Household Loan Growth Slows After 6·27 Lending Restriction Measures

Seoul Apartment Price Gains Accelerate Again in August

Real Estate Market Instability Persists... Urgent Need for Supply Measures

Last month, the growth in household loans across the financial sector slowed significantly compared to June. However, as of August, instability in the market persists, with Seoul apartment prices rebounding and unsecured loans also increasing. While financial authorities have stated that they will proactively implement additional regulations if instability continues, there are growing calls that regulatory measures alone have limitations and that supply-side policies need to be introduced swiftly.

Household Loan Growth Slows After 6·27 Lending Restrictions

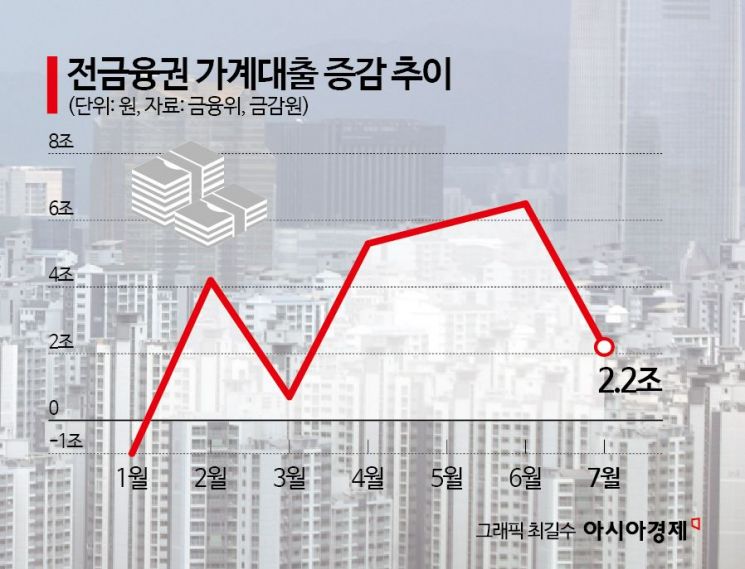

According to the Financial Services Commission and the Financial Supervisory Service on August 14, household loans across all financial institutions increased by 2.2 trillion won last month compared to June, a significant reduction from the 6.5 trillion won increase recorded in the previous month. Breaking down household loans for July by category, mortgage loans increased by 4.1 trillion won compared to the previous month, a smaller rise than the 6.1 trillion won increase seen in June. Other loans, including unsecured loans, decreased by 1.9 trillion won compared to the previous month, marking a return to a downward trend for the first time in four months since March.

The scale of household loan growth in the financial sector had sharply increased for three consecutive months: 4.2 trillion won in February, 5.3 trillion won in April, and 6.5 trillion won in June. This was largely due to a surge in demand for home purchases financed by debt, following a rapid rise in apartment prices in Seoul.

In response, the government announced strengthened household debt management measures on June 27, with a key provision limiting the maximum mortgage amount in the Seoul metropolitan area to 600 million won, to curb overheating in the real estate market. The government explained that the pace of loan growth has clearly slowed since then. An official from the Financial Services Commission stated, "Despite the seasonal factors in July that typically increase demand for funds, the slowdown in loan growth was due to the strengthened household debt management measures announced in June and the implementation of the third phase of the stress-based total debt service ratio (DSR) from July."

However, the government also noted that, considering home transactions and loan approvals that occurred before the 6·27 household debt measures were announced, the trend of increasing household loans-especially mortgage loans-could continue for some time. Additionally, August is a period when household loan growth typically accelerates due to seasonal factors such as increased demand for moving and vacation expenses, so the situation cannot be considered stable.

Real Estate Market Instability Persists... Supply Measures Needed Urgently

Although the pace of household loan growth has slowed, the continued rise in Seoul housing prices remains a source of concern. According to the Korea Real Estate Board, during the first week of August (as of the 4th), Seoul apartment sale prices rose by 0.14% compared to the previous week, with the rate of increase higher than the previous week's 0.12%. The rate of increase in Seoul apartment prices had steadily declined from the last week of June-immediately after the 6·27 household debt measures were announced-through the last week of July, but rebounded after six weeks.

It is also worrisome that household loans, particularly unsecured loans from banks, are once again on the rise in August. According to the financial sector, as of August 7, the outstanding balance of household loans at the five major commercial banks-KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup-stood at 760.8845 trillion won, an increase of 1.9111 trillion won compared to the end of July. The average daily increase was 273 billion won, more than double July's 133.5 billion won. By category, unsecured loans surged by 1.0693 trillion won, driving the overall increase. The main causes are believed to be an increase in demand for loans in anticipation of initial public offering (IPO) investments and government household loan regulations.

Financial authorities plan to immediately introduce additional regulatory measures if market instability intensifies. Potential additional regulations include further tightening of the loan-to-value (LTV) ratio in regulated areas and adjustments to macroprudential regulations, such as changes to the risk weighting of mortgage loans. However, both inside and outside the financial authorities, there are calls that financial regulations alone are clearly limited in stabilizing the real estate market, and that the government needs to announce housing supply measures quickly. A financial sector official said, "Although a considerable amount of time has passed since the new government took office, housing supply measures have yet to be announced. Since financial regulations alone cannot stabilize the real estate market, we hope supply-side measures will be introduced as soon as possible."

The Housing Industry Research Institute (Jusan-yeon) also pointed out that the effects of loan regulations last only three to six months at most. Kim Deokrae, head of the Housing Research Department at the institute, warned at a seminar held at the National Assembly on August 5, "Unless rapid and strong supply-side measures are pursued-such as expediting the supply of the third-generation new towns, deregulating to promote private housing supply, and revitalizing urban renewal-suppressed purchase demand could be revived by low interest rates and an economic recovery, leading to a sharp rise in housing prices again in the fourth quarter."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.