"Education Tax Likely to Reduce Net Profit"

Financial Risks Materialize for Insurers

Temporary Increase in Insurance Liabilities Heightens K-ICS Ratio Risk

Tax Equity Issues Arise Between Companies Above and Below the 1 Trillion KRW Threshold

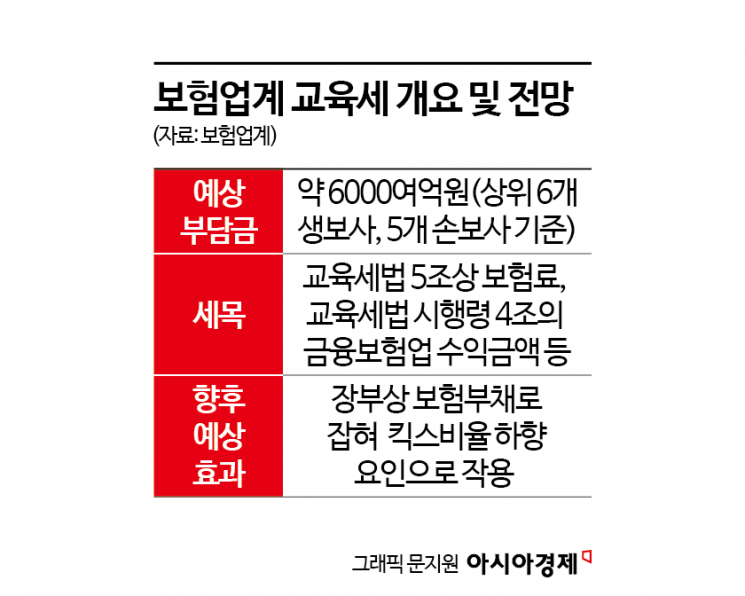

The insurance industry has raised concerns about a potential deterioration in financial soundness due to an increase in liabilities, as it will be required to pay approximately 600 billion KRW in education tax starting next year. The industry warns that the tax hike is not merely a doubling of the current amount, but could also lead to greater management burdens, such as a decline in the capital adequacy (K-ICS) ratio.

According to the industry on August 14, the government has decided to raise the education tax rate for financial and insurance companies with annual revenue exceeding 1 trillion KRW from the current 0.5% to 1.0%, starting next year. Currently, the five major non-life insurers-Samsung Fire & Marine, DB Insurance, Meritz Fire & Marine, Hyundai Marine & Fire, and KB Insurance-pay about 200 billion KRW in education tax, while the top six life insurers-Samsung Life, Hanwha Life, Kyobo Life, Shinhan Life, NH NongHyup Life, and Mirae Asset Life-pay about 150 billion KRW. If the proposed tax law revision passes the National Assembly, the total education tax paid by these companies is expected to nearly double from the current 350 billion KRW to approximately 600 billion KRW.

It should be noted that the "1 trillion KRW in revenue" applied to insurance companies is a different concept from quarterly or semiannual net income or insurance revenue on the comprehensive income statement. According to the Education Tax Act and its enforcement decree, the revenue of insurance companies used as the tax base refers to "premiums" as specified in Article 5 of the Act and the financial and insurance business revenue specified in Article 4 of the enforcement decree. Based on this standard, not only the five major non-life insurers but also mid-sized companies such as Hanwha General Insurance, Lotte Insurance, Heungkuk Fire & Marine, and NH NongHyup Property & Casualty could fall into the 1% tax bracket. Among life insurers, not only the three largest-Samsung, Hanwha, and Kyobo Life-but also Shinhan Life, NH NongHyup Life, and Mirae Asset Life are expected to face an increased tax rate.

Insurance companies are concerned that the impact will not be limited to a simple doubling of tax payments, but could also undermine their financial soundness in the future. Jo Beonhyeong, Executive Director and Head of Management Support at Samsung Fire & Marine, stated during the company’s second-quarter earnings conference call held the previous day, in response to a question about the impact of the education tax increase, "Although the exact amount of the tax rate increase has not been finalized, it is structured in a way that will significantly affect (our revenue)," adding, "It will impact the future cost increases for long-term insurance."

The industry interprets Jo’s remarks as expressing concern that the increased tax will be recorded as an insurance liability, which could lead to a decline in the K-ICS ratio. Unlike automobile insurance, long-term insurance contracts can extend up to maturity at age 100 or beyond. If the doubled tax rate is reflected in the risk premium (the portion of the premium used as the source of insurance payouts for events such as death or disability), it could lead to an increase in insurance liabilities and, consequently, a lower K-ICS ratio. The Financial Supervisory Service recommends a minimum K-ICS ratio of 130%, but as of the second quarter, some major insurers such as Hyundai Marine & Fire (170%) and Samsung Life (187%) are just above the 100% level.

The increase in education tax could also negatively affect the Contractual Service Margin (CSM), a key profitability indicator for insurers. Jo pointed out the previous day that "the total CSM will decrease, leading to a reduction in amortization profit," a view shared throughout the insurance industry.

For insurance liabilities, insurers apply a method that evaluates future cash flows related to insurance contracts at present value. The future education tax burden acts as a cash outflow factor. Under the structure of insurance accounting and capital adequacy regulations, not only the education tax for the current tax period is recognized, but also the expected future burden is temporarily reflected as a present liability. As a result, insurers' capital may decrease and the K-ICS ratio may fall further.

An industry official commented, "Recently, insurance companies have been facing a triple burden due to the strengthening of various regulations related to loss ratios (the ratio of insurance payouts to premiums collected), surrender rates, and discount rates," adding, "If the education tax is raised, the financial soundness of the entire insurance sector will deteriorate, potentially leading to higher premiums and increased social costs."

There is also criticism that applying different education tax bases depending on the size of an insurer’s assets is not fair. The concern is that there could be disparities in business activities between insurers that must bear a higher tax rate due to exceeding the 1 trillion KRW revenue threshold and those that do not.

An industry official stated, "From the policyholder’s (consumer’s) perspective, joining a product from an insurer with revenue exceeding 1 trillion KRW means indirectly bearing the increased tax burden. On the other hand, if they choose a product from another insurer, they will only bear the 0.5% tax rate, which could raise concerns about tax equity among policyholders."

Meanwhile, the Korea Life Insurance Association and the General Insurance Association of Korea plan to collect opinions from their 22 and 19 member companies, respectively, regarding the education tax increase and submit a position paper to the Ministry of Economy and Finance by the end of the legislative notice period, which is today. Insurance companies intend to persuade tax authorities by arguing that if the education tax rate varies between companies based on the 1 trillion KRW tax base, it will intensify fairness issues and ultimately lead to higher premiums, thereby worsening consumer welfare.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.