"Stock Market Crash Imminent... Baby Boomers to Be Hit Hardest"

"To Protect Your Wealth, Invest in Gold, Silver, and Bitcoin"

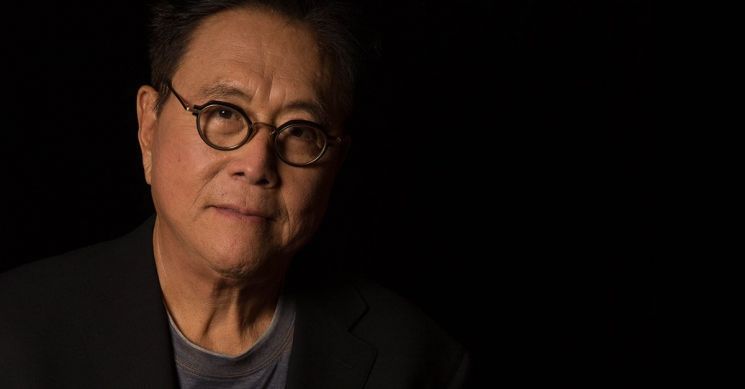

As Bitcoin, which had paused for breath, regains upward momentum, Robert Kiyosaki, the world-renowned bestselling author of "Rich Dad Poor Dad," has once again urged investment in gold, silver, and Bitcoin, warning of a massive stock market crash.

"Stock Market Crash Imminent... Baby Boomers to Be Hit Hardest"

Kiyosaki recently stated on his social media that "major warning signs of a large-scale stock market decline have already appeared," and cautioned that "baby boomers, who have their retirement assets tied up in stocks, will be hit the hardest." In contrast, he predicted that investors holding gold, silver, and Bitcoin would actually benefit.

He also drew attention to an executive order signed by U.S. President Donald Trump. This measure allows Bitcoin and alternative assets to be included in retirement accounts, which is analyzed to be more stable than the traditional dollar-centric asset structure.

The price is displayed on the Upbit customer center status board in Gangnam-gu, Seoul. This is unrelated to the article content.

The price is displayed on the Upbit customer center status board in Gangnam-gu, Seoul. This is unrelated to the article content.

"To Protect Your Wealth, Invest in Gold, Silver, and Bitcoin"

Kiyosaki has long advocated the "weak dollar theory," emphasizing gold, silver, and Bitcoin as alternative assets. In April, he also argued that "the value of stocks, bonds, and the dollar will all collapse," and insisted that "investing in gold, silver, and Bitcoin is necessary to protect your portfolio."

He claimed, "Those who take action and acquire real gold, silver, and Bitcoin will be able to escape this planned disaster," and emphasized, "Now is the only opportunity to achieve financial independence by breaking free from central bank control."

Meanwhile, according to Upbit, a domestic cryptocurrency exchange, the price of Bitcoin on August 11 briefly surged to 166,839,000 won, marking a new all-time high in about a month since July 14 (166,900,000 won). In the global market, Bitcoin recovered the $120,000 level for the first time since July 23.

Experts analyze that this rebound is the result of several factors, including the U.S. maintaining its interest rate freeze, strengthened investor sentiment toward alternative assets, and the expanded possibility of including Bitcoin in retirement pension plans. In the market, there is growing support for the view that Bitcoin, along with gold and silver, could become a "turning point" as a crisis alternative asset.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)