Korean downstream companies → forced ethylene exports."

Although Yeochun NCC recently halted operations at its third plant in Yeosu, effectively reducing annual production by about 180,000 tons, this is considered far from sufficient to resolve the oversupply issue. Industry insiders believe that with the Ministry of Trade, Industry and Energy soon to announce its "Petrochemical Industry Restructuring Plan," it is time for serious discussions on restructuring and capacity reduction.

Kwon Namhun, president of the Korea Institute for Industrial Economics and Trade, stated, "If restructuring is left solely to companies, it will eventually happen, but the process could further weaken the industry's competitiveness." He added, "The government needs to actively intervene in areas such as fair trade law, taxation, finance, and employment transition." He continued, "Because the level of support remains uncertain, companies tend to delay restructuring, so swift government action is needed."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)