Sadana, Micron CBO, Announces at U.S. Forum

Statement Draws Attention Amid SK hynix Negotiation Delays

"HBM3E 12-high Yield Rate Rising Rapidly"

Confident in HBM4 Performance: "Mature and Superior"

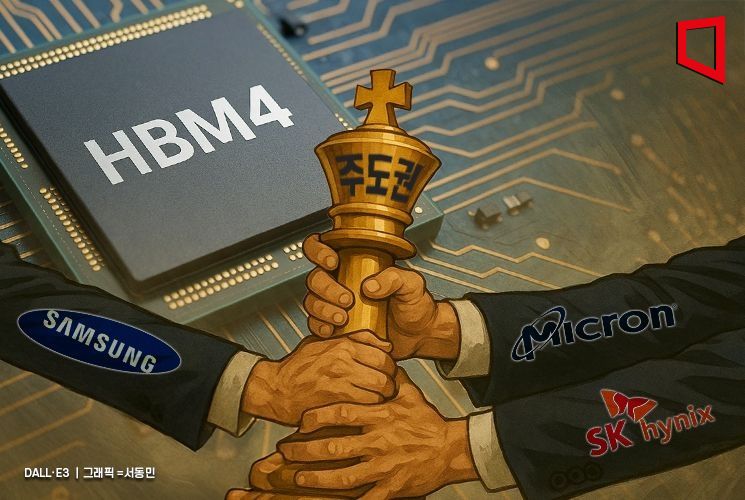

Micron, the American company leading a three-way competition with Korean firms in the high-bandwidth memory (HBM) market, has expressed confidence that it will sell out all of its HBM production for next year.

According to industry sources and foreign media on August 13, Sumit Sadana, Chief Business Officer (CBO) of Micron, announced the company’s fiscal fourth-quarter outlook at the "Technology Leadership Forum" hosted by KeyBank in the United States on August 11 (local time). He stated, "We have been in discussions with customers regarding HBM volumes for 2026 and have made significant progress in recent months. Based on this, we are confident that we can sell all of our HBM supply for next year." He added, "The yield rate of our HBM3E 12-high stack is increasing much faster than that of the 8-high stack, and shipments of the 12-high product have already surpassed those of the 8-high stack."

The supply volume Micron mentioned for next year is expected to consist mostly of HBM3E (5th generation) 12-high stacks, with some HBM4 (6th generation) included as well.

This strong statement is drawing attention because SK hynix, the top HBM supplier, has not yet concluded negotiations with Nvidia regarding next year's volumes. While other competitors have not mentioned selling out their supply, Micron was the first to express such confidence. As a result, there is growing industry interest in whether the landscape of next year's HBM market will shift.

Micron, along with SK hynix, is supplying HBM3E 12-high stacks to Nvidia, the major player in the artificial intelligence (AI) chip market. Samsung Electronics is currently undergoing quality testing. Micron has repeatedly highlighted its mass production of HBM3E and has directly named Nvidia as a customer, emphasizing differences with its competitors. This latest mention of selling out is also being interpreted as a statement with Nvidia supply in mind.

Micron also expressed confidence in HBM4. The three major memory companies have started supplying HBM4 samples to key customers such as Nvidia and have begun taking orders. SK hynix and Samsung Electronics are expected to begin mass production in the second half of this year, while Micron is reportedly targeting next year for mass production.

In this context, with HBM4 set to be widely adopted in AI chips starting next year, Micron's early mention of potential supply to Nvidia suggests that competition in the next-generation HBM market may become even more intense.

CBO Sadana stated, "Our HBM4 is produced on the same 1-beta (β) process node as HBM3E, which is a very mature and high-performance node. In contrast, one of our competitors is attempting to produce HBM4 on the 1c node, which will require additional work to validate the new technology."

The 1β process refers to Micron's designation for fifth-generation 10nm-class DRAM (1nm = one-billionth of a meter), which is commonly referred to as the 1b process in the semiconductor industry. The next generation after 1b, known as 1c, is sixth-generation 10nm-class DRAM, which Samsung Electronics is expected to use starting with HBM4.

Regarding the next-generation product HBM4E (7th generation), CBO Sadana said, "Some customers want custom products that integrate GPU logic into the HBM base die. Since such custom development is costly, we will only collaborate with a small number of suppliers, which could change the structure of the market."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)